Henderson Rowe is disrupting the UK market by delivering institutional-quality investment solutions directly to private clients. In a recent client update, Art Baluszynski, Head of Research at Henderson Rowe, and Dr. Phil Wool, Head of Investment Solutions at Rayliant provide context in answering a question on many investors’ minds.

This content was originally distributed in a client update on 16 March 2020.

With the global markets in a full-on panic mode, Henderson Rowe and Rayliant research teams get asked one question more often than others: How does our strategy deal with big market sell-offs?

Before we try to answer this question, let us look at why the markets are reacting the way they are to coronavirus. Markets usually go into deep panic mode over events they have difficulty pricing. The COVID-19 scare is exactly that. While some medical experts are able to forecast infection rates and death rates, the actual economic fallout from the COVID-19 is mostly unknown. Supply chains, as well as consumer demand, are being impaired, and we have very few data points to try to forecast any timeline for how the epidemic or the economic fallout will develop.

In 2008 when neither the market nor the bankers themselves could adequately price the risk on banks’ balance sheet, the global banking system came to a halt which in turn pulled the rug from under the global markets. Although not as severe as 2008, the coronavirus scare takes market participants on the same behavioural rollercoaster. Markets fear what they cannot price; they fear uncertainty. If one assumes that in the short term markets tend to be driven 80% by psychology and 20% by fundamentals, at present, it is probably closer to 99% and 1%. The only edge the smart investor has over the market is a cool head and a long time horizon. This is the best advice we can give our clients in times like this. Keep a cool head and know what you hold in your portfolio; in other words, know where the risk is.

One of the things I love most about my job is working with colleagues who are smarter than me. Dr Phil Wool, a managing director at Rayliant and Head of our Investment Solutions team, is not only one of the sharpest people I know in this industry, but also a fantastic communicator. No one in our team is better positioned to give you a “deep dive” into the mechanics of our strategies and how they perform in times like these. Please find below Phil’s answer to the question: How does our strategy deal with big market sell-offs?

Artur Baluszynski

Executive Director, Head of Research

Henderson Rowe

In light of recent market turbulence related to COVID-19, we’ve been asked many questions about how our strategy responds in periods of extreme financial stress. In fact, our approach is explicitly designed to identify good opportunities under a variety of market conditions—including periods of heightened uncertainty, investor anxiety, and adverse economic shocks like we’re experiencing now, in the face of a potential pandemic.

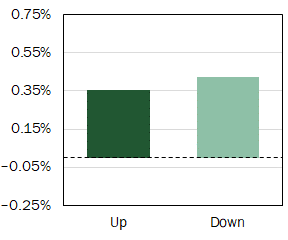

One way to see this first-hand is by digging into the performance of the model that selects stocks for our fundamental researchers to review in up markets versus down markets. How do the model’s top picks perform relative to an average stock when global equities are in the red? How do model selections perform when the overall market is rallying? One of the nice things about a quantitative strategy is that it’s possible to simulate past performance under different market environments. To that end, here’s a look at how top-quintile stocks (i.e., stocks ranking in the top 20% of all stocks on our full R-Score model) perform versus the global MSCI All Country World Index (ACWI) in months for which the ACWI is up versus down:

Backtested performance of R-Score top quintile model selections in excess of MSCI ACWI return

Monthly geometric avg. return in months when market is up vs. down, Jul. 1994 – Feb. 2020

You can see that the strategy is pretty balanced in terms of its outperformance, overall, but does just a little bit better in down markets. We’ll talk more about why that’s the case in a moment, but for now just rest assured that’s not a coincidence, but a matter of our strategy’s design.

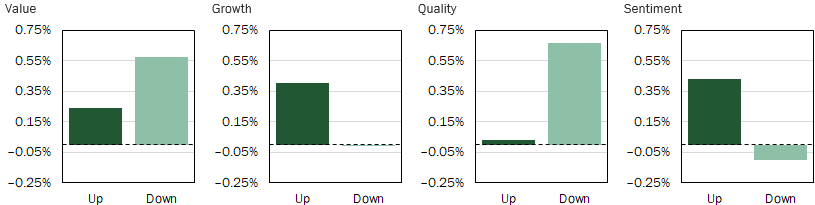

Things get more interesting when you look at individual categories. You might recall the four categories in which our signals reside are Value, Growth, Quality, and Sentiment. We can reproduce the same simple comparison we made with respect to up and down markets for the overall strategy, but restricted to stock selections within each of our factor categories:

Backtested performance of R-Score top quintile model selections in excess of MSCI ACWI return:

Individual factor categories

Monthly geometric avg. return in months when market is up vs. down, Jul. 1994 – Feb. 2020

You can see that Value, which searches the market for companies that are underpriced relative to fundamentals—in other words, identifying “cheap” stocks trading at bargain prices—tends to outperform in both up and down markets, but does substantially better when stocks are struggling. In part, that’s because the companies identified by our value signals are those that already trade at very attractive valuations and experience less of a decline when markets are receding. We also note that stressful periods in the market tend to produce opportunities when solid companies see unreasonably pessimistic reactions in their share price.

Quality is another factor that produces most of its outperformance in down markets. That’s because quality stocks are those with strong underlying fundamentals, irrespective of price: companies with efficient operations, good managers, high-integrity accounting¬ and low risk of financial distress, amongst other things. We’re explicitly picking out the companies that should fare best in markets characterised by investor anxiety. Our high-quality selections are those we deem likely to hold up best when economic and financial stress is at its peak.

A foundation of our approach is diversification. That entails, for example, holding a broad enough portfolio of stocks to avoid taking too much risk in individual names, regions or industries. We also think about diversifying across sources of information that we use in our trading models. Along those lines, while Value and Quality perform better in declining markets, our Growth and Sentiment signals tend to do better when stocks are rallying—which is exactly why the overall performance we saw before shows such balance.

Our model identifies “good growth” stocks that have demonstrated strong recent expansion—not just in share price, but also in underlying fundamentals. This allows our portfolio to participate in periods when investors are optimistic and forward-looking, rewarding companies with strong growth, even if they aren’t particularly cheap. Sentiment-based signals likewise seek to ride recent winners that have underreacted to good fundamental news due to investors’ slow reaction to information in the marketplace. Not surprisingly, since both categories depend on positive reactions (e.g., to growth and good news), they tend to perform better in up markets than in down markets. Indeed, both signals modestly underperform when the market is declining—a testament to the benefits of pairing these signals with countercyclical factors like Value and Quality.

We’ve just seen that the R-Score model underlying Henderson Rowe’s direct stock investments produces fairly balanced outperformance in historical simulations through different economic environments, outperforming in both up and down markets. Looking more closely at the individual factors driving our strategy, we saw that the model includes both defensive trading signals that spring into action when fear dominates, and pro-cyclical factors that exploit investor greed when optimism reigns. We believe systematic models built around investor behaviour are one of the most effective ways of not only preserving wealth during periods when psychology rather than fundamentals is driving markets, but also positioning clients to benefit when the pendulum swings back.

Phil Wool, Ph.D.

Head of Investment Solutions

Rayliant Global Advisors

IMPORTANT INFORMATION

This document does not constitute a financial promotion under Section 21 of the Financial Services and Markets Act 2000 (‘FSMA’). Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809. Investing with Henderson Rowe or any other investment firm involves risks. Please ensure that you fully understand the risks before investing. The value of investments may go up as well as down and you may not get back the amount invested. Past performance is not an indicator of future performance.

The content of this article represents the writer’s own view. Nothing in this article constitutes investment, tax or legal advice.