Talking Points

-

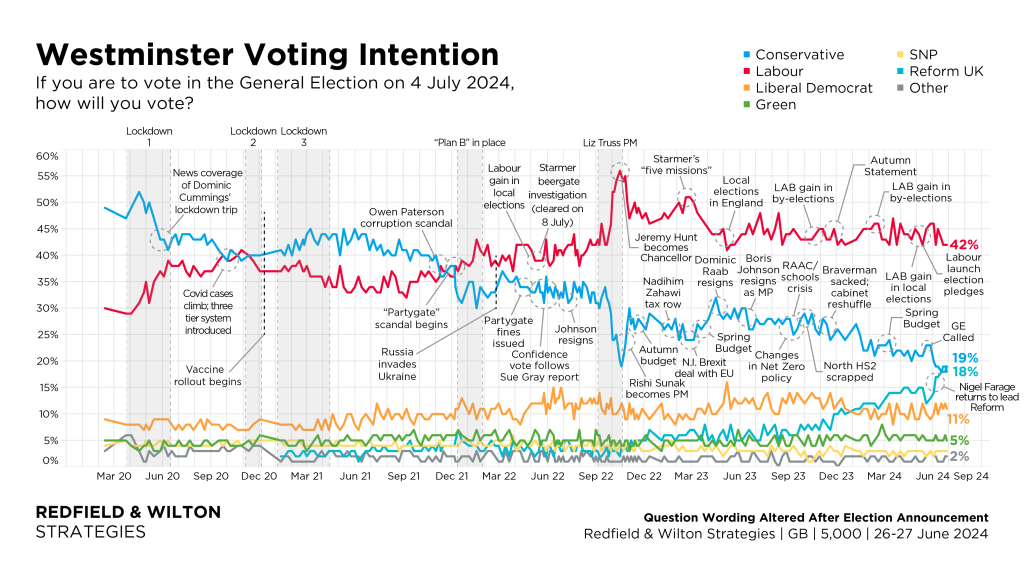

- The polls confirm our long-held view that we expect Labour to win the General Election and the Conservatives to suffer a crushing defeat.

- We still expect Labour to raise additional taxes, with something around ‘wealth’ being the most obvious: we think it will be inheritance tax.

- We think it’s unlikely to be a successful Labour administration, as the electorate is changing. The Conservatives failed to adapt to this, and we expect Labour to fall into the same trap.

- As can be seen in Europe, there is a drift to the right politically. We expect the UK to do something similar over the coming years due to similar economic and social drivers.

- Ultimately, economically we are expecting to shift to a more inflationary and politically volatile era but one that will present many opportunities.

“If voting changed anything, they’d make it illegal.”

—Emma Goldman

“Governments should have policies; they should not put the matters to a referendum.”

—Michael Gove

With the upcoming election we have been asked a series of questions from clients, but we have waited until we could read all the Party manifestos before replying.

The problem with writing about politics is that it soon gets – well – political.

The field of economics is divided into two parts:

Positive economics, which is effectively the observation of the world as it is; and Normative economics, which is the world as people want it to be and this is where political philosophy tends to get involved.

We, however, are going to focus on the ‘positive’ side, which is what we think is happening and likely to happen.

But first… Congratulations!

Before we begin, we must congratulate our good friend Helen Thomas of the research company, Blonde Money. As detailed in our last note, she accurately predicted the General Election would be called in July and even got the date correct.

The only difference from her prediction is that the hapless Sunak will be leading the party rather than Mordaunt. Helen operated on the logical basis that letting such a dud as Sunak lead the Conservative Party into an election would be electoral suicide. So, in a way, she was right about that too.

Do you have any recommendations or endorsements for the election?

No.

Keynes described government as the balancing of ‘economic efficiency, social justice and individual liberty’. How you think this should be achieved is personal preference.

What do you expect to happen?

We have been consistent since the over-promotion of Rishi Sunak to the top of the Tory party that they were heading for an electoral beating on par with 1997.

It is quite possible that it could be worse than that, and we might be witnessing the death of the world’s oldest political party. We think it will be hard for the Conservative Party to recover from this election.

So Much For the ‘Grown-Ups’

Source: Redfield & Wilton Strategies, https://redfieldandwiltonstrategies.com/latest-gb-voting-intention-26-27-june-2024/.

“There is no worse mistake in public leadership than to hold out false hope soon to be swept away.”

—Winston Churchill

How do you think Labour fares when in power?

We wish them all the best but ultimately, we expect Labour to fail – like the Tories – when it achieves power. We base this on several factors:

- As we have pointed out before, Labour is not getting into power because it’s doing well with the general population. Rather, its vote has just held up while the Tories has collapsed. And whilst this might deliver a big majority, it does not have widespread political support as approximately 60-65% of voters preferred something else.

- Next, both the major parties are effectively coalitions. We believe that the Labour ‘coalition’ will find it difficult to maintain cohesion once it is faced with difficult choices. The economy is already heavily indebted and taxed which leaves Labour without its traditional methods to reward its voters.

- As the IMF has pointed out, the UK needs to cut government expenditure and lower taxes to improve growth. These actions are not in the Labour Party’s DNA. Further, Labour’s main funders are the unions who are heavily aligned with the public sector so they will be resistant to this. This funding issue was a perennial problem under the Blair administration.

The IMF has pointed out 4 key objectives for the UK

Source: IMF.

- As the recent Abbot/Rayner spat shows, the party still has a discipline problem which we suspect will only accelerate once it achieves power, but Labour will also have a personnel problem. The party has still not fully recovered from its last big loss in the 2019 election combined with the Corbyn-era factionalism. When any political party faces a heavy defeat like it did in 2019 it loses a pool of talented MPs – ones that Labour really could use right now. This is because some lose their seats whilst others quit because they are understandably unenthused with the thought of 10 years in opposition.

- Hence, like the Conservatives post-1997, the residual parliamentary party is either filled with idealogues who do not want to do anything else or people unable to get well-paying jobs elsewhere. So, the talent pool in the party will be narrow.

- If we want better government and expand this talent pool through all parties, then society will need to accept that we need to pay politicians and senior civil servants more. As historian Dominic Sandbrook pointed out, if MPs wages had kept pace with inflation, they would be on circa £250,000 now rather than £91,346 which is why we have ended up with increasingly ineffective legislators where one technocratic drone replaces another to no great effect.

- Also if Labour’s chief of staff, Sue Gray’s, comments in the recent Starmer biography are to be believed, she is helping Labour’s incoming ministers to ‘be better prepared how to work within the parameters of the Civil Service’. Which is an intriguing inversion of democracy. Elsewhere, she has talked about yet new devolutionary measures, despite the obvious problems with those left by the last Labour administration.

- Starmer is also a former civil servant. His period as Director of Public Prosecutions received much criticism. We suspect he will be quickly found out as not a great politician or leader.

- Finally, we believe there is a much bigger social-economic regime shift going on that Labour is equally ill prepared for. For example, polling shows immigration is far more important for the average voter than trans issues or Palestine are, yet Labour remains more heavily involved in the latter than the former.

“I would describe myself as a socialist.

I describe myself as a progressive.”

—Keir Starmer, May 2024

Do you see any positives with a strong Labour administration?

Generally, markets like stronger governments over weaker ones, so that would be a positive but how long Labour stays composed remains open to question. We are old enough to remember the 90-seat Tory majority in 2019 when everybody said they would be in power for ‘at least’ a decade.

Hopefully the Labour Party can get some structural reform through in the welfare state but, given its natural conflicts of interest with the unions, we are sceptical.

Additionally, a radical easing of planning laws and decent infrastructure investment would also help. Though given Labour’s increasingly unpopular ‘green’ zealotry we suspect the additional bureaucracy and cost this brings will likely undo any benefits from easier planning.

Finally, a Labour administration that commits more fully to making Brexit a success might help some sections of society move on. As we have said in other notes, we have a negative view on the European economy and aligning more with it will just import their problems. Unfortunately, Labour still doesn’t seem to grasp this.

“The problem with socialism is eventually you

run out of other peoples’ money.”

—Margaret Thatcher

What do we think a Labour government does when it gets into power?

Labour has committed to not raising taxes in several areas, yet it has also made several spending promises. Inheritance tax appears to be the only major tax it hasn’t ruled out yet. Also, wealthy older voters are generally right wing, so Labour has less to lose politically from taxing them.

Alternatively, Labour could get in and claim, ‘everything is worse than we thought’ and attempt to immediately renege on some of its commitments. Given the growing unhappiness with the public and politicians we are sceptical this will work.

We would observe that Labour also committed to no new taxes in 1997 and then proceeded to wreck the defined benefit pension system from almost the day it got into office. This is something the eminent economist Sir John Kay calls ‘the biggest avoidable policy disaster in British politics’.

Rachel Reeves gave a speech earlier this year that was revealing. In it she diagnosed some of the failings of the British economy, many of which we would agree with. However, her solutions implied more government – despite it being the least productive part of the economy – and academic references to some very left leaning economic theorists.

In common with many people that lack real world commercial experience, she is very heavy on Normative economics (how she thinks the world should be) rather than acknowledging the realities of the world as it is. Some of the problems in the UK economy have persisted for over a century and they are highly likely to outlast Rachel Reeves too.

The economy

The other thing we think will work against Labour is the wider economy. Unlike the 1997 Blair administration – where debt was below 40%, taxes were low and the economy growing – we have an economy that is barely growing, highly taxed and indebted.

This has been the result of several decades of poor decision making by both major parties. Rather than repeat ourselves, we have included a link to an article written with renowned economist Andrew Hunt detailing the key points.

Unfortunately, this leaves the economy at the risk of having a currency crisis.

Further, Labour has an unfortunate habit of being the wrong people in the wrong place at the wrong time. Only one Labour administration in its history of government has avoided a sterling currency crisis (Blair 97-2007) and even then, it was by a matter of months.

To be clear, we suspect whoever wins this election will be facing this risk and we have no faith in the ‘Hunack collective’ to avoid this either.

“(I have) friends who are aristocrats, I have friends who are

upper-class, I have friends who are, you know, working-class… well, not working-class.”

—Rishi Sunak

Do you think the Conservative party is failing because it has gone too right wing?

Crudely, no. If the Tory Party had not gone too far left it would not now be hemorrhaging votes to a more right-wing party. As the Liberals discovered nearly a century ago, you cannot expose your dominant axis in a 2-party system.

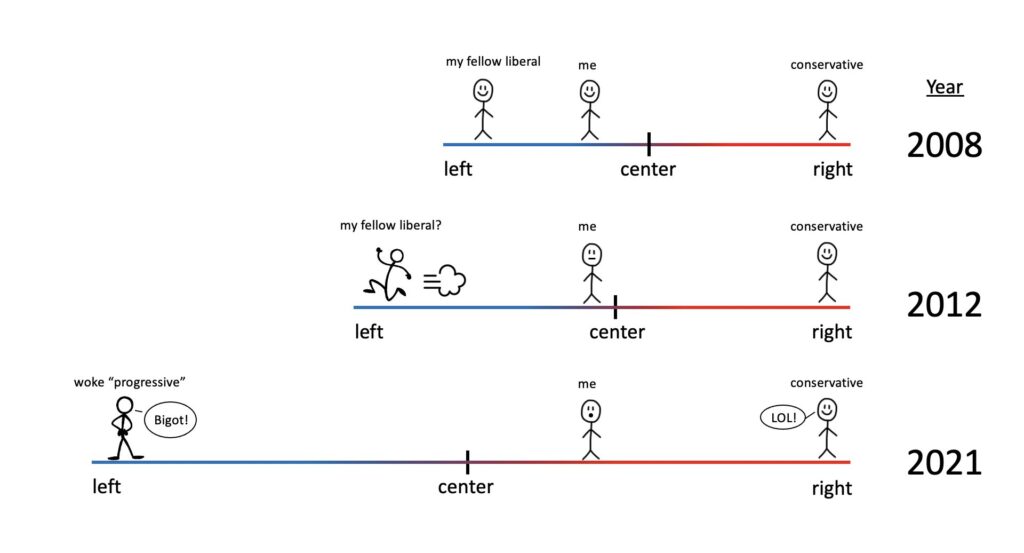

That said, we think traditional right/left terminology is getting more outdated. As we have repeatedly stated, we think there is a broader political alignment going on. The current ‘centre’ is a nebulous thing but many of the current views that comprise, what Irving Welsh called, ‘radical centrism’ would be considered odd a few years ago.

Elon Musk Posted a Chart About the Shifting Political Centre

Source: Colin Wright (@SwipeWright), https://x.com/SwipeWright/status/1462114108535312388/photo/1.

Regardless of what you think of them, the future of the Conservative Party will probably have to look more like Reform if it wishes to survive. To be fair to Reform, most of their policies are consistent with a mid-1980s Thatcher-led Conservative Party.

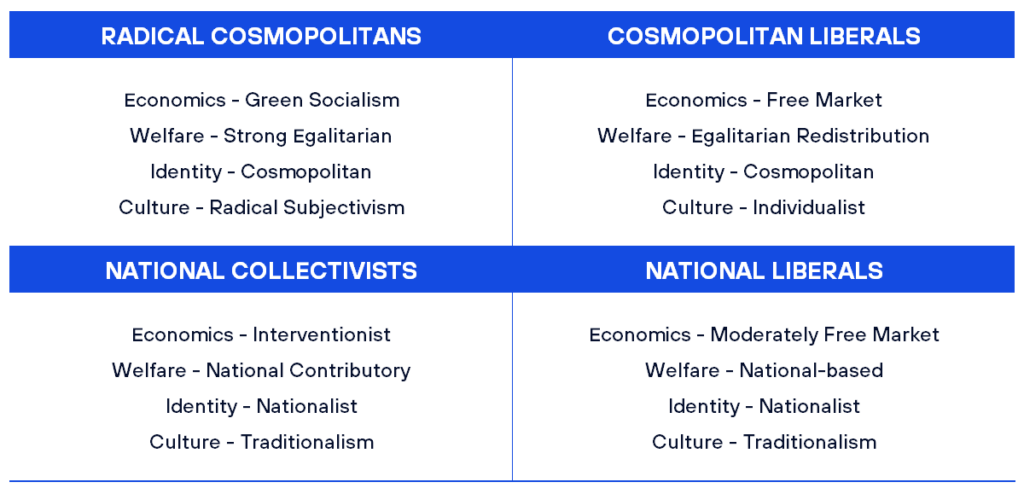

Below we have reproduced some broad groupings from Stephen Davies work on the realignment of British public life. Assuming he is correct, you can see Labour is also going to have a problem. They are likely to lose their traditional working class voting base and its emerging class of ‘educated metropolitan’ voters are ultimately not natural fellow travellers with Labour’s growing sectarian vote in areas with high immigration.

The UK Political Compass from 1983

Source: Dr. Stephen Davies/IEA.

The Emerging UK Political Compass

Source: Dr. Stephen Davies/IEA.

“Fate is like a strange, unpopular restaurant filled with

odd little waiters who bring you things you never asked for

and don’t always like.”

—Lemony Snicket

You seem very negative on Labour

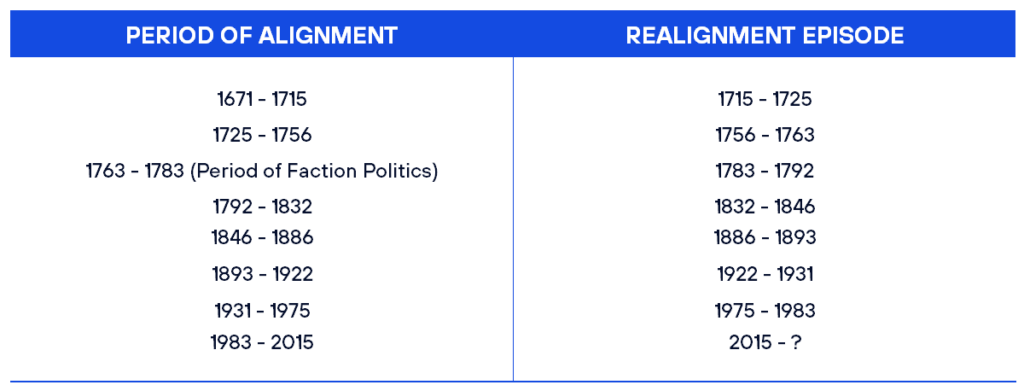

Not really, we think this is one of the big social-economic realignments and neither of the major parties are prepared for it. This is not a big conspiracy theory it’s just a reality of human civilisation.

As you can see below, these happen frequently and can take a few years to work their way through the system. Like all big changes to the status quo there will be winners and losers.

Political Realignments Are Common Features In UK Political Life

Source: Dr. Stephen Davies/IEA.

Hence, for acute observers of social change, events like Brexit and Trump’s election have been predicted for some time. As Karl Marx long ago observed, politics must reflect economic reality. In his opinion, this meant that communism was inevitable as workers ultimately produce all value. For us, it is the failure of the current economic ‘orthodoxy’ to deliver enough improvement for the wider population. In the final section we have provided a long list of additional reading that supports this view.

“It’s the economy, stupid.”

—James Carville

Why do we think this is occurring now?

First, as Keynes observed, occasionally capitalism needs to be saved from itself periodically and be reset. It is prone to booms and busts and uneven allocation of the gains over time. We think after the long cycle of the past decades we have reached the periods of reset.

Humans like to divide up history into discrete periods, rather than a continuous stream but for the ease of explanation we are going to start with the end of the Cold War. Simplistically, the ‘West’ thought liberal democracy had won and started on globalisation to bring all these countries into the same broad orbit. Unfortunately, how trade works in practice versus how it works in theory is very different.

Not all countries play by the same rules and some game the system to create export-driven economies. Also, this theory relies on the concept of comparative advantage: as ‘old’ industry is lost, then new – and higher value added – industries need to be created. This hasn’t happened.

This difference between theory and practice has finally entered mainstream economic thought, although it has taken nearly 40 years to do so. US Treasury Secretary Janet Yellen – previously a vociferous supporter of ‘free trade’ – finally acknowledged she had made a mistake recently: “People like me grew up with the view: If people send you cheap goods, you should send a thank-you note. That’s what standard economics basically says,” … “I would never ever again say, ‘Send a thank-you note.’”

Additionally, capitalists don’t like competition and hence tend to move towards oligopolistic or even monopolistic positions. One of the ways this can be achieved is by ever higher levels of regulation which large corporations often support.

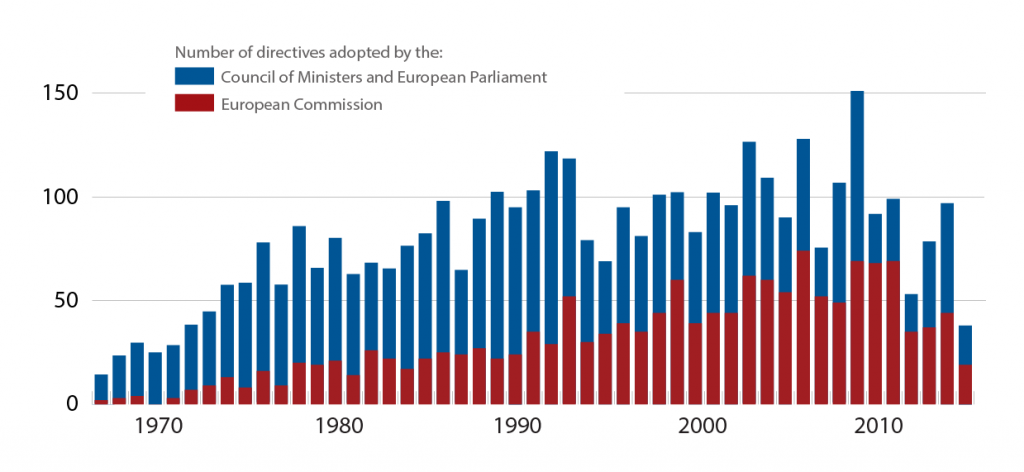

More Europe Usually Means More Regulation

Source: Toshkov, Dimiter. 2017. “The European Union Could Be Simple, Inclusive, or Effective. Pick Two.” Atlantic Council (July 17), Figure 2.

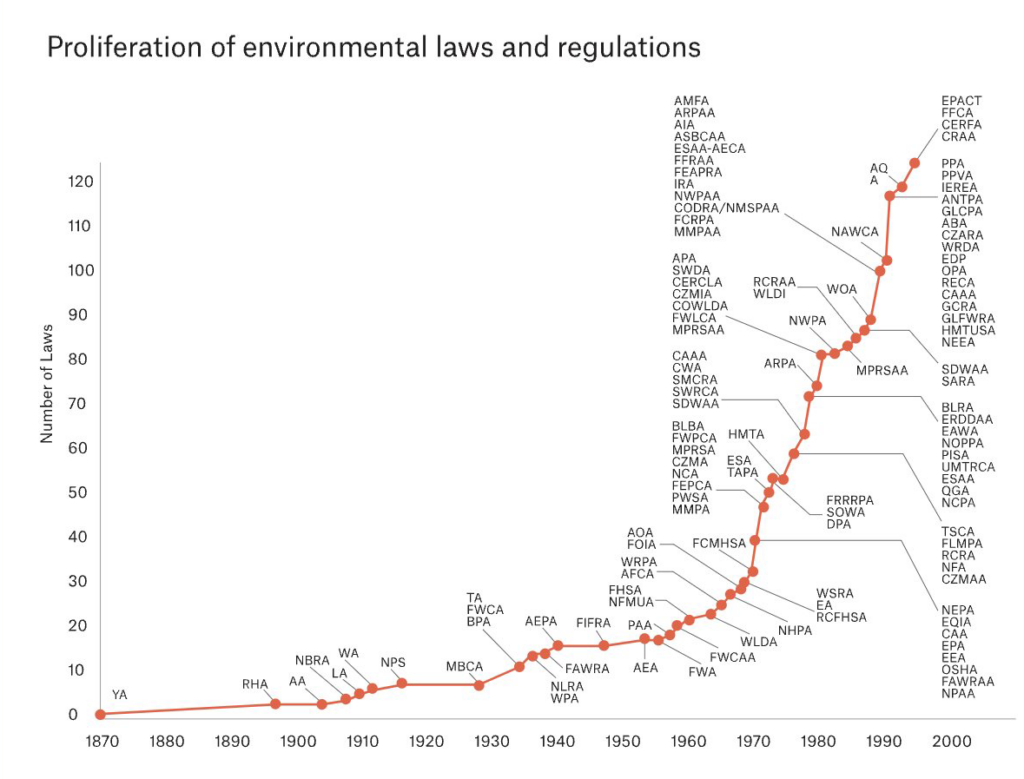

Even In ‘Lower’ Regulation USA, Regulation In Many Areas Has Ballooned

Source: Roberts, Jody A. 2005. “Creating Green Chemistry: Discursive Strategies of a Scientific Movement.” PhD diss. Virginia Polytechnic Institute and State University. https://www.researchgate.net/publication/34467869_Creating_green_chemistry_electronic_resource_discursive_strategies_of_a_scientific_movement

Another issue is that the Global Financial Crisis and Covid are two of the biggest wealth transfers that have ever occurred in history. Few have benefited, but many are being taxed for it. This spreads the gains too thinly and, probably most importantly, the prospects for the younger generation are not as good.

Hence, our view is that the system we have ended up with is over-financialised as debt has been used to subsidise consumption, real industry has become over-regulated, and it benefits large, slow growing, companies rather than smaller more dynamic ones. It was a system that benefited the backslappers at Davos.

As this system toddled along – slowly accumulating massive debts – then no real change was required. We slowly ended up with a combination of have and have nots and a political class that was increasing focused on the ‘haves’ since politics in the UK doesn’t pay and that was where their future wealth was coming from. Given the economy was largely on autopilot it didn’t require many hard decisions.

And this is about to change.

What does all of this mean for your money?

As regular readers know, we think we are about to go through something like the 1970s. So, a period of political and economic volatility, probably ending with a fiscal crisis; like the UK going to the IMF in 1976.

The massive borrowing during the GFC and Covid has brought forward years’ worth of demand. Without this, deflation would occur, but the Western governments cannot allow deflation to take root as it will mean these debts grow in real terms. Therefore, there will be a natural bias by governments to run higher inflation, so longer dated government debt looks unattractive.

Oddly, certain heavily indebted companies ARE attractive in the scenario. It requires careful analysis but companies that can reprice their products quickly to reflect rising prices and have long dated debt will see an effective transfer of value to equity holders from debt holders.

Certain commodity producers will be attractive, as there are inflation linked qualities to them. Our favourite would be some energy companies due to the MASSIVE misallocation of capital to the ‘green transformation’, which are immature and inefficient technologies in many cases. There is likely to be a renewed case for precious metals, but we remain more sceptical on this for various reasons

Finally, certain technology companies. The 1970s saw the birth of industry giants like Apple and Microsoft. We are going to see the application of AI revolutionise lots of different sectors; perhaps most exciting for us is in medicine but there will be others.

Despite the noise there is likely to be lots of opportunities too. That said, we suspect there will be a lot of doom and gloom over the next few years. We do not have a class of politician that can navigate this regime shift skillfully. As Enoch Powell observed, “all political lives end in failure” and we expect Keir Starmer’s will too.

“I’ve read too many books to believe what I am told.”

—Suheir Hammad

Reading List

For those interested about the changing political inflection, we have added a reading list. It is also very useful for sleeping.

The Road to Somewhere: The Populist Revolt and the Future of Politics by David Goodhart.

When Theresa May used the expression ‘citizen of nowhere’ she was referencing this book. Goodhart is a left wing academic and talks about how we have created a two-tiered society of ‘Anywheres’ (highly educated, mobile professionals) and ‘Somewheres’ (Less educated but with much deeper roots to where they live). Somewheres form the bulk of the population, but Anywheres run the country and fail to take Somewheres’ interests into account.

The Economics and Politics of Brexit: The Realignment of British Public Life by Stephen Davies.

Think Brexit was caused by a red bus? Think again. Davies is a right-wing academic charting the same pattern as Goodhart. The economic policies of the last few years have created deep divisions in society. Davies charts these changes and tries to predict the future.

The British Dream: Successes and Failures of Post-War Immigration by David Goodhart.

Further work by Goodhart where he looks at what has worked in immigration but why it is increasingly failing. He highlights multiculturalism isn’t actually a good idea as it promotes division rather than social cohesion.

The Fourth Turning: An American Prophecy – What the Cycles of History Tell Us About America’s Next Rendezvous with Destiny by William Strauss and Neil Howe.

A controversial book that claims there are long run identifiable cycles in society. At the end of these cycles there is usually a lot of political upheaval and even violence as the ‘four turning’ begins. Published in 1993 it has proven very accurate so far from the GFC to the current period of stagnation

Breaking the Code of History by David Murrin.

A very heavy weight book written by a good friend of the firm. David is an ex-trader and successful fund manager. David also makes claims that history follows longer term patterns. However, his work is far less deterministic.

Globalization and its Discontents by Joe Stiglitz.

Stiglitz is an American Nobel winning economist. In this book he gives a left-wing perspective on why globalisation might have been of economic benefit, but it hasn’t been great social in many countries.

On Europe by Margaret Thatcher.

Post-politics thoughts by Maggie on the UK’s relationship with Europe. In short, the COMMON market was a decent idea but Maastricht, the birth of the EU and the SINGLE market was a bad one and meant the UK was likely to have an increasingly fractious relationship and would probably have to leave. Prophetic.

The Trap + The Response by Sir James Goldsmith.

Actually, two books; both are freely available on the internet. We prefer The Response as it deals with the objections to the original polemic. Goldsmith was one of the first to highlight the effect globalisation would have on the middle and working classes as real life didn’t operate the way economists claimed it did. His predictions have been proven correct and the received wisdom of the economic experts has been proven wrong.

You Always Hurt the One You Love: Central Banks and the Murder of Capitalism by Bernard Connolly.

A depressing book by a former top EU civil servant who correctly predicted why the Euro would be such an economic disaster. In this book Connolly goes further and states that the massive money printing and big government is slowly crushing the economy.

EuroTragedy: A Drama in Nine Acts by Ashoka Mody.

A good read by the former head of the IMF bailout of Ireland. Similar to Connolly Mody explains why the Euro has been a disaster, why it will never work and why Europe needs a more flexible structure than the EU.

The Strange Non-death of Neo-liberalism by Colin Crouch.

Again, a left-wing perspective of the neo-liberalism and the radical centralism that has left neither the right nor the left particularly happy about the current state of affairs.

Important Information

The information contained in this article is the opinion of Henderson Rowe and does not represent investment advice. The value of investment may go up and down and investors may not get back what they invested. Past performance is not an indicator of future performance.

This document is intended for the use and distribution to all client types. It is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution would be unlawful and participation in the portfolio referred to herein shall not be offered or sold to any person where such sale would be unlawful. Any onward distribution of this factsheet is strictly prohibited.

The value of investments and the income from them can go up as well as down and you may realise less than the sum invested. Some investments may be subject to sudden and large falls in value and you may realise a large loss equal to the amount invested. Past performance is not an indicator of future performance. If you invest in currencies other than Sterling, the exchange rates may also have an adverse effect on the value of your investment independent of the performance of the company. International businesses can have complex currency exposure.

Nothing in this document constitutes investment, tax, legal or other advice by Henderson Rowe Limited. You should understand the risks associated with the investment strategy before making an investment decision to invest.

Investors should be aware of the risks associated with data sources and quantitative processes used in our investment management process. Errors may exist in data acquired from third-party vendors, the construction of model portfolios, and in coding related to the index and portfolio construction process. Information contained in this fact sheet is based on analysis of data and information obtained from third parties. Henderson Rowe Limited has not independently verified the third-party information. The firm, its directors, employees, or any of its associates, may either have, or have had, a position, holding or material interest in the investments concerned or a related investment.

Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809. It is a company registered in England and Wales under company number 04379340.