“Volatility is the price of admission. The prizes inside are superior long-term returns. You have to pay the price to get the returns.”

—Morgan Housel

Talking Points

- The liquidity that powered markets in H1 is set to reverse from August as the US Treasury rebuilds its cash war chest and restarts heavy issuance.

- Whilst the market has convinced itself that Trump’s trade policy doesn’t matter, we suspect it is about to be negatively surprised. He has achieved his main policy objective of lower taxes.

- The UK political and economic landscape is, unfortunately, unfolding just as we predicted. The implosion is likely to accelerate over the next 18 months.

- We are nudging liquidity higher and trimming portfolio volatility, which makes the portfolio less volatile, to ride out the bumpier second half.

- We have been very pleased with our performance in H1, achieved with significantly less volatility than the market, as well as the temporary appreciation of the GBP. We expect GBP’s strength to start to weaken in H2, as reality bites.

- Cash has been a poor investment over the past decade; it is likely to remain so in the future as government finances continue to deteriorate.

The Party Is Starting to Wind Down

At the time of writing, the two super-charged liquidity spigots sent the S&P 500 to another record close. Some of this gain is a result of a money illusion, as it reflects a weaker US dollar.

- Treasury General Account (TGA) run-down. One of the quirks of the US financial system is that the government has its own bank account. This is called the TGA. Typically, the US Treasury maintains a roughly balanced budget; it spends money and replenishes it through tax revenues and the issuance of debt. However, it’s been drawing down on this account and it fell from roughly $460 billion in early March to $372 billion by 2 July—a de facto cash injection into the financial system.

- Anaemic debt issuance. With Washington preoccupied by budget wrangles, bill and bond auctions were held back. Again, this removed a drag on the financial system. Whilst money dragged out of the financial system does get recycled and spent, often there are timing differences and it comes at a cost. The numbers are staggering. The US government needs to borrow an additional $1.9 trillion this year and is currently rolling a $8bn debt pile annually. Small changes in interest rates cause big increases in debt costs.

Both tailwinds end soon. The US Treasury now says it will rebuild the TGA to about $500 billion and simultaneously “step up” borrowing. The message is clear: net liquidity starts contracting in August.

When this starts to impact the market is hard to predict. It is possible they could squeeze another 18 months out of their current borrowing strategy. Though this is likely to come at the cost of inflation.

Regular readers will recall that we were surprised in Q4 ’23 when the US Treasury first began using short-term borrowing aggressively. While it would support asset prices (which it did), it would also likely cause inflationary issues and potentially cost the Biden Administration the election (which it did). However, we’ve discovered that sensible long-term economic policies are not compatible with our current crop of politicians.

Trump’s Tariff Tsunami – A Risk Markets Ignore

Unfortunately, that is not all. From August 1, President Trump’s 10% blanket tariff on all imports, plus product-specific levies of up to 50% on copper, steel, and autos, kicks in. It is the most significant protectionist jump since the 1930s, which ended badly.

Yet the market has convinced itself that Trump is not serious about tariffs or TACO in market parlance (Trump Always Chickens Out).

Yet this overlooks a key factor. Trump needed to pass his controversial Big Beautiful Bill; this was his one and only piece of major legislation, and he needed every vote. Hence, he could not afford any problems in markets, nor could he avoid the America First crowd’s demands for an end to the Forever Wars. So, Ukraine was duly chastised, and Israel reined in. Trump is now unleashed.

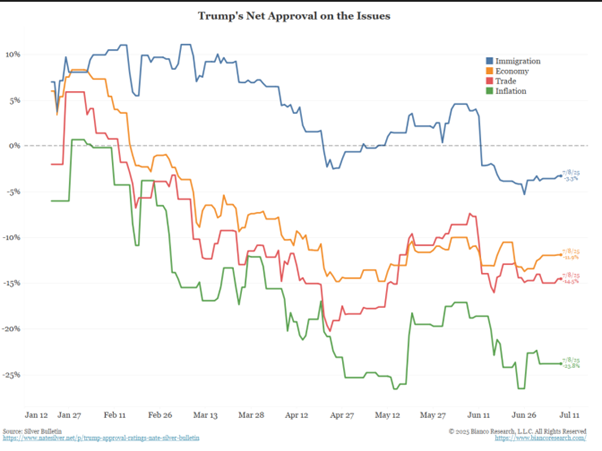

Unsurprisingly, Trump’s Approval Ratings Are Falling Across the Board

History suggests a lag of one to two quarters before higher landed costs squeeze margins; we expect reality to bite before the end of the year.

Neither of these things indicates an imminent crash, but they do suggest that it will be more challenging for the market to continue appreciating. The issue is that what the US is doing is extremely stimulative for its economy. However, it’s also likely to prove inflationary, and the bond market is expected to demand an increasing premium (or higher yields) to compensate for this.

“We believe that the Labour ‘coalition’ will find it difficult to maintain cohesion once it is faced with difficult choices. The economy is already heavily indebted and taxed, which leaves Labour without its traditional methods to reward its voters.”

—Game of Drones

Game Of Drones Prophecy Comes True – Labour’s Early Unravelling

In our Game of Drones note, we predicted a Labour landslide would “self-destruct once forced to choose.” Twelve months on, with the collapse of the relatively modest welfare bill, it appears we were too optimistic.

For a party with a triple-digit majority, that is extraordinary. If ministers cannot pass modest trims now, bigger IMF-style decisions look impossible.

I cannot stress how remarkable this is. Labour’s cadre of MPs, allegedly hand-picked by Morgan McSweeney, have already rebelled and are effectively abdicating the hard choices of government for student politics. It’s a complete institutional failure on their part as a political party and as a government.

“Rachel Reeves arrived in London less than 4 weeks ago.

Like some sort of financial Mary Poppins, she just had to

click her fingers and she could fix public services and

boost the economy all without raising taxes.

We feared the electorate was being misled…we believe

taxes are going to be going up quicker than you can say

Superconnedbylabourwatchmyassetsgetexpropriated.”

—Summer 2024 Update

Instead, profoundly debilitating wealth taxes are being discussed, or more money printing is being raised. This has never worked anywhere because of the simple issue that it is much easier to tax flows, not stocks. We would like to say we were surprised, but as we pointed out, it was all very predictable.

As the LibDems discovered during the coalition, it’s all very well to promise the world and try to be all things to all people. The reality is that they will not be able to deliver on their promises prior to the election and will alienate and chase away swing voters and disappoint the left wing of their party too.

We believe it unlikely Sir Keir Starmer will still be Prime Minister at the next election. Unfortunately, we suspect Angela Rayner will replace him, probably in 2027. Without going into the Labour Party’s mechanics, we think the simplest explanation is given by Logan Roy in Succession: they “are not serious people”.

“It’s all fun and games until your funding costs go sharply up.”

—Trump in a China Shop

What We’re Doing About It

- Raise a touch of cash. Balanced and growth mandates now carry 2–3 percentage points more liquidity—dry powder for better entry points.

- Lower beta. Beta is a market term for volatility RELATIVE to the market. A beta of 1 means it moves in line with the market. A Beta of 2 means it’s twice as volatile, .5 means it’s half as much. We will be reducing expected volatility by once again buying slightly more defensive companies. These companies are still expected to grow, just at a slower or more predictable rate. Hence, the lower beta.

- Maintain structural growth exposure. Raising liquidity is a tactical move; in the long term, cash is a poor hedge against governments that are bent on inflating away obligations.

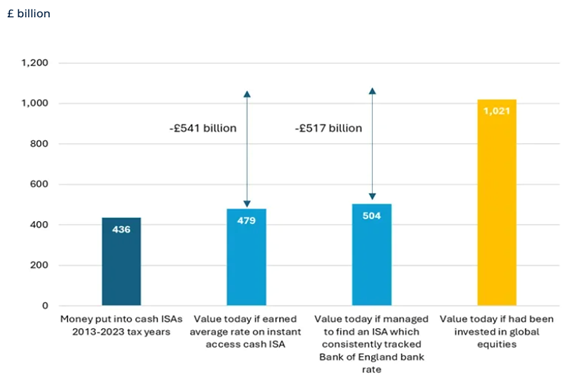

For example, Duncan Lamont of Schroders estimates UK households are £500 billion worse off than if they had invested their cash ISAs in equities over the past decade—about 20 % of GDP. That gap widens when high inflation erodes deposit rates. In real terms, cash is a government IOU whose value policymakers are signalling they will dilute.

Schroder’s Calculates that UK Investors Have Missed Out On £500bn of Gains By Being Too Cautious

Source: Schroders.

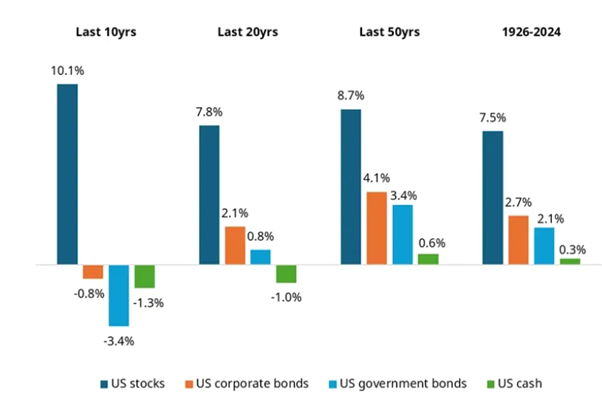

Using US data as it is better quality than the UK equivalent. Historically, as Lamont shows, stocks have outperformed.

Source: Schroders.

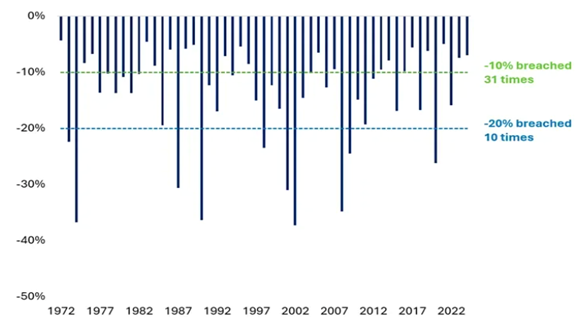

Unfortunately, there is a price to pay for this, which is volatility. Or in other words, share prices can move around a lot in the short term. With 10% drops being more common than not. Given the uncertainty and conflicting economic policies, we anticipate an increase in volatility. However, the lesson from history is to remain patient, as long as your portfolio is well chosen and not too speculative, history suggests you will be rewarded.

10% Drops in the Stock Market Are Common. Sometimes You Even Get Daddy Bear Drops – But Sit Tight.

Source: Schroders.

In summary, “Forewarned is forearmed.”

Liquidity tailwinds that flattered markets in H1 turn to headwinds from August. Add a tariff shock and a wobbling UK government, and we expect choppier waters ahead. We are therefore defensive but opportunistic: a little more cash, materially lower beta, and a readiness to redeploy when volatility offers value.

Please contact your Investment Manager if you would like to discuss any aspect of this update.

Important Information

This document is issued by Henderson Rowe for information purposes only. It does not constitute a personal recommendation, investment advice or an offer to transact. Past performance is not a reliable indicator of future results and the value of investments can fall as well as rise; you may not get back the amount you invest. Any views expressed are subject to change and may become outdated. Investments may not be suitable for every investor and you should seek advice based on your individual circumstances.