Following the dark news coming out of Ukraine over the last two months, our hearts break at the sight of the human tragedy unfolding each day and the grave impact this senseless act of aggression has inflicted on the lives of millions of innocent people. It is a grim part of our work that entails looking at such conflict through the lens of an economist or statistician, and coldly assessing the costs and the risks events like this pose to our clients. Even so, we find that the task reveals hopeful trends and offers useful lessons for global investors who must inevitably cope with such crises in the course of protecting and growing capital over the long term.

An Economic Battlefield

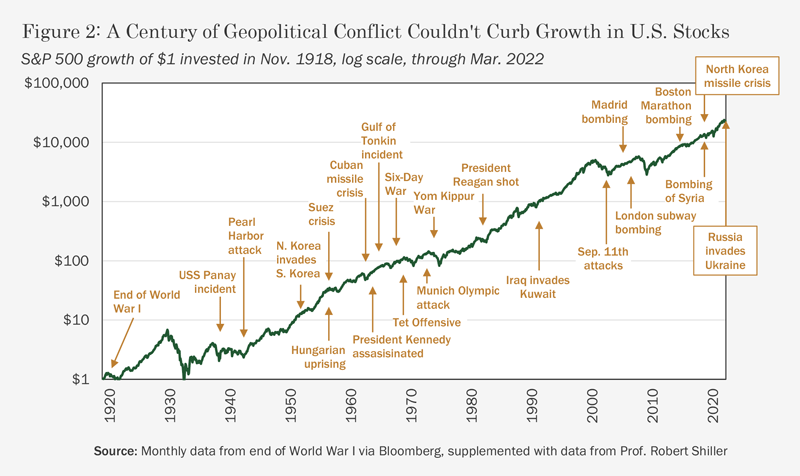

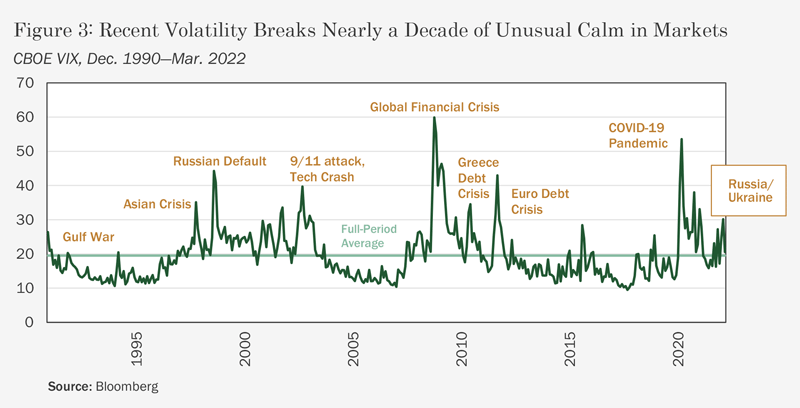

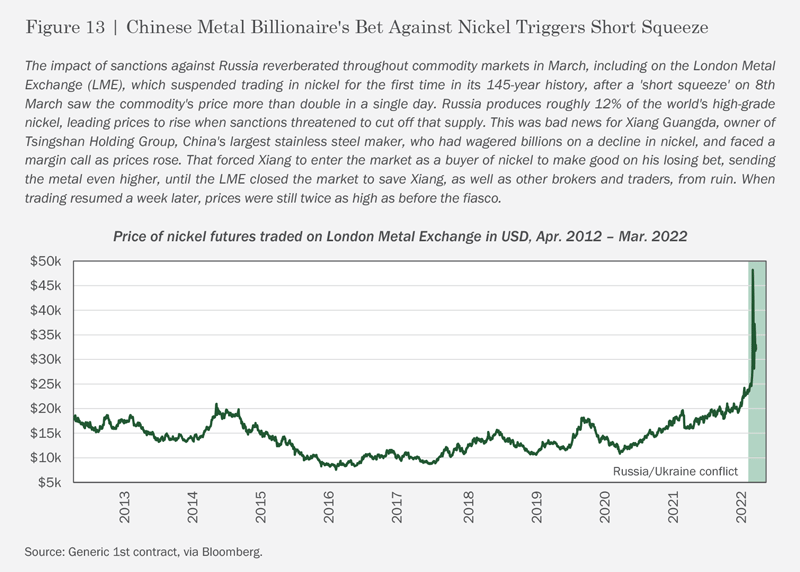

For one thing, those of us who have invested through many past cases of geopolitical conflict would likely agree that one of the most notable aspects of the current episode is the extreme degree to which markets have been deployed as financial weapons, forcing Russia and its citizens to internalize the costs of its belligerence. Beyond the old tools of economic sanctions, decades of intense globalization have created an interconnected community of nations, for whom the benefit to remaining a part of the network creates strong incentives not to act so as to be cut out.

In many ways, the public reaction to Russia’s invasion reflects a trend toward ESG investing that has been underway for some time, though we have rarely seen customers and shareholders put such pressure on companies to act in defense of a country under military siege. For their aggression, Russian citizens have been deprived of McDonald’s, Coca Cola, and Starbucks. They won’t have access to new Samsung and Apple smartphones, nor will they receive shipments of Sony and Nintendo gaming consoles. Disney, Sony, and Warner Bros. will stop releasing films in Russia, and Netflix has suspended streaming.

So far, the West’s economic offensive has failed to deter Russian hostility, and on the face of it, such measures may seem weak in comparison to military weapons. It’s worth noting, however, that no amount of spending on national defense can insulate Russia’s population from the loss of so many goods they have come to expect since the end of the Soviet era—let alone protect them from the more direct, widely felt, and extreme costs imposed by traditional sanctions. Bank runs and supermarket fights over sugar will undoubtedly take a toll on Russia’s morale in the longer run. The steep price Russia pays in terms of global financial and economic alienation will, at the very least, serve as a stark warning to other would-be aggressors.

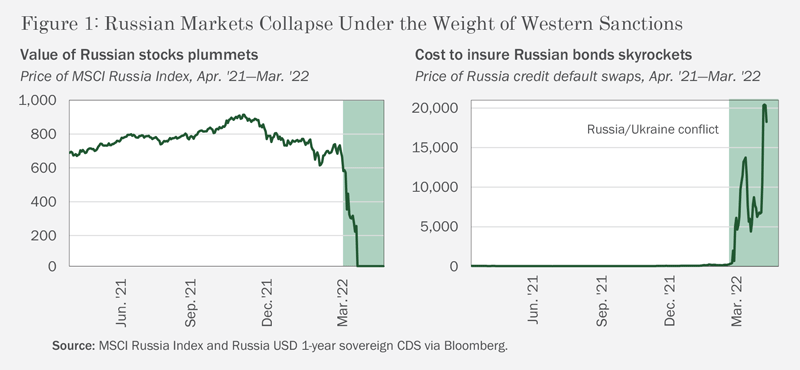

Russian Markets Postmortem

That Russia hasn’t yet called off its attack should not be taken to mean economic penalties haven’t had an effect. Indeed, within weeks of launching its offensive, Russia’s financial markets were already on the brink of collapse (see Figure 1). On 25th February, just one day after Russian stocks lost one-third of their value upon the official start of the invasion, the nation’s stock exchange was shuttered, and global benchmark provider MSCI quickly declared Russian stocks to be ‘uninvestable’, marking positions down to zero. While trading nominally resumed in late March, the longest closure of Russia’s equity market since the fall of the USSR, foreign investors are still barred from transacting. Russian debt hasn’t fared much better, with the price to insure the nation’s bonds against default skyrocketing as sanctions were imposed. Russia officially entered ‘selective default’ in early April, when the country attempted to make interest payments on two dollar-denominated bonds in roubles, the first time Russia defaulted on foreign debt since just after the Bolshevik Revolution in 1917.