“If you don’t get everything you want, think of the things you don’t get that you don’t want.”

—Oscar Wilde

Talking Points

- The US has once again shifted focus towards loosening financial conditions.

- Inflation pressures are likely to manifest next year. Will they be temporary? Who knows? Trump doesn’t seem to have revealed any end goal.

- Investments related to Artificial Intelligence appear to be entering bubble territory.

- What are we doing?

In our last note, we warned that liquidity would tighten as the Treasury rebuilt its cash balances and bill issuance accelerated. By August, that thesis looked ready to bite until Jerome Powell – once again – blinked.

At Jackson Hole and again at the September meeting, the Fed executed a sharp, in our view, unjustified, dovish turn. Despite resilient inflation and early signs of tariff-driven price pressure, the Fed cut rates pre-emptively and signalled a willingness to ease further. Quantitative tightening was already tapering to a crawl; this pivot effectively nullified the liquidity headwinds we expected in the second half of the year.

Once again, policy trumped prudence, and markets took the cue. The result has been an extraordinary re-inflation of almost everything with a ticker. Equities rallied through Q3, credit spreads narrowed, and speculative assets—from venture to crypto—sprang back to life.

This is not new; it’s the same pattern we saw in 2020 and 2023. Policymakers, faced with slowing momentum, choose to defend nominal asset values rather than real purchasing power. The regime now treats asset-price inflation as policy—implicit stimulus via the wealth effect.

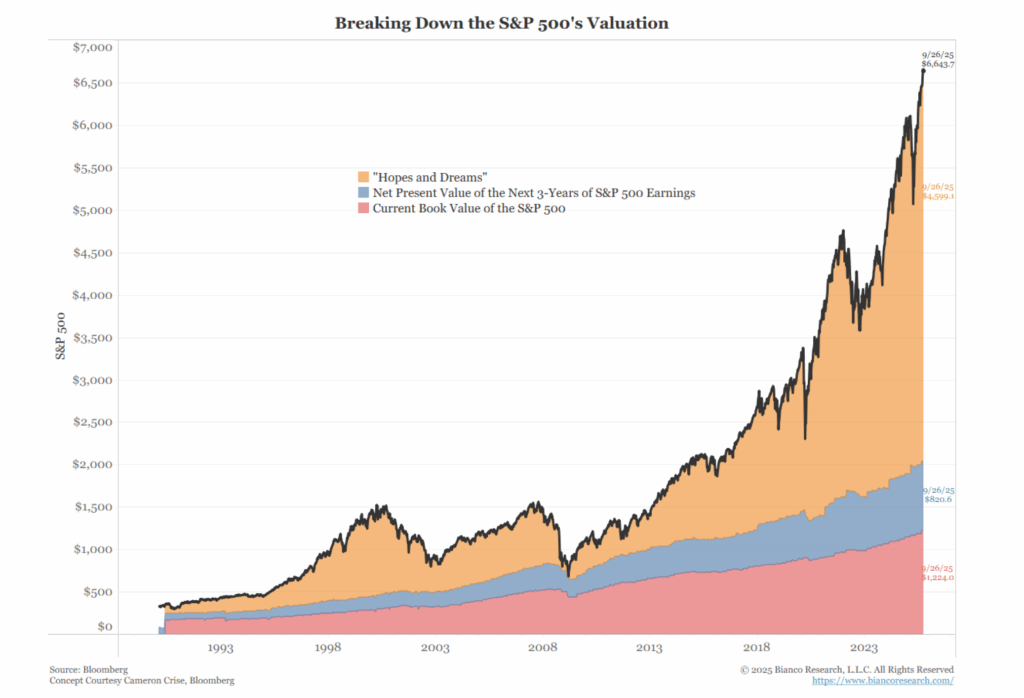

Liquidity remains too loose relative to the fundamentals underlying it, and this is dangerous. By any given metric, US assets are expensive by historical standards, and this action could well propel them higher.

The S&P Has a Lot of Hope and Dreams Priced In

Gold Leads the Revolt

Against that backdrop, our allocation to gold miners—introduced as a hedge against policy stupidity—has delivered far ahead of expectations. The metal itself surged through $4,000/oz in early October, driven by central bank buying, Asian inflows, and a growing sense that fiat discipline has eroded.

For many, gold has become the most honest asset in this environment. It doesn’t require a policy narrative or a productivity story it simply measures the erosion of monetary credibility. Miners, with leverage to bullion, have amplified the move.

Despite the gains, we’ll trim selectively into strength. Our long experience in the markets has taught us that while gold mining companies can be a good investment, they can also be highly volatile.

“The suspense is terrible. I hope it will last.”

—Oscar Wilde

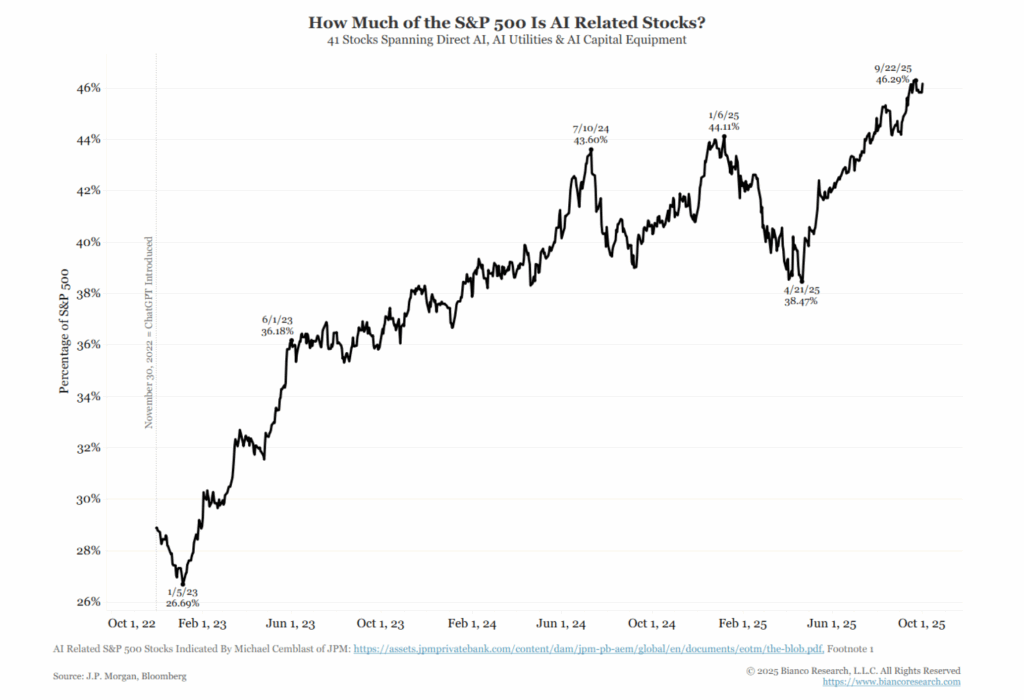

The Mania: AI and the Illusion of Infinite Growth

While gold represents the sober response to excess liquidity, AI is its speculative counterpart. The technology is transformative; the valuations are not.

We are now witnessing a liquidity-fuelled mania, with pricing perfection across an increasingly narrow group of companies. Market breadth is the weakest in two decades, and earnings revisions can’t justify current multiples.

As I noted elsewhere, this is not about whether AI changes the world; it will. It’s whether investors will ever be paid for that change. Scaling large models remains expensive, adoption outside tech is slow, and regulation looms. These equities have become long-duration assets with optionality attached—vulnerable to any rise in real yields or loss of narrative momentum.

Not Only Is the S&P Very Concentrated by Company, But There Are a Lot of Companies Doing Similar Things

“Some cause happiness wherever they go,

others whenever they go.”

—Oscar Wilde

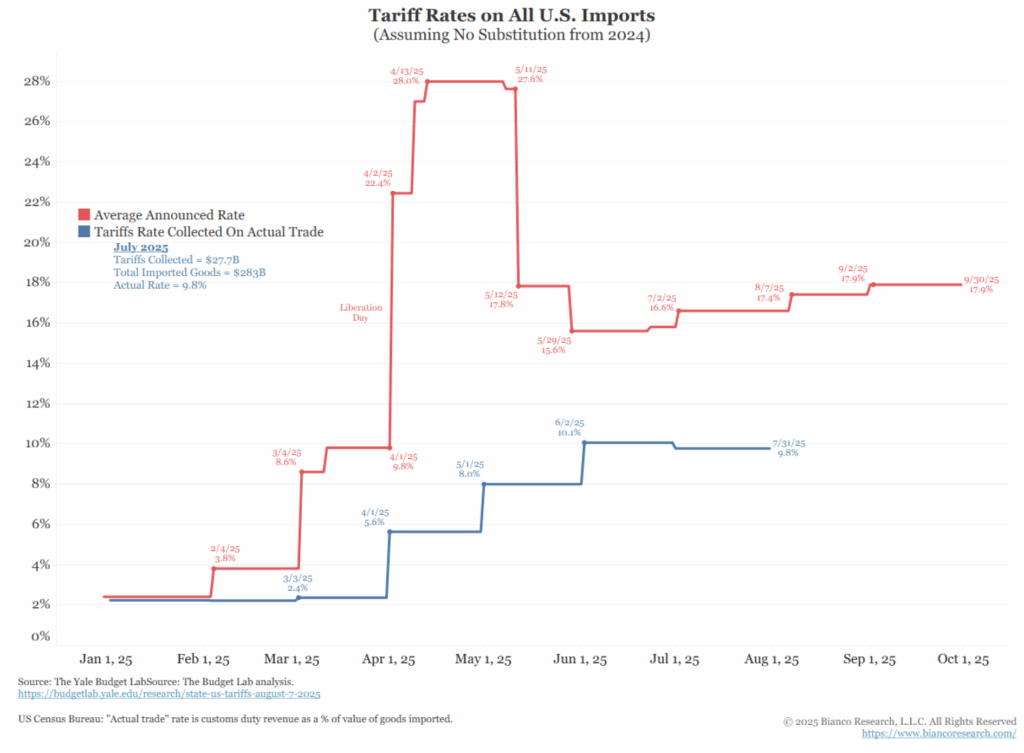

Tariffs and the Lagged Inflation Problem

Throw in that mix, Trump’s renewed tariff regime will probably not fully hit consumer prices until next year. The lag only means that today’s monetary easing amplifies tomorrow’s inflation risk. Will this be temporary or sustained? We don’t know, partly because Trump has identified no obvious end state.

The inflation problem hasn’t vanished; it’s merely deferred. And by the time it returns, policymakers will have even less credibility left to confront it. May you live in interesting times, as the ancient curse goes.

Tariffs Have a Lagged Effect on Prices

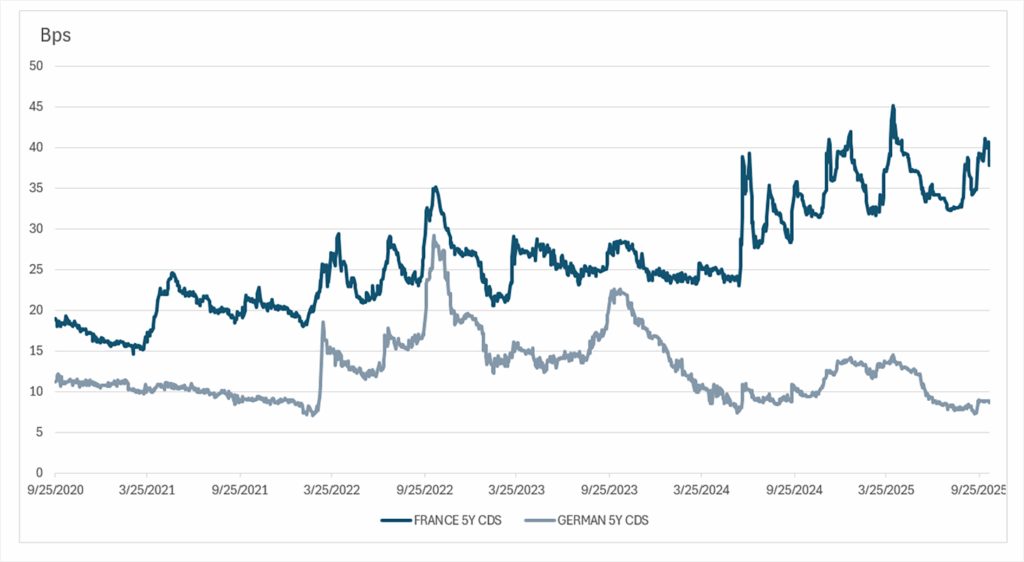

Between the last note and this one the US has borrowed approximately an extra $1.64 trillion dollars, or $5.6bn a day. This daily rate is going to increase towards the end of the year to between $6-7bn a day. When will the bond market take notice of this? We don’t know. But as we saw with France recently the bond market can ignore some obvious issues for some time before panicking. That’s what 17 years of low rates and over easy monetary policy does. France is in the crosshairs today and we expect the UK will be too at some point.

The Cost of Insuring Against French Debt Problems Has Soared

Source: Henderson Rowe, based on data from Bloomberg.

UK Politics: A Week Is a Long Time

Harold Wilson was right—a week is indeed a long time in politics. Few would have predicted that the Labour Party would decapitate its own deputy, Angela Rayner, within the space of 48 hours.

The sudden defenestration of Angela Rayner caught even seasoned Westminster hands by surprise. We had assumed she was being quietly positioned as the inevitable successor to Sir Keir Starmer. That theory is now in pieces. The nature of her fall—the precision leaks, the timing, the tone—suggests an inside job. Only someone close to the leadership could have known which threads to pull.

Andy Burnham continues to act as the focal point for the anti-Starmer faction in the Labour Party, but that feels almost too obvious. As any veteran observer knows, he who wields the knife rarely wears the crown. And those of us with longer memories recall that Burnham was once dismissed as an incompetent lightweight Blairite, was eliminated early in a Labour leadership contest, and even had to retreat from Westminster to rebuild his reputation in Manchester. His sudden, slipshod stand-down at the party conference was more in line with his previous performances.

Which leads us to a more mischievous speculation: perhaps the hand behind the leaks belongs to someone else—someone who has shown a willingness to betray even his own brother when ambition required it. Stranger resurrections have happened in British politics.

Our working view remains unchanged: Starmer is unlikely to see out the full parliamentary term. His authority within the party is collapsing, and the leaks now have the flavour of a slow internal coup rather than isolated discontent.

As an aside, Nigel Farage’s recent quip that he will be Prime Minister by 2027 was widely mocked. Yet it is not entirely fanciful. Should the government fail to pass a Budget, constitutional precedent allows for a general election. We doubt this government is any great respecter of precedent—but the mechanism exists, and the public mood is mercurial.

For investors, the message is simple: British politics remains as unpredictable as sterling liquidity. Both can move violently, and both now hinge on confidence—something that, once lost, is rarely regained quickly.

We expect another round of tax rises when the budget is announced on the 26th of November. Given that the economy has already stalled, unemployment is rising, and inflation is sticky, we see no reason to doubt our gloomy projections. Expect yet more tax rises.

It’s a vicious circle, the taxes and misallocation of capital are slowing the economy, as the economy slows, it cannot meet its obligations.

What Are We Doing?

- Timing is never perfect, but we continue to run lower volatility in our funds. We advise clients that just because some US stocks are overvalued, not all of them are. We are aware of the risk and are monitoring it closely.

- Equities: Bias towards quality-biased and valuation-aware.

- Gold: Maintaining the overweight, but we will trim on the recent exuberance.

- We remain with limited exposure to longer-term interest rates and especially UK gilts. Rachel Reeves might want others to fund her lifestyle, but we’re not going to.

Closing Thought

Powell’s dovishness delayed the reckoning; it didn’t prevent it. Between the rush into gold, the AI mania, and the broad boom in assets, we may yet see one last spike higher. We’ll use it not to celebrate, but to prepare.

Important Information

This document is issued by Henderson Rowe for information purposes only. It does not constitute a personal recommendation, investment advice or an offer to transact. Past performance is not a reliable indicator of future results and the value of investments can fall as well as rise; you may not get back the amount you invest. Any views expressed are subject to change and may become outdated. Investments may not be suitable for every investor and you should seek advice based on your individual circumstances.