Global investors, baffled but enriched by the extraordinary events of the last eighteen months, might have to learn to pay more attention to politics than has been necessary the last few decades.

For some time, the USA has been the hegemon, the dominant power—arguably since World War II, and definitely since the fall of the Soviet Union. But as China rises, declining US influence is revealing not another duopoly, but a new multipolar line-up. Rishi Sunak linked news of the failure of EU equivalence talks—which would have enabled the UK’s finance sector to operate freely in the EU, post-Brexit—to ambitions for trade with China; the EU, in turn, agreed to an investment deal with China (albeit currently on hold) just before Biden assumed office, annoying the incoming president with its timing. With ‘allies’ like these, it will be difficult for Biden to build an aggressively anti-China consensus. In a bipolar trade war, barriers and tariffs push up prices and reduce trade, but in a multipolar world, third parties nip in and replace the missing trade, though not to previous free trade levels. The other downside is that, unlike regimes in which hegemons enforce stability, multipolarity allows smaller belligerents to create conflict and veto holders to prevent consensus. It is much easier to read geopolitics when the world is simpler.

Meanwhile, we have become accustomed to see central banking as a rarefied world, run by monk-like academics, untainted by politics. This too is likely to change. The idea of a central bank was political in origin. The Bank of England was ‘emphatically the servant of the State…cradled in a Ways and Means Act dealing with tunnage duties’¹ and nicknamed the ‘Tunnage Bank’. Napoleon established the Bank of France to ‘compel it to meet his wishes’², and early central banks were regularly exploited for fiscal gain.³ The ECB is nakedly political, stripping power from national governments. But in 1951, the US Federal Reserve broke out from tutelage to the Treasury after the Korean War, on the grounds it risked becoming ‘an inflation engine’. Bank of England technocrats took on more responsibility for interest rate policy in the 1970s, after years of disastrous inflation. Since the 2008 GFC the keys everywhere have been heading back to their real owners, Trump’s 2019 tweets demanding lower rates and more QE to send the US economy ‘up like a rocket’, a colourful example.

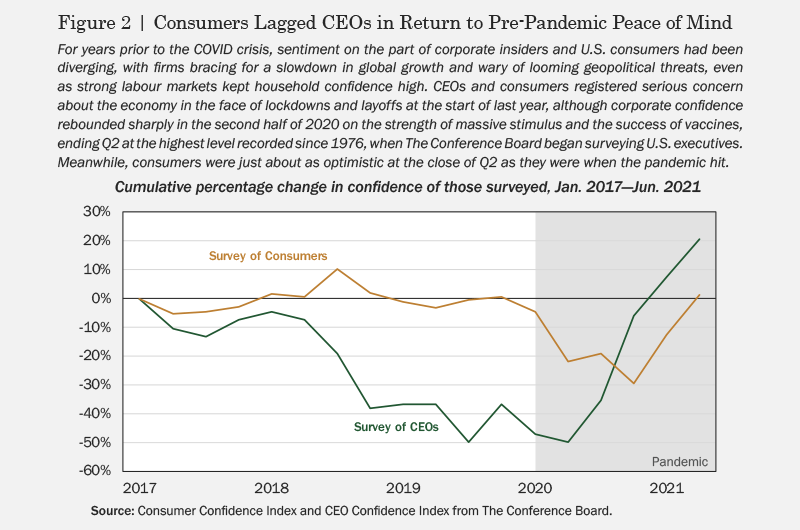

Such a shift reflects deeper change, as Western electorates, battered by China’s 2000 WTO admission, move leftward. A recent Institute for Economic Affairs survey⁴ found 67% of 17- to 30-year-olds in the UK prefer socialism to capitalism. Politicians have obliged with escalating deficits. In the US, ‘QE’ is morphing into ‘fiscal QE’, the difference being that fiscal QE is used for purposes other than fighting recessions. In one Green New Deal proposal in February 2019, Democrats envisaged fiscal QE helping finance a decade-long spending program costing over $6 trillion (34% of GDP) a year! COVID pushed things well past the Rubicon, as Western governments distributed funds directly to individuals’ pockets via banking systems they now controlled. As a result, money supply has been soaring.

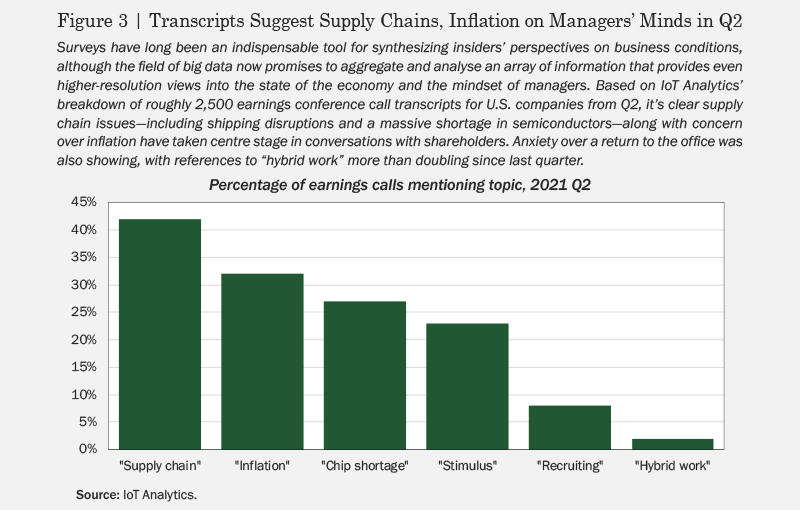

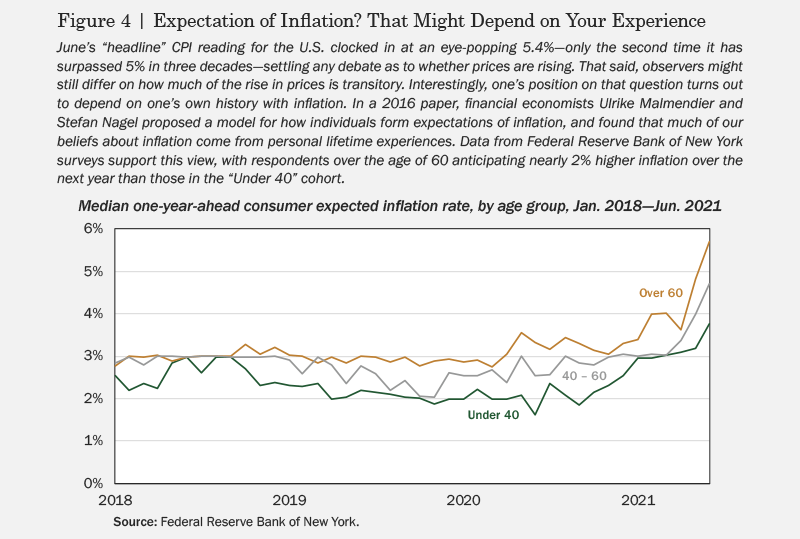

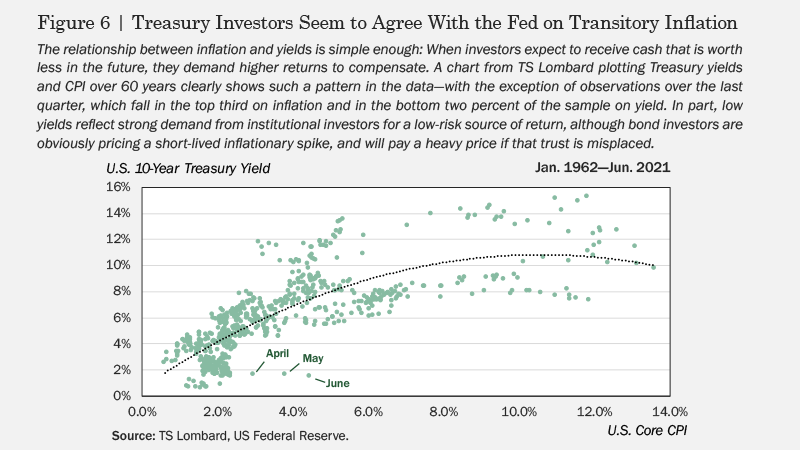

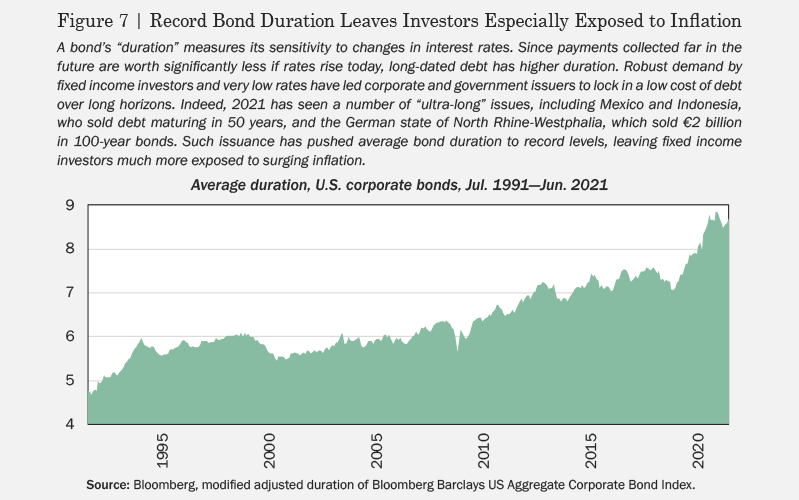

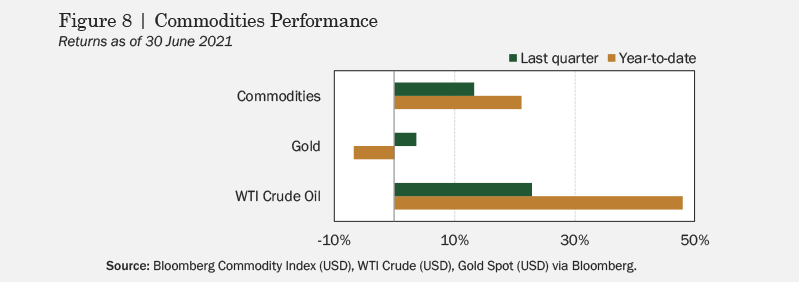

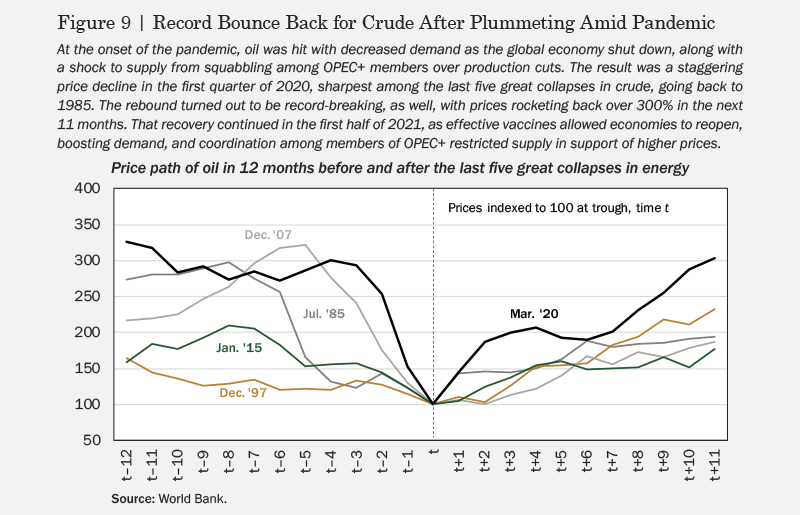

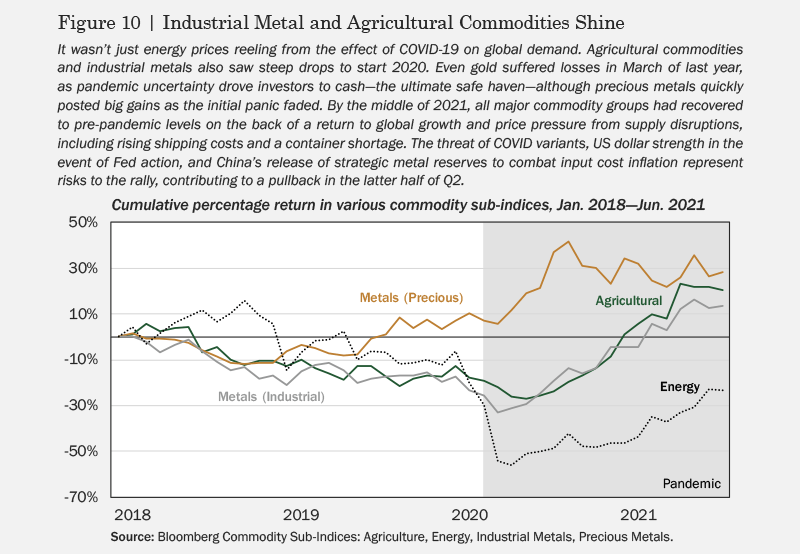

The question raging now, as peak fiscal and monetary interventions collide with lockdown vandalised supply chains, is whether inflation is simply a short-term impulse or will be returning as a new multi-year regime. The issue divides on ideological as much as theoretical lines and the evidence is still ambiguous, with commodity prices ricocheting, some mimicking meme stocks and cryptocurrencies as they crash from peaks, while labour shortages push up wages. At the same time, the scale of ‘support’ for the recovery is extraordinary with potentially over $6 trillion fiscal stimulus and the Fed buying $120bn bonds a month. As a result, the banks are gorged on cash, swimming in reserves equivalent to some 17% of the USA’s $22 trillion GDP. For comparison, bank reserves were only $46bn or 0.3% of GDP the day of Lehman’s collapse in 2008. Other developed world banks are doing the same. Will the first pulse of goods-driven inflation peaking at around 8% be followed by persistent inflation at over 4%, or will it sink back to 1%? Left to its own devices, human business activity is deflationary⁵: we continually make ‘stuff’ better and cheaper. But when governments seek to pump up economies by printing money, the price of ‘stuff’ goes up. The scale of recent money creation lends weight to the upper end of these inflation expectations.

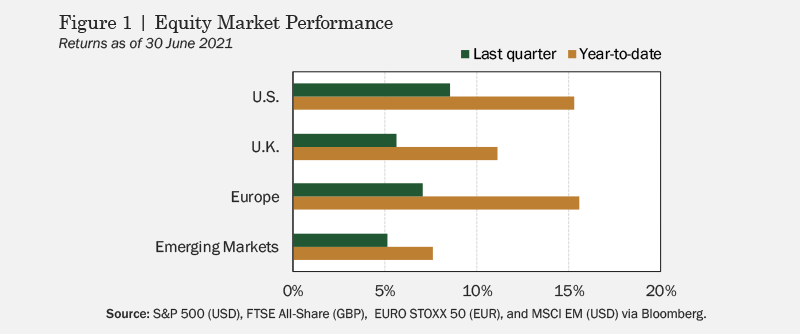

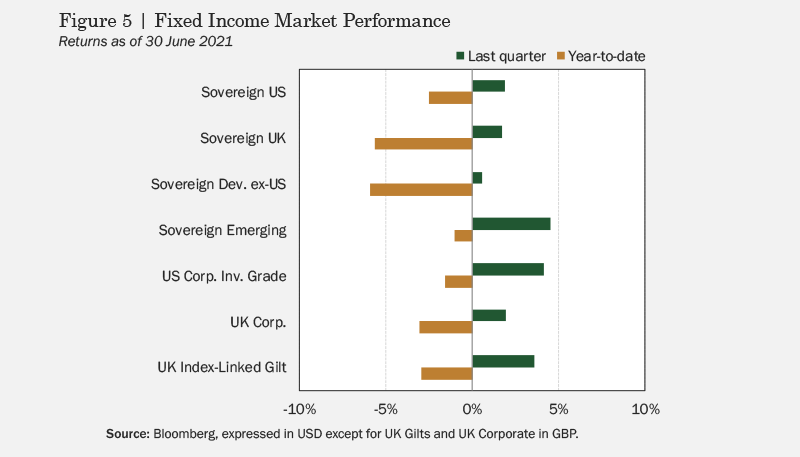

Which brings us to asset valuations. What should you hold to preserve and build value in times of high or highish inflation? Definitely not cash or low risk fixed income, which yield less than nothing and lose value. Given the determination to keep interest rates low, equities, commodities and index-linked bonds look interesting. Less exposed to inflation risk are areas like litigation finance and reinsurance. Of course, there are plenty of signs that equities are overvalued, but these are strange times. COVID has given governments a taste of running projects to save the world, and in a sea of liquidity looking for returns, there are some gigantic opportunities—from onshoring supply chains to fighting global warming—waiting to oblige.