“The Grinch hated Christmas! The whole Christmas season!

It could be, perhaps, that his shoes were too tight.

…the most likely reason of all…that his heart was two sizes too small!”

—How the Grinch Stole Christmas, Dr. Seuss

The recent price action of various financial asset markets is more characteristic of a Bear Market Rally rather than a new Bull market.

Use the recent rally to review your wider investments. Liquidity is likely to be at a premium in 2023. The old market adage is: You have to use liquidity when it’s available, not when you want it.

Various governments, especially those of the Eurozone, have a substantial amount of debt to issue in 2023. Especially if inflation proves more ‘sticky’.

Despite the growing negativity, the opportunities for attractive long-term investment are increasing.

FIRST, A THANK YOU!

“Reflect upon your present blessings—of which every man has many—not on your past misfortunes, of which all men have some!”

— A Christmas Carol, Charles Dickens

I wanted to start by saying thank you on behalf of all of us at Henderson Rowe and Rayliant for both your business and your trust this year. We really appreciate it!

As long-term clients know, we implemented a lot of changes over the past couple of years and we really appreciate the faith you have shown in us. Hopefully, our performance this year has helped show your patience was worthwhile.

We will be following up with our usual Quarterly Update early in the New Year. In the meantime we thought you might appreciate a short update as to our views, based on typical investor questions we have been asked recently.

INVESTOR Q&A

“Business!” cried the Ghost, wringing its hands again. “Mankind was my business; charity, mercy, forbearance, and benevolence, were all my business. The deals of my trade were but a drop of water in the comprehensive ocean of my business!”

— A Christmas Carol, Charles Dickens

WHAT’S YOUR MARKET VIEW?

According to a early December Bloomberg poll, 71% of equity analysts believe the US stock market will rise next year, and only 19% forecast declines. We disagree with the majority view.

With the Federal Reserve and other Central Banks determined to squeeze out inflation and takeaway the cheap money and excess liquidity that has characterised the last decade, we have difficulty seeing an appreciation in wider asset markets. This does not mean all assets will be going down, just that the trend in many cases will be down as investors get more selective and some of the biggest speculative bubbles will burst and are unlikely to recover.

Whilst cryptocurrencies are probably the ‘poster child’ of investor excess and mania, we have concerns around real estate, private equity and various parts of the debt market.

Recently, one of the world’s largest REITs (Real Estate Investment Trusts) has been forced to suspend redemptions due to liquidity issues. The impact of this is that investors cannot get their money back yet continue to be charged fees and the “crown jewels” of the fund will likely have to be sold to raise cash. We do not think that this will be an isolated incident.

Another bubble that appears to be popping are ESG or ‘green’ funds and assets. We believe its highly likely mis-selling claims will proliferate due to a combination of performance and the fact many of these funds were never as ‘green’ as they claimed.

As stated in our recent notes we think there is a large probability that there is a bigger market regime shift going on. These happen relatively rarely, and the true implications take time to become clear. We appear to have been joined in this view by veteran investor Howard Marks. We recommend reading his recent note.

It’s important to remember the adage that ‘as one door closes another opens’. Whilst there is likely to be some volatility, bear markets are usually an excellent opportunity to acquire assets at great prices for the long term.

BUT IF THAT IS YOUR VIEW, WHAT DO YOU MAKE OF THE RECENT RALLY?

We believe it’s temporary in nature.

One of the first people to analyse the phenomena and investor psychology of bear markets was the 1930s financial theorist, Robert Rhea. He advocated that bear markets had three distinct stages: Stage 1- a sharp selloff; Stage 2—a reflexive rebound & Stage 3—a drawn out fundamental downtrend.

The first part of the year saw the sharp down trend that characterises Stage 1. We believe we are in Stage 2 which is the reflective rebound. This is characterised by a series of short-term powerful rallies and bouts of extreme volatility. Rhea suggested stage 2 was an excellent opportunity for investors to de-risk and rebalance their portfolios, a financial ‘get out of jail free card’. We think the same and cover this more in the next question.

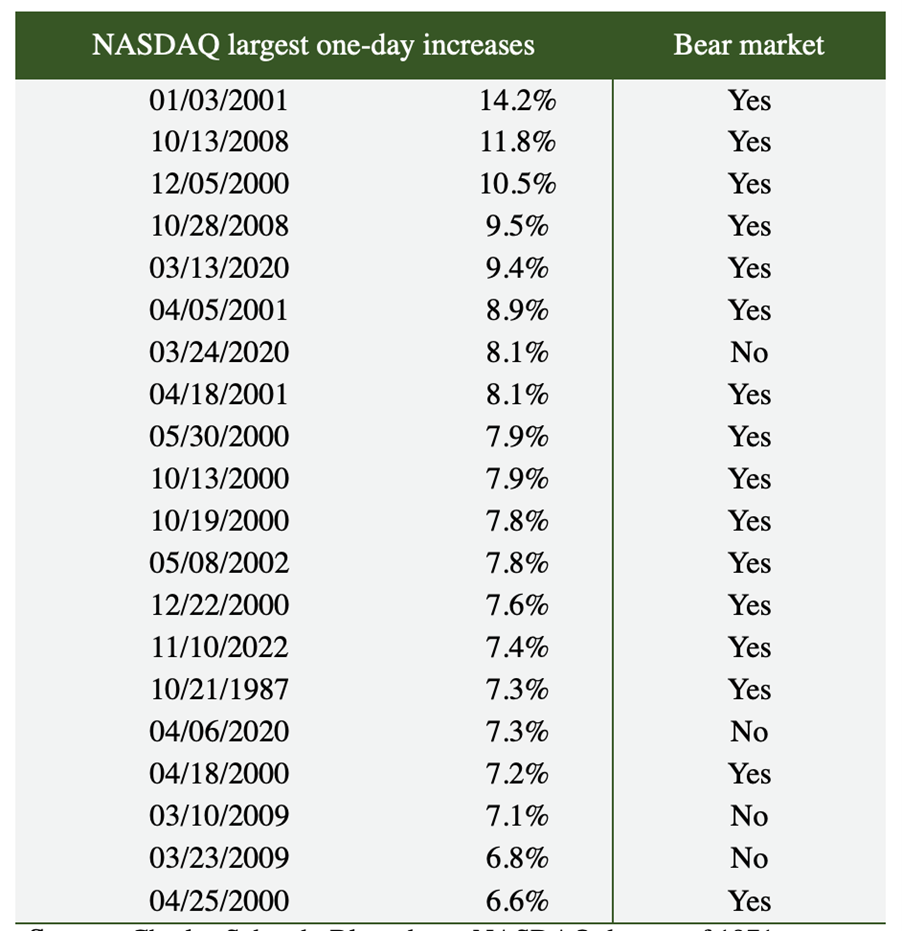

TABLE

Most of the most powerful rallies of the past 50 years occurred in bear markets

Source: Charles Schwab, Bloomberg, NASDAQ data as of 1971-11/10/2022

WHAT ARE COMMON INVESTOR MISTAKES THAT YOU ARE SEEING?

This is a long list, so I will highlight a couple. The most common mistakes we see are around diversification. These can come in different forms.

First, some level of diversification is a good idea. But complexity is the nemesis of good risk management and most investor portfolios we see are overly diversified.

If you have been put into dozens of different funds across different asset classes and geographies, potentially containing thousands of different securities, this is not sensible diversification but more likely diworsification.

As Warren Buffett once observed, this is more to do with your investment manager having very little idea of what they are doing and hiding under the guise of prudence. The shortcomings of this ‘spray and pray’ approach becomes clear in a bear market when it’s clear your portfolio has compounded poor risks, so you’re losing money in new and different ways. You also need to ask how many of these investments benefited from low interest rates and crazy monetary policies, and how many are genuinely sensible investments.

The opposite of this, but less common, is being too concentrated in a couple of much-loved assets or funds. Whilst this can be the route to great performance, it can obviously lead to problems as times change. Even too much cash can be an issue in these inflationary times.

Hope is not a strategy

The second most common investor mistake is inertia, which can be for a variety of reasons. The most common is investors often don’t want to sell at a loss but will instead wait – hoping – that the price recovers. This loss aversion is classic human behaviourism but ‘hope is not a strategy’. Many assets are unlikely to recover their previous valuations and – in fact – further downside awaits.

The opposite is usually due to crystalising large capital gains. In many ways recognising the right time to sell an asset can be even harder, especially given the reduction in your capital due to tax.

Professional traders in investment banks are taught some heuristics or ‘golden rules’ to overcome these behavioural biases. Two of these are ‘don’t get wedded to a position’ and ‘the first cut is the cheapest’.

I had some of these issues at a non-profit I am the treasurer of. Due to prior performance, they had ended up with a huge position in the Scottish Mortgage Trust. Despite the tax implications we decided to sell 90% of this position and reinvest it across a wider range of more value orientated securities. At time of writing, the Scottish Mortgage Trust has fallen 44% in the past 12 months – far, far in excess of the 8 securities it was replaced with – plus there is a big uplift in investment income.

Hence, as we have mentioned before but cannot stress enough: Investors should review their wider portfolios and take advantage of the current valuations in Stage 2 to rebalance their portfolio

WHAT IS YOUR VIEW ON THE BRITISH POUND – DO YOU THINK THE DOLLAR HAS PEAKED?

As a general rule, we try to avoid using foreign exchange as a source of returns. However, as many are aware we have benefited this year from a bias towards US dollar assets. However, our views around this are more complex than a simple currency bet.

The primary reason we have overweighted the US dollar is because of our cautious market outlook. In our opinion, given its role as the world’s reserve currency, nothing else comes close to offering the liquidity and security of the dollar.

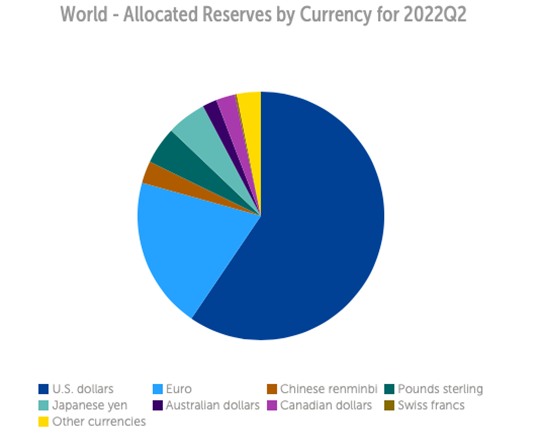

CHART

The USD continues to dominate global FX reserves

Source: The International Monetary Fund

We also don’t like the alternatives:

The Euro (which may well appreciate in the short term given the recent change in ECB policy) is riddled with credit risk due to their deeply dysfunctional monetary union.

The Japanese Yen—which has had an awful year—continues to see the Bank of Japan in money printing mode.

The Chinese Renminbi is a controlled currency and maintains a quasi-peg with the US dollar anyway.

The next issue is the US dollar’s role in international trade and financial markets. As this short video explains, US monetary policy may well cause greater strains elsewhere. Big currency swings can take years to play out.

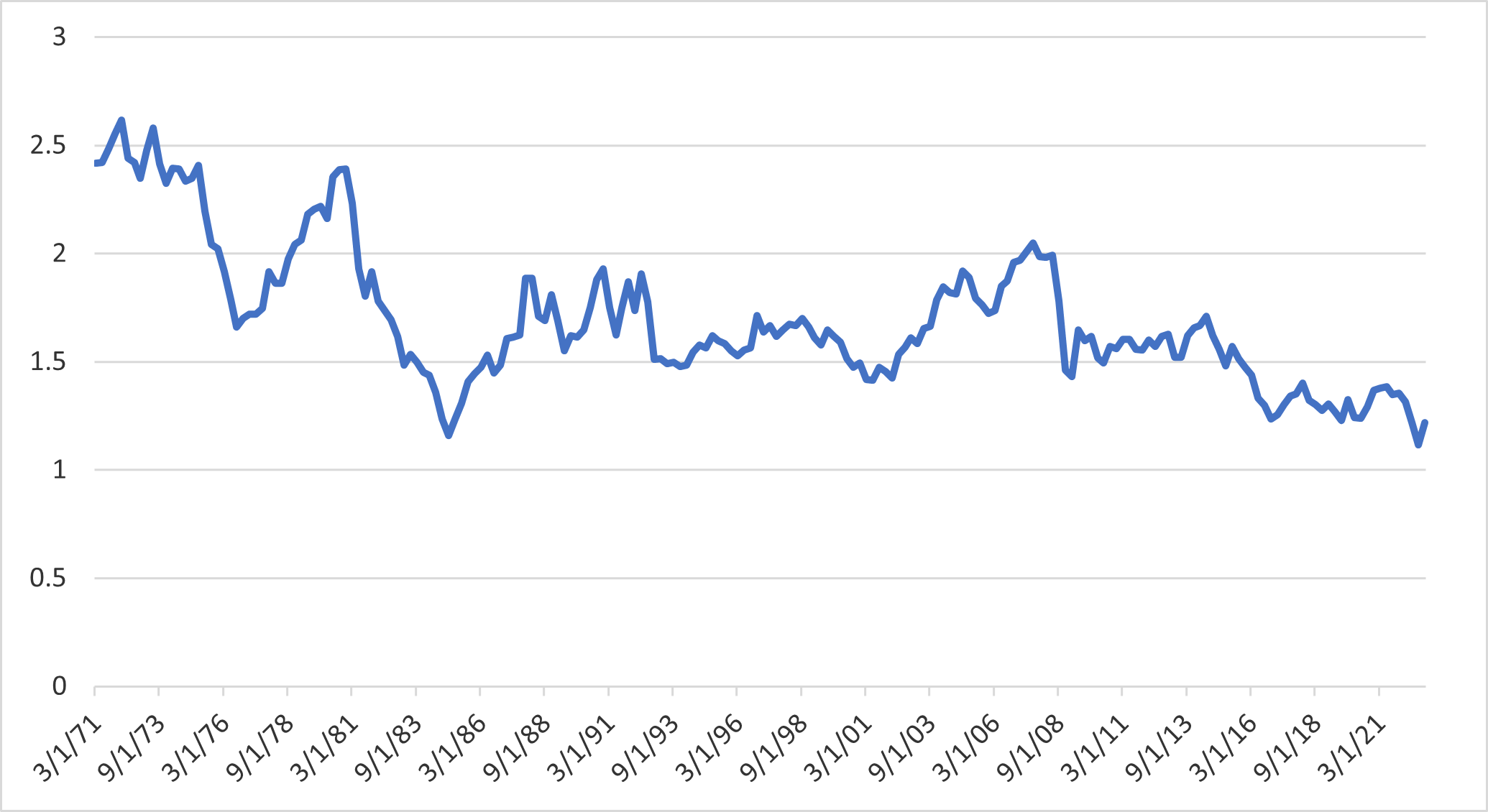

CHART

GBP has rarely outperformed the USD in a bear market and long-term “the trend is also not your friend”

Source: Bloomberg

As can be seen from the chart above the pound tends to be a ‘high beta’ to the dollar. What this means is that it tends to exaggerate the wider market moves, so it will underperform the US dollar in downturns and outperform in recoveries.

For what it’s worth, we think the recent strength in the UK pound has had more to do with a temporary shift in the Federal Reserve’s policies, but time will tell. Ultimately, what will make the biggest difference is what long term assets we invest your capital in.

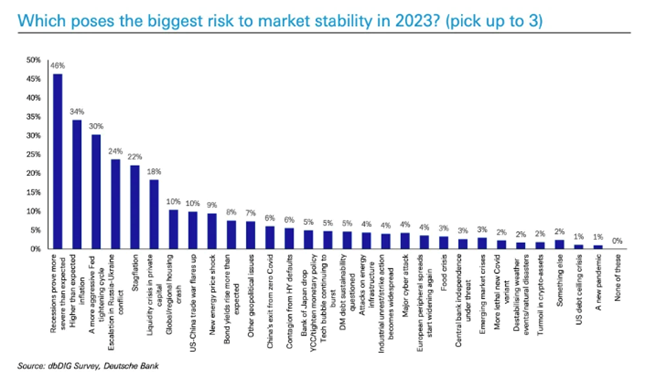

WHAT ARE THE BIGGEST RISKS?

Below we have produced the results from a Deutsche Bank survey of professional investors. We would weight things differently, but we think it covers most things.

Source: Deutsche Bank

DO YOU THINK MY BANK WILL BE SAFE?

The UK and US regulators undertook huge changes in the banking system post-2008. The major banks are now vastly better capitalised than they were in 2008. Whilst the EU regulators implemented many of the same changes, their interpretations were very different due to the financial architecture of the Eurozone. We have less confidence in these in general.

It is worth noting, however, that some of the biggest banks in the world have idiosyncratic risks that they might be more vulnerable to, relative to their peers. A simple example of this would be HSBC and Hong Kong.

The second issue is that, as risk was pushed out of the banking system by the regulators, it found new homes in other market participants such as investors’ portfolios, pension funds and insurance companies. As the LDI funds discovered this year these make some heroic assumptions around liquidity under stress.

WHERE IS MY MONEY KEPT?

First, all Henderson Rowe’s assets are kept in segregated account not kept in a general, mixed account.

The assets themselves are kept at Bank of New York Mellon, a AA rated US bank and one of the three largest custody/trust banks in the world. Related to the previous question we tend to have an aversion to placing assets in any firm that has material investment banking operations.

DO YOU THINK AN END TO THE UKRAINE WAR WILL CAUSE INFLATION TO SUDDENLY DROP?

Inflation had actually started to rise in the middle of 2021 long before the Ukraine war. Inflation also tends to be a process, which can take time to work its way through the economy. So our base case is it will likely take a couple of years to abate, at best.

A good example of deeper inflationary drivers has been rising energy prices which have been the result of material underinvestment and wishful thinking, and whilst they may fluctuate we think they will take many years to resolve.

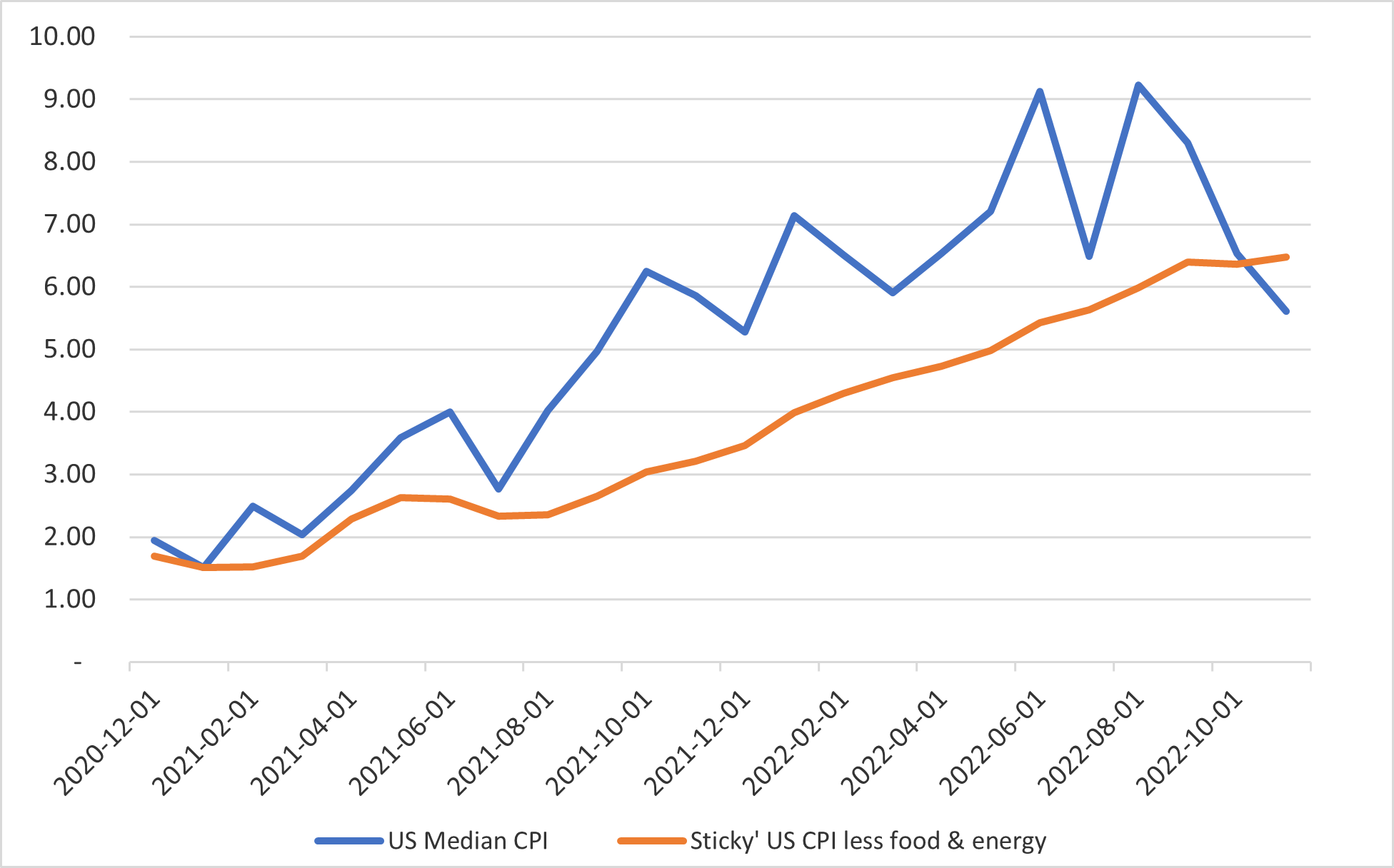

CHART

Inflation started to rise long before Ukraine war

Source: BLS and Bloomberg

Regarding the end of the war materially changing things, we are sceptical. I personally first became involved in investing in emerging markets in Russia in the mid-1990s and have had some level of dealings ever since. My personal view is the country has a reasonable probability of becoming a failed state. Additionally, for a variety of reasons I would be sceptical that, should Putin lose power, much would change – whether from an ‘unexpected’ heart attack or suffer the traditional Russian inability to close windows in high buildings whilst keeping his balance. Most of the ‘liberal’ opposition has fled or been jailed, so Putin is more likely at risk from nationalist hard liners. Also, I am sceptical that a sudden regime change is very unlikely to cause sanctions to be lifted in the short term.

Regarding the war itself, alas despite my years spent in the reserves bravely defending the Brecon Beacons and the North Yorkshire moors against a sneak weekend attack, I have no special insight. I would observe that NATO never expected to expend as much artillery ammunition and would worry about the ability to keep Ukraine supplied in 2023. I also worry a lot about what the prospect of defeat would mean for Russia.

WHAT ABOUT THE REOPENING OF CHINA?

Regarding China, our specialists believe that the reopening will be bumpy due to the likely spread of covid. Hence, we think issues with supply chains will persist. That said, many Chinese investments remain extremely cheap and we think it offers an attractive risk versus return for the portfolio.

YOU SEEM MORE OPTIMISTIC?

We are!

Whilst we still expect 2023 to be challenging from an investing perspective many things are in fact better than twelve months ago. This time last year we had the same level of inflation but Central Banks that were still running excessively loose monetary policy and lots of seriously overpriced investments.

This situation has started to change with the changes in monetary policy. Whilst the process of ‘price discovery’ is likely to be volatile it’s important to remember there are always opportunities and we invest your capital in the best ideas globally.

Also, despite the vast amount of likely wasted money into venture capital there will likely be many revolutionary innovations that will surface over the coming years.

FINALLY!

Once again thank you for your custom this year. I enjoyed meeting many of you over the last year and hope to meet even more in 2023.

And with that, we wish you a Merry Christmas and a Happy New Year!