As negotiations between financial institutions and politicians drag on, UK expats are left wondering how to safely look after their financial matters. Henderson Rowe Investment Manager Thomas Fawcett explores the limited range of options available to expats in light of Brexit.

If you are a British expat living in the EU, you might have been contacted by your bank recently notifying you that your bank account will be closed at the end of 31 December 2020. Lloyds, Barclays and Coutts are reportedly amongst the first banks to have contacted their customers for their account closures. As surprised as you may be, their actions actually stemmed from a lack of definitive agreements between the UK and EU relationship starting 1 January 2021, causing an end to “passporting”. Financial institutions inside and outside the EU will operate in separate regulatory frameworks.

If you are non-resident in the UK, you will know that there are many practical reasons why you might like to continue to have a British account. Perhaps, you wish to retain financial ties, or you need the convenience of paying income into a UK-domiciled account. If you have been contacted by your bank requesting your account closure, or are just looking for a change, have you considered an investment account with Henderson Rowe?

For 20 years, nestled in the heart of Mayfair, a small, independent, agile wealth manager has managed discretionary investment accounts for citizens around the world. Henderson Rowe is not a bank but we might be a suitable alternative for some expatriates who wish to keep financial ties to the UK.

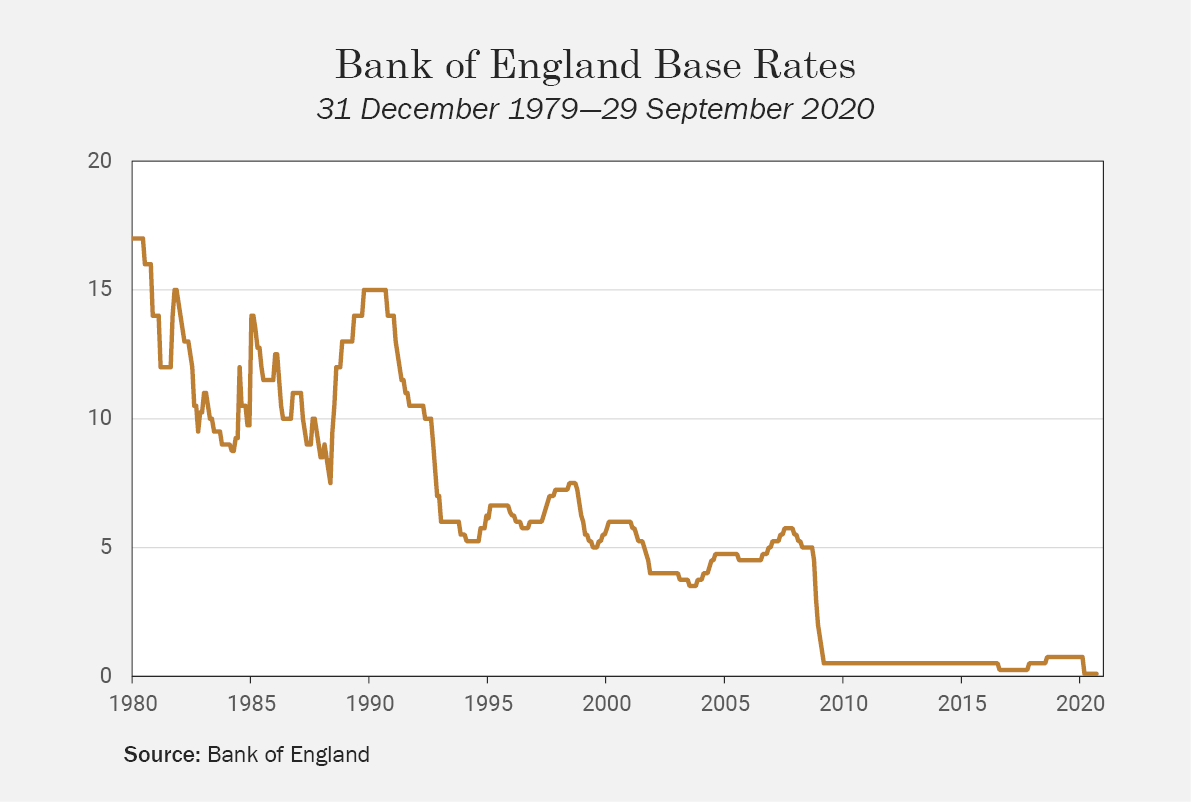

Cash savings accounts are at record low interest rates with some banks in Europe applying a negative interest rate on positive cash balances. Investment can offer rewards, but it also involves a variety of risks and is not suitable for everyone. Investments can change in value, but there is also a risk that your money doesn’t keep up with inflation or the interest you have foregone by not holding your money in a savings account.

In weighing up whether an investment account is right for you, you should consider the following:

Time Frame: Investment is a catch all term for a payment now in expectation of a future payback, but investments can fluctuate in value, even traditionally less volatile ones. Whether you have a specific goal in mind or are simply saving for a rainy day, the longer your timeframe, the more able you are to withstand short term downturns. If you have only a short-term goal, then your money is more readily accessible in a cash savings account.

Ability to withstand losses: Know what you can afford to lose particularly considering any dependents or large expenditure you expect. Investment can offer some great rewards but unfortunately, it sometimes can bring losses. If your financial circumstances mean that you cannot afford to withstand any loss, then your ability to take risk is very low.

Risk Attitude: Some people are happy to live with more short-term calculated risks if it means the chance of a higher return in the long run; others don’t want to lose money under any circumstances. This is down to an individual comfort level, but short-term market gyrations can make even the most strong-stomached investors feel sea-sick. If fact, our highly acclaimed chairman, Jason Hsu, recommends that investors “lose their login credentials” so they avoid concerning themselves about the day to day fluctuations.

Henderson Rowe offers a range of mid to high risk investment products and can help you assess your risk appetite. If you are interested in learning more about our product range, then please complete the form on the Contact Us page. Terms and Conditions apply.

IMPORTANT INFORMATION

Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809.

The information contained in this article is the opinion of Henderson Rowe and does not represent investment advice. The value of investment may go up and down and investors may not get back what they invested. Past performance is not an indicator of future performance.