“There are times to make money. There are times not to lose money. Now is a time not to lose money”

—David Tepper

Talking Points

-

- We believe we are in the final stages of a bear market rally

- We believe the banking problems are likely to continue and likely spread

- Challenges in US debt ceiling & the vast issuance of more unproductive government debt is likely to drag on markets over the next few months

- The big question is when and what form the slowdown will take. We have positioned the portfolio to be both defensive & highly cash generative to take advantage of any dislocations

- We update on UK politics: are we heading for a hung Parliament?

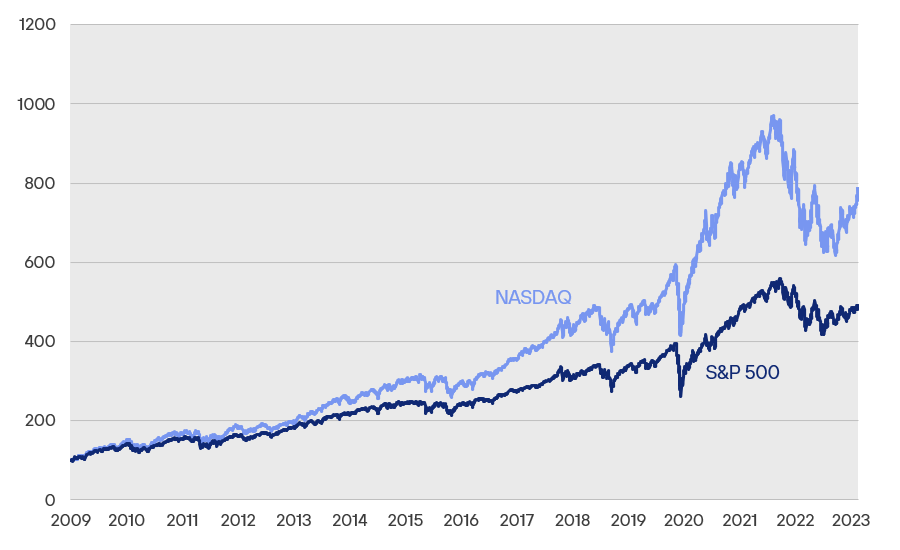

Last year we said it was highly probable that we would see a bear market rally at some point. Given the scale of previous monetary excess, we suspected this might be a larger, more extended one than usual.

As we discussed at a recent investor event, we believe this has been unfolding over the past few months in markets. This continues to be our view as the recent rally fits many of the characteristics.

Chart: Bear markets follow typical patterns this looks like one of them

Source: Henderson Rowe, Bloomberg

The initial rally looked very much like a short squeeze as it was focused on junk companies that usually had a high percentage of ‘short’ interest. However, the performance of these securities has faded, and the market has largely centred to a small number of large technology centric companies. Many of these companies are involved in the race to monetise the recent breakthroughs in Artificial Intelligence.

We agree that AI is a transformational technology, but we are somewhat sceptical as to the valuations. We think NIVIDIA is a great company too but is it worth 190 years’ worth of current earnings? Additionally, we are sceptical as to the merits of ‘thematic’ investing: research suggests it is more to do with marketing than investing. There is an old market adage that ‘bear markets start with a bang and end with a whimper’.

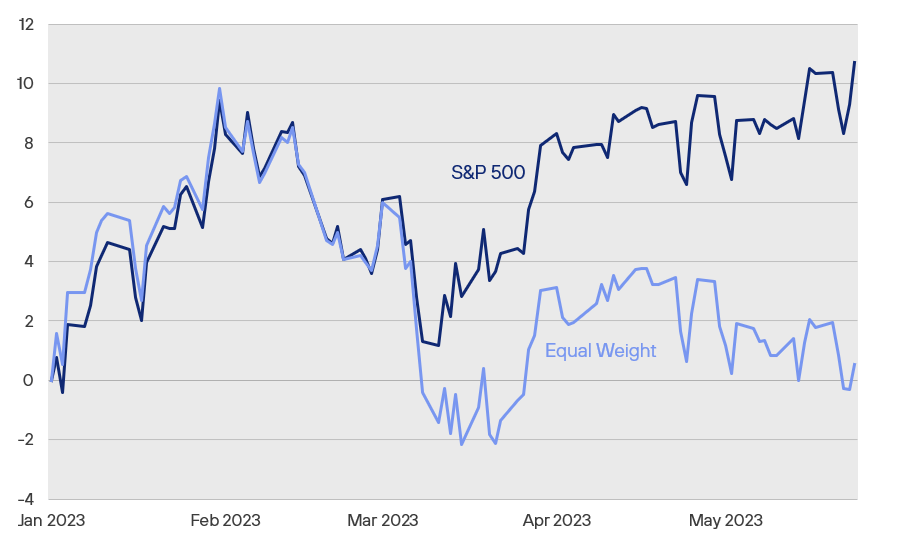

Often when we see such narrow market breadth it is usually before or during a major bear market.

Chart: Market breadth is collapsing, this is usually an unhealthy sign

Source: Henderson Rowe, Bloomberg

Finally, the market may have benefited from a well-known seasonal phenomena called the Year 3 of the ‘Presidential cycle’. This tends to disappear from May onwards.

“No plan survives first contact with the enemy”

– Helmuth von Moltke the Elder

Plan the trade – Trade the plan

We had extensive discussions internally about whether we wanted to attempt to ‘trade’ this rally. As outlined at our recent event, our view was that ultimately it was a high risk as it would require buying securities we didn’t like. Also, these rallies usually end suddenly and dramatically. Finally, it wasn’t clear to us that we possessed any sort of edge or competitive advantage in doing this. Given we are about risk management of your capital first and foremost we decided to wait it out.

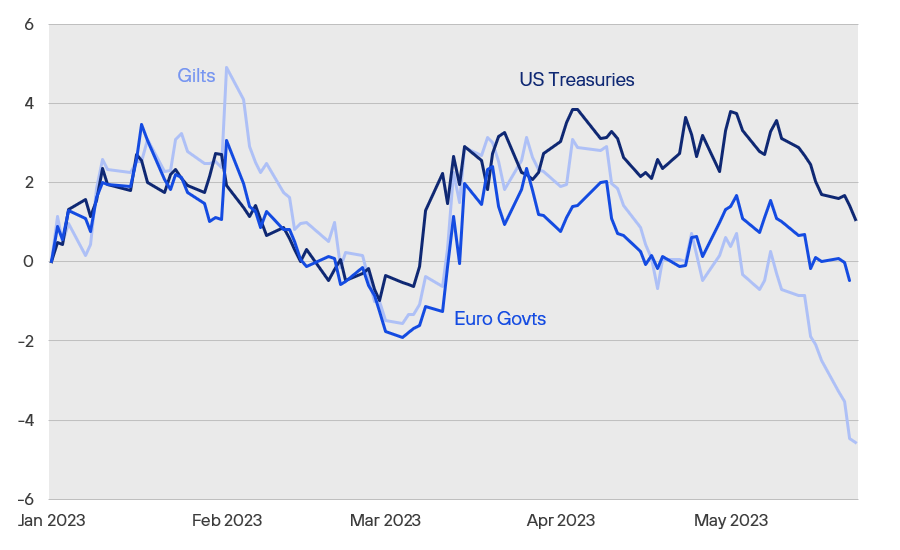

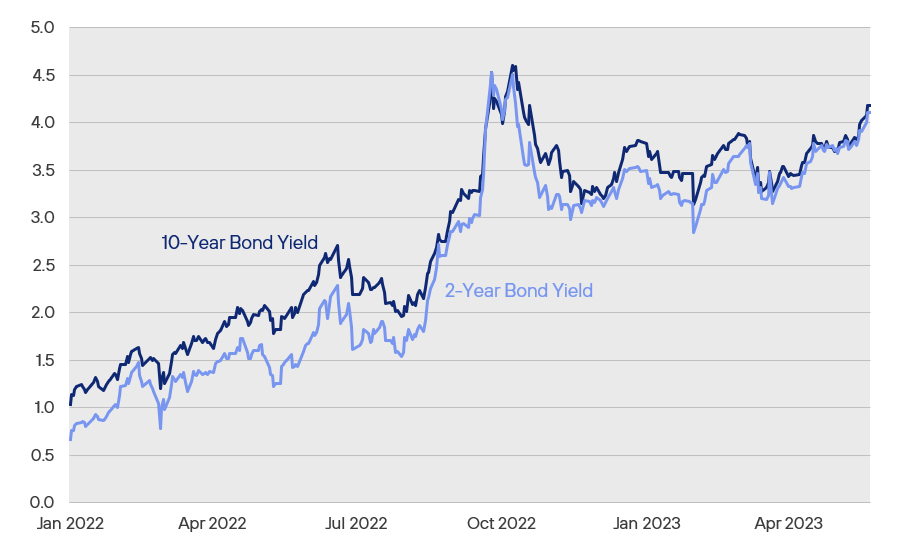

So far, the rally has largely played out as we expected. In particular, rising bond yields are offering us more opportunities. We also think ultimately that it will cause the market to re-evaluate shorter duration assets more favourably. That is, investments that offer faster payback periods.

Chart: It looks like another loss-making year for Gilts, we think US Treasuries may well join them

Source: Henderson Rowe, Bloomberg

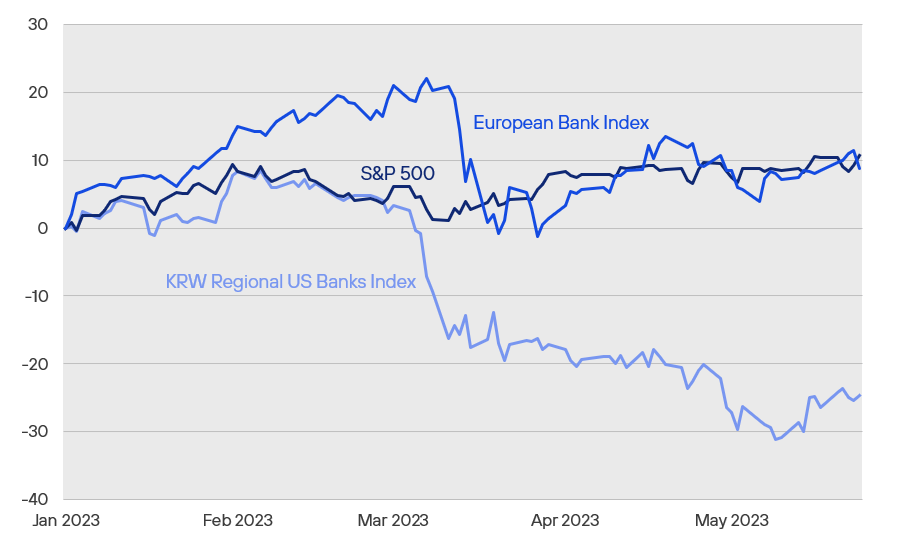

That said, two things have surprised us. As regular readers know we had doubts over the banking system. We fully expected problems to surface as rates rose. However, even we have been surprised at how quickly problems have occurred. We discuss this in more detail later.

Chart: US banks have materially underperformed this year, by contrast European banks are still doing okay

Source: Henderson Rowe, Bloomberg

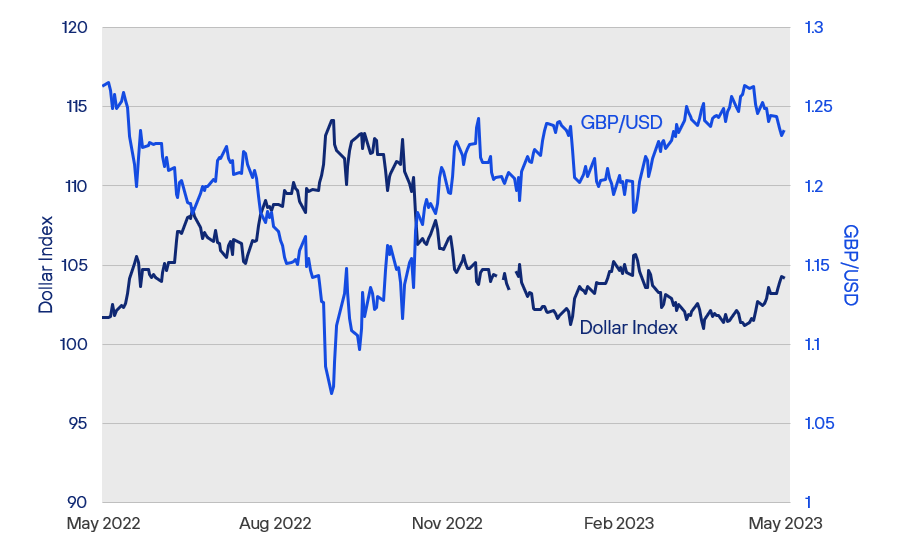

The second area where we have been surprised is the strength in sterling. We knew it would trade like a ‘risk asset’ and therefore rally in any ‘risk on’ environment. We also knew it would have support from the UK dividend season (UK companies sell foreign currency to buy sterling to make dividend payments). The UK also had a lot of investor negativity attached to it which made a short squeeze possible.

Chart: Strong GBP or just weaker USD generally?

Source: Henderson Rowe, Bloomberg

Again, we thought about increasing our GBP exposure, but our first problem was what to buy? There are no doubts that GBP equities are cheap, but they were cheap last year too. They were cheap five years ago as well and a catalyst for a repricing remains unclear. Also, the UK equity indices are dominated by financial institutions (which we wanted to avoid as rates adjusted), primary industries and pharmaceutical firms whereas we already thought we had better investments.

We also thought the UK would need to hike rates more, and with inflation still running in double digits we decided to hold off on buying bonds.

We now believe this rally is likely in its final stages. The key question for us is now what comes next?

What comes next?

Our view at the beginning of the year was that an economic slowdown was likely to take longer to manifest itself than various parts of the market had priced for. The tailwinds from covid reopening and the massive stimulus given to the economy was likely to take some time to play out. The bond market looked too aggressively priced – fully pricing a massive financial crisis by summer. It still looks aggressively priced to us in the United States, especially given the massive amount of projected issuance and the risk the US itself could potentially ‘technically’ default on its debt over the summer.

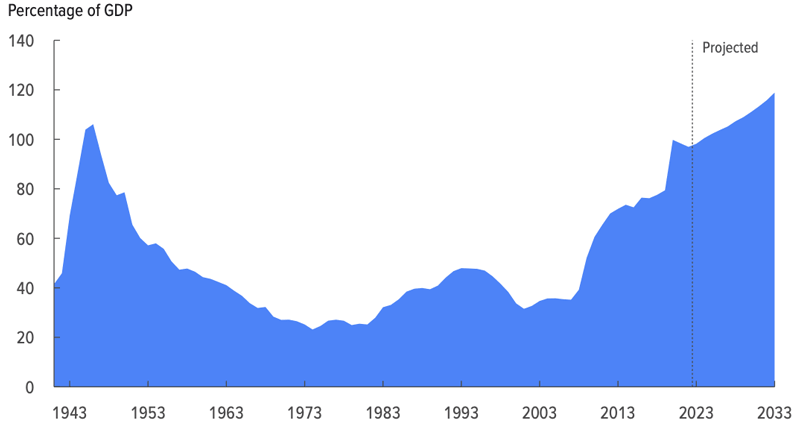

Chart: The US will soon exceed the amount of debt as it did after WW2

Source: Congressional Budget Office

We also thought problems in the banking sector would start to surface. But even we have been surprised at the speed of the problems. Without dramatic intervention from the Central Bank we expect these issues to continue. There are several reasons behind this.

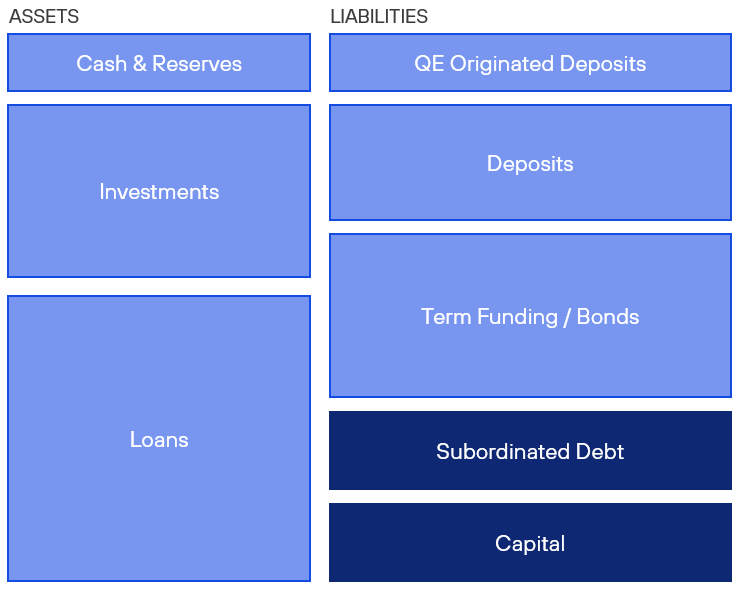

Essentially, Quantitative Easing creates deposits in the banking system. These deposits are fickle as they are artificial – for want of a better term – as they were not created by genuine economic activity. By forcing these deposits onto banks’ balance sheets, the banks were forced to find assets to match them. Given the equally short-sighted policy of Zero Interest Rates (aka ZIRP) the banks were forced to take more risk than they would have done otherwise. Now rates have started to move to more realistic levels, the value of these ZIRP era assets has fallen and the Central Banks now want to remove these deposits. In essence many banks cannot afford to do this. Selling the losses would generate a loss so they cannot buy higher yielding securities. Holding the assets creates a drag on the balance sheet as the cost of deposits rise.

So, the banks will start cutting back elsewhere, most likely loans to the real economy. The most obvious sector where this will arise is in Commercial Real Estate which was already struggling with post-Covid changes in working patterns and ongoing changes in retailing. Combined with higher rates this will tighten financial conditions.

Diagram: How do you remove QE deposits without shrinking balance sheets?

Source: Henderson Rowe

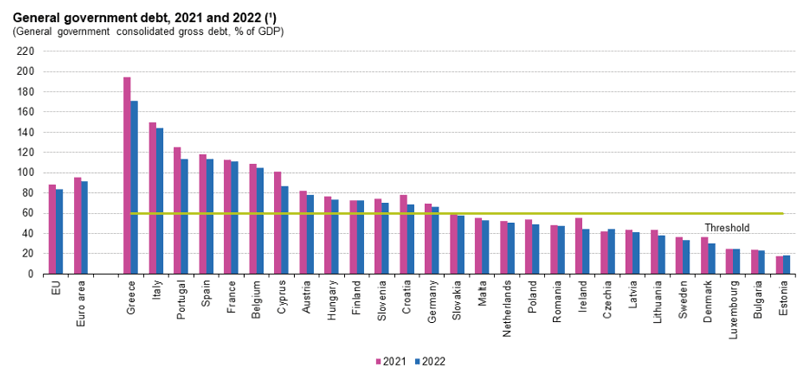

A key question is whether this could spread to Europe? Our view is that elements of it will. Whilst there are some key differences between the US and the European financial systems, European banks also did silly things with their balance sheets. The tipping point for the US system was about 4% rates.

We haven’t yet hit the tipping point in the European system, however. Rates likely need to be a bit higher in the EU and liquidity a bit tighter before we see issues start to manifest. The biggest difference between the two systems is the inherently flawed structure of the Euro. This means there is genuine credit risk in European government debt.

Chart: Many European debt levels also look unsustainable. Italy, France & Spain in particular

Source: Eurostat as of 20.04.2023

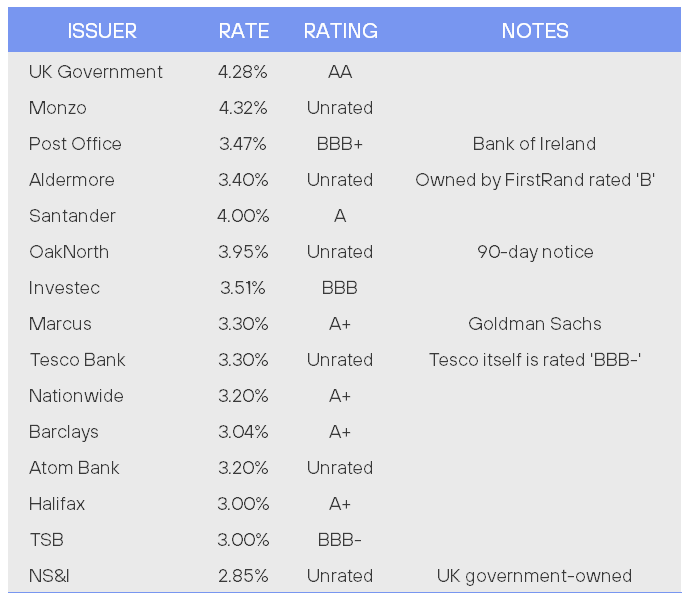

In the UK we probably have reached the crossover point with rates as you can see below it also doesn’t make sense to keep your money in a bank. UK government bonds offer both a superior yield, tax advantages and better credit rating.

We are nonplussed why anybody would want to keep their savings in an unrated bank especially. Additionally, many of the smaller ‘challenger’ banks have very unclear business models and paths to profitability. Indeed, some such as Revolut have multiple red flags.

Table: Bank deposits vs Gilts

Source: Various company websites

Rest assured, as we discussed in previous notes, we have spent a lot of time looking at our banking and custodian arrangements.

The stage is now set…

As we have previously pointed out, monetary policy acts with long and variable lags. The US has hiked rates, continues Quantitative Tightening, and needs to issue a lot of new debt. Combined with growing problems in the banking system it seems highly probable a material credit squeeze is going to occur.

So, when it will manifest itself in the real economy & how? We may be wrong, but we think it will probably appear before the end of the year and the effects are likely to be pronounced.

Our reasoning behind this is:

1. Once the new debt ceiling is established then the US government has a LOT of new debt to issue. We think this may well drag on curves and support the US dollar. Counterintuitively, the new issuance reduces dollar liquidity in the short term.

2. We also suspect the adjustment is likely to be quite painful, stretching over several quarters. Even once the Federal Reserve starts to cut rates it takes many months to flow into the real economy. History shows the worst time to buy assets is just AFTER the hikes start for exactly this reason. Volatility is also likely to be very high, which compels many professional investors to de-risk.

Yet, despite the noise it’s important to remember that, despite the tightening financial conditions, the US is stimulating its economy due to the huge government spending.

Whilst the wider economy is adjusting there will be winners from this process. As the old expression goes ‘it’s always a bull market somewhere’.

Hence, we are seeking to preserve your capital to take advantage of this likely scenario. As we saw last year, the windows of opportunity can be relatively short.

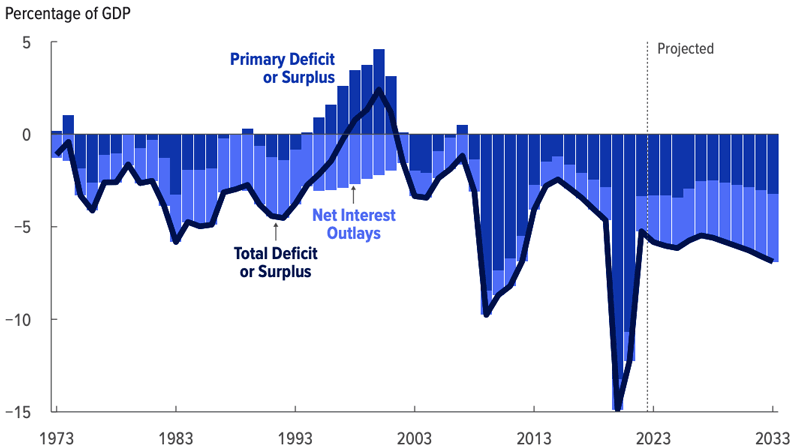

Chart: The US deficit remains very large and with no plans to reduce it

Source: Congressional Budget Office

In summary of this section: as you know, we continue to be patient and have reduced risk in your portfolio and biased the equity component towards highly cash generative, value companies. We have also cut the maturity of the bond portfolio, which has also benefited from rising rates. Whilst it might not be immediately obvious from the reported asset values, the portfolio is far more cash generative than it was 18 months ago.

Our intention is to start deploying more of your capital. As we have stated before, credit assets are beginning to look attractive to us but they remain below the historic spread levels you would expect in a downturn. We also expect to replace these defensive assets with those with more favourable long term growth characteristics. Hence, we remain patient.

UK politics

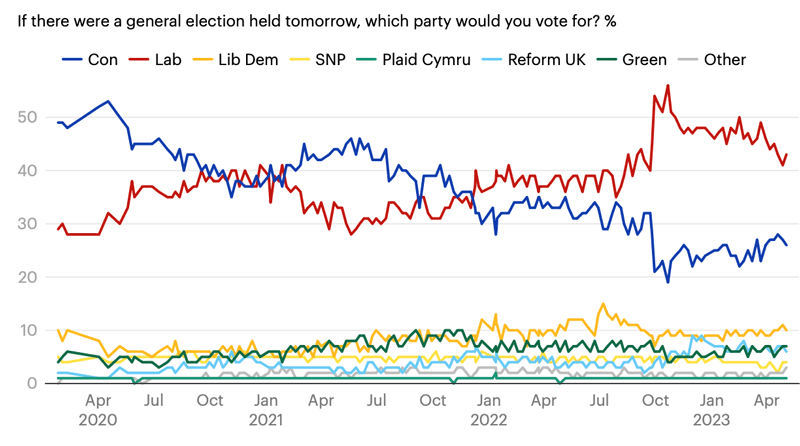

When we last commented on UK politics, we said we thought it was unlikely that Sunak – especially combined with Hunt’s economic policies – would not lead to any sort of sustained Conservative revival at the polls.

As we have seen with the local election results this continues to be the case. However, Labour did not benefit as much as expected amongst voter apathy and a splintering of the vote.

Source: yougov.com

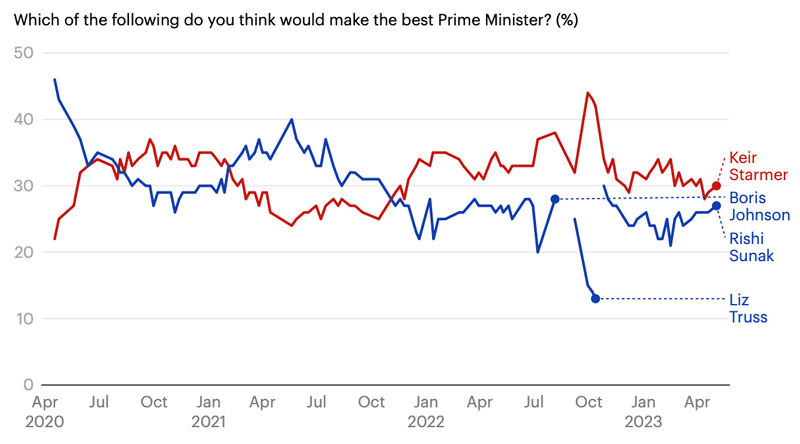

Whilst polling isn’t actual voting, a key problem is the thought of a possible Starmer administration continues to be less popular than the dying days of Johnson’s – which is some achievement. Basically, the more the public see of him the less they warm to him.

Indeed, we are impressed by Starmer’s ability to announce vote losing policies before the election such as a massive expansion of the voting franchise and more taxes on the middle class. We also thought the recent attack ads by Labour were a good example of their general ineptitude, as polling showed the ads drew more attention to Labour’s perceived various shortcomings on crime than the Conservatives’. Despite this, the Labour Leadership continues to run them. Starmer seems determined to miss an open goal – there again, he is an Arsenal fan so it perhaps should be no surprise.

Chart: Sunak is less popular Johnson, Starmer continues to underwhelm

Source: yougov.com

Our guess is the Conservatives hope to get within a touching distance of where they can use the ‘coalition of chaos’ tactic and thereby bleed potential swing voters. Whether they can manage this before their short-sighted economic policies catch up with them remains unclear.

We don’t think so. It is now dawning on the market that Truss’ push for growth was broadly right. She may have been incompetent but at least she had broadly the right idea. As the great economist, Lord Keynes remarked ‘it is often better to be broadly right, than precisely wrong’.

By contrast we have two incompetents with no idea. ‘Hunak’ has failed to tame inflation, nor has the UK’s borrowing requirement dropped. We have got stagflation with no possibility of growth and Bank of England officials saying we should just accept it. UK bond yields have also reached the same levels as where ‘Hunak’s’ cabal demanded Truss resign. Despite the clear precedent they set for their predecessor, will they be resigning for incompetence too?

Chart: UK bond yields approach similar levels to Truss’ brief tenure

Source: Henderson Rowe, Bloomberg

But this political battle between ‘Dumb and Dumber’ does raise another possibility. Instead of a Labour victory, we may well see a hung Parliament. Given the difficulty of managing the country as a minority government or giving in to minority parties – who appear to steadfastly want to ignore the key principles of the Enlightenment – we could see another election by early 2026 after some short-term pump priming. Either way, we think there is a high probability that both Sunak and Starmer will be gone within 24 months.

Who will replace them remains anybody’s guess. The increased speculation of Penny Mordaunt as a potential leader just because she was able to hold a sword aloft is indicative of how vapid political debate has become in the country. We deserve better, but neither is it wholly unexpected for students of long run economic-political cycles.

Whilst we view the world probabilistically, we are also keen students of history. US economic historians Howe & Strauss predicted in 1991 a very similar situation to that which we now face. Their view was that the early 21st Century would be marked by a series of financial crises, and greater disparity and polarisation of society. Ultimately this was due to a failure of the prevailing social-economic orthodoxy and with it the existing – and soon to be legacy – political class.

Whilst we have some sympathy with this theory, our view is that what passes for the political “centre” in the UK is collapsing – as it is across ‘the West’ – and the country will either break more right or left wing at some point in the future. Given the massive sovereign debt load, high tax burden and failing public services we ultimately need more growth and productivity orientated policies.

But what does this mean for markets? Firstly, we have limited UK investments. Secondly, generally, markets do not like left wing governments but – economically speaking – it’s increasingly difficult to see how the current UK government qualifies as a right wing one. History tells us markets like the uncertainty of hung Parliaments even less.

So, we struggle to see any catalyst for a broad re-rating of UK public assets. The UK has many good things going for it but many of the best opportunities lie in private markets such as venture capital. Unlocking that will be key to whoever gets into power.

Important Information

The information contained in this article is the opinion of Henderson Rowe and does not represent investment advice. The value of investment may go up and down and investors may not get back what they invested. Past performance is not an indicator of future performance.

This document is intended for the use and distribution to all client types. It is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution would be unlawful and participation in the portfolio referred to herein shall not be offered or sold to any person where such sale would be unlawful. Any onward distribution of this factsheet is strictly prohibited.

The value of investments and the income from them can go up as well as down and you may realise less than the sum invested. Some investments may be subject to sudden and large falls in value and you may realise a large loss equal to the amount invested. Past performance is not an indicator of future performance. If you invest in currencies other than Sterling, the exchange rates may also have an adverse effect on the value of your investment independent of the performance of the company. International businesses can have complex currency exposure.

Nothing in this document constitutes investment, tax, legal or other advice by Henderson Rowe Limited. You should understand the risks associated with the investment strategy before making an investment decision to invest.

Investors should be aware of the risks associated with data sources and quantitative processes used in our investment management process. Errors may exist in data acquired from third-party vendors, the construction of model portfolios, and in coding related to the index and portfolio construction process. Information contained in this fact sheet is based on analysis of data and information obtained from third parties. Henderson Rowe Limited has not independently verified the third-party information. The firm, its directors, employees, or any of its associates, may either have, or have had, a position, holding or material interest in the investments concerned or a related investment.

Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809. It is a company registered in England and Wales under company number 04379340.