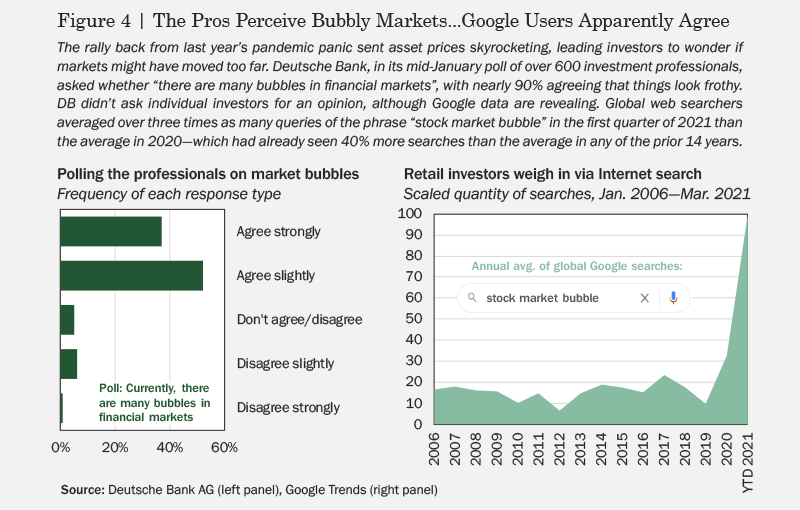

The ping pong in US markets between yield hike bears and sector rotation bulls distracts from a bigger story: the Hype Wave smashing cryptos ever upwards just as the FAANG (Facebook, Apple, Amazon, Netflix, Google) stocks’ lockdown surge peaks. But that is what markets have always done to fundamental technological changes—from railways and oil through to motor cars. The technology then percolates into the mainstream economy. Even tulip mania fits with the pattern, preceding cultivation of repeatable plant varieties at scale. Likewise, the wreckage of the dot-com boom’s collapse seeded the infrastructure on which today’s social network giants are built. The pulse we see today heralds further massive change. Instances right now look frivolous: bitcoin, immersive online concerts, augmented reality multiplayer games. But Facebook and others are betting the ranch on hardware and related tech that will play a part in opening the gates to a new digital metaverse. Next come commercial applications and powerful validation tools for luxury goods, high-end brands, breaking open and disintermediating payment systems. Rapid processing evolution is driving this with massive force. Today, for instance, the average teen’s PS5 or Xbox has the rendering capacity of a 2016 Hollywood studio, and the pace is only accelerating.

Digitisation is about to be joined by energy as a source of deflation. How long can oil trade around $50 when the equivalent solar price is $20 and falling? When fusion power is looming? The scale of change is so great it is not just commercial operations being disrupted, but whole societies and economic systems. All this, it goes without saying, should be music to long-term investors’ ears.

Unfortunately, it looks much bumpier close-up. GDP growth and developed economy interest rates have been declining for 40 years thanks to globalisation and digitisation, with high debt, ageing demographics, and inequality among the results. The only one that appears in reverse at present is globalisation. COVID-19 has reintroduced politicians to a whole new toybox, and the issue bouncing markets round is whether putting the pedal to the metal with fiscal largesse will cure secular stagnation, trigger excessive inflation, or both. The fiscal response has been extraordinary: in the US over 25% of GDP, 20% in Germany, and 16% in the UK. Using Japan as a yardstick, there is plenty of room for more. As a proportion of GDP, Japan’s central bank liabilities total 135%. Europe is a mere 60%, the UK and the US, 40%. The GFC stimulus was followed by restraint, but this time a return to austerity is politically impossible and, in any case, likely to hurt. Japan’s attempts to impose fiscal rectitude have hit real consumer spending every time.

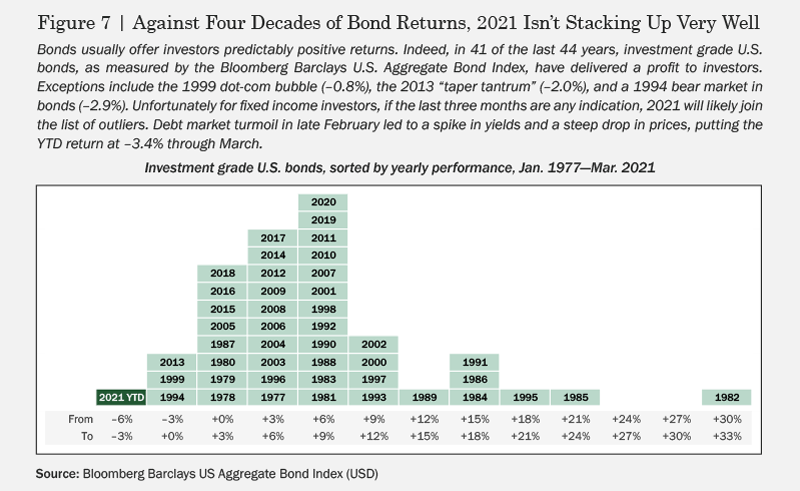

What will the new world look like? Bonds yield next to nothing now—sometimes less—and will be unable to generate equity-like returns from today’s prices. Leverage will be much less attractive as rates rise, which will exacerbate a likely end to the era of bonds rising when equities fall. Portfolio construction will need to change as investors cease being paid for bond insurance, either through yield or negative correlation protection.

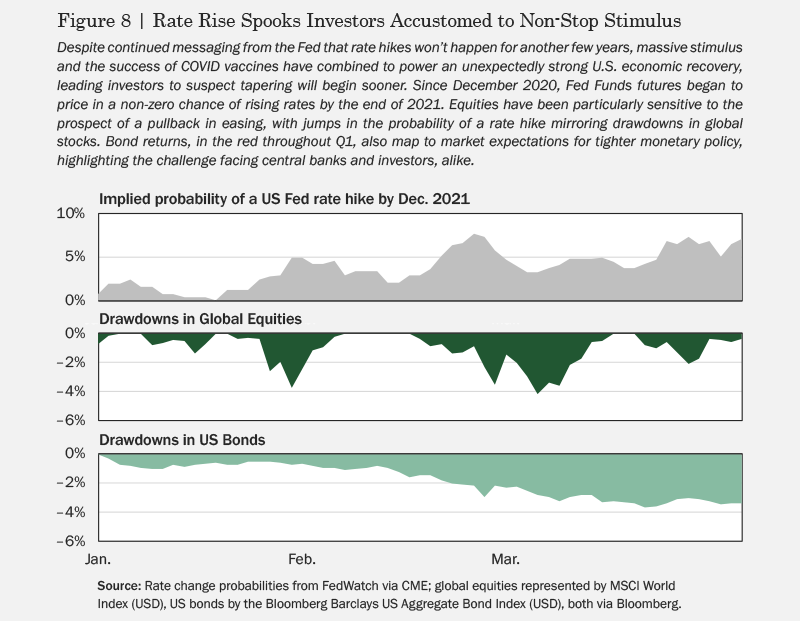

There is a ray of light. Equities tend to have low valuations when interest rates are very high or very low. US FAANGs are the exception, thanks to above-market growth in earnings per share (EPS). Indeed, the rising valuation of the FAANGs explains the entire outperformance of US markets over the last few years, without which US equities would have been in line with the rest of the world, on a low valuation. So, as rates rise, the theory goes, non-FAANGs should start to see valuations rise, while FAANGs fall back to where they should have been. This is the great rotation, and every day, as bond and equity markets gyrate, the battle is being fought between rotation hopes and fears that “magic money tree” fiscal policy will cause inflation. This would be bad news, because both equity and bond values slump as inflation rises above moderate levels.

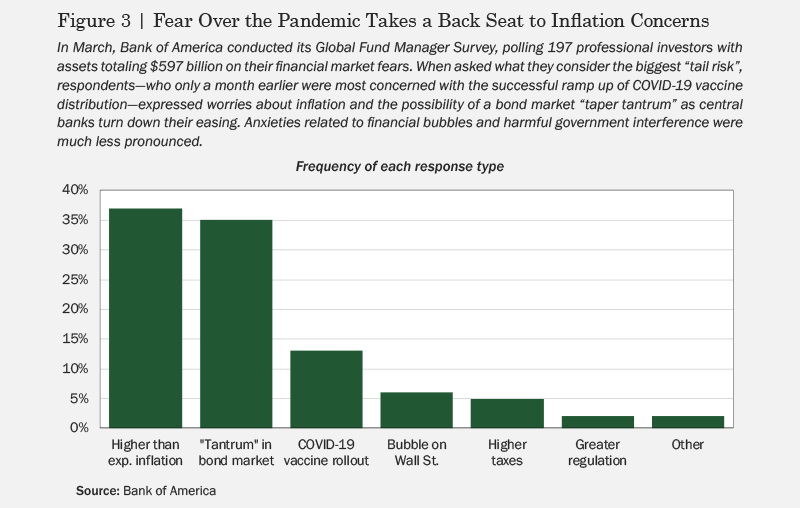

Inflation is complex but made more likely by two factors. One is a policy shift aiming to increase labour’s share of profits in a bid to deal with inequality, and the other the risk of a reduction or even collapse in faith in the fiat currencies so recklessly being printed. Which brings us back to bitcoin and other exotica. The heart of the issue is that there is enough worry out there to suggest that, despite the froth, there is still cash sitting things out and ready to come in. Which means the bull market that started in March 2020 may still have legs.