Market Overview

More than the weather is heating up. The EU’s threat to Swiss independence makes China’s stand-off with Hong Kong look benign, while Iran’s militarized response to US pressure and the ever-escalating rhetoric between the US and China are occasionally moving even UK political dramas off the front page. Bull markets – and the US bull market is now at an all-time high – love a bit of worry.

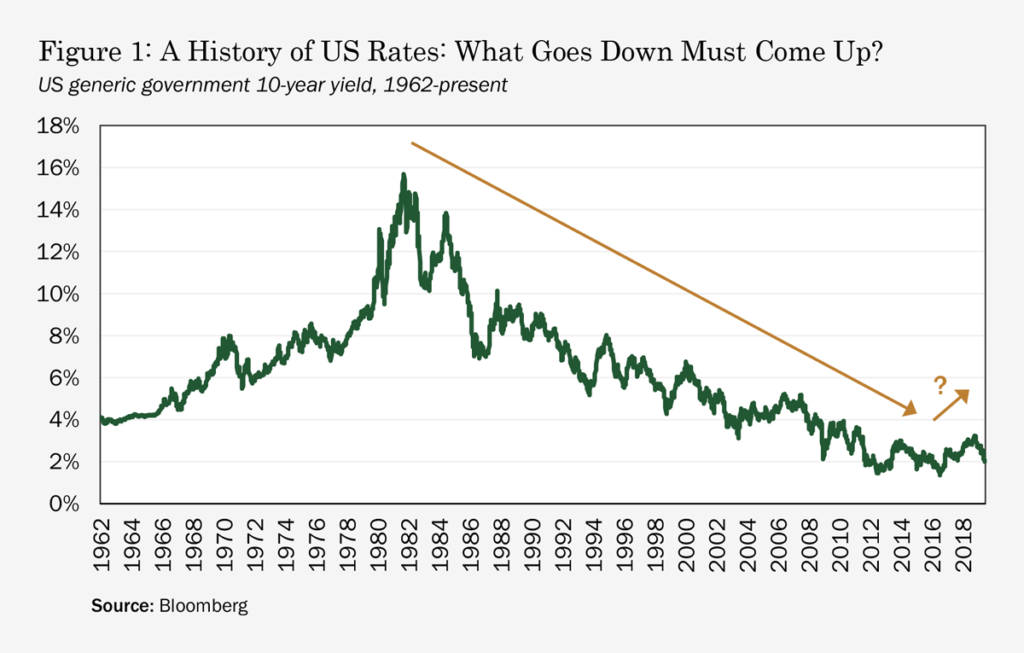

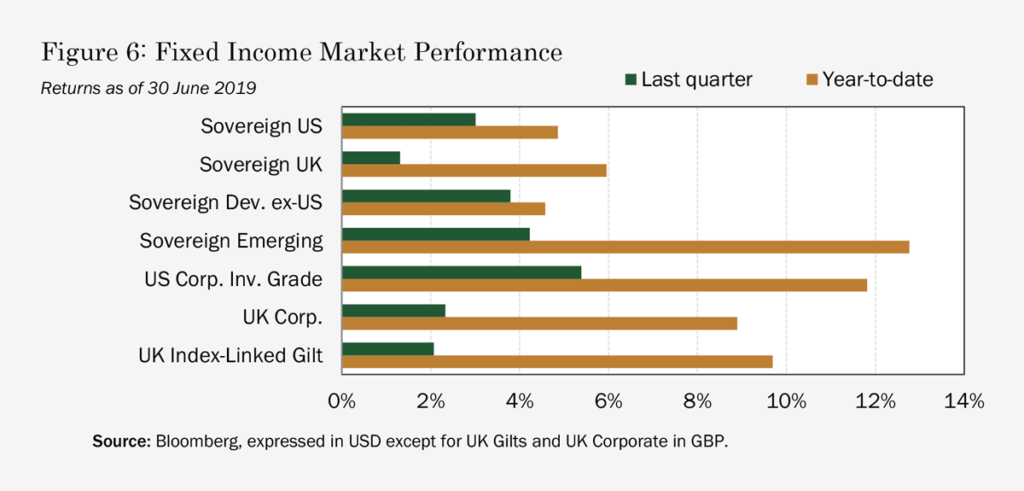

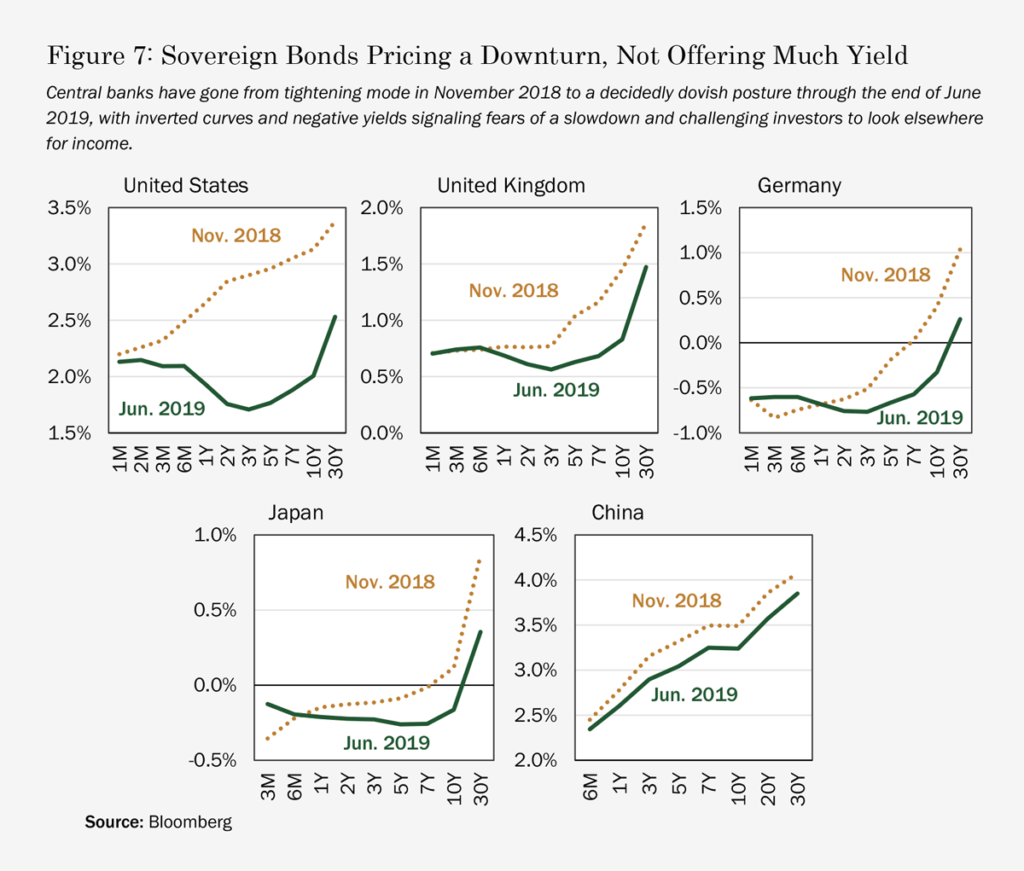

Although US bond yields seem to be bottoming, illustrated in Figure 1 below, downward pressure remains intense globally as the ECB says it is open to further QE and more bonds enter negative yield territory. Even some junk bonds are trading with negative yield in Europe. Is this sustainable, or is the US leading the turn in this powerful thirty year trend?

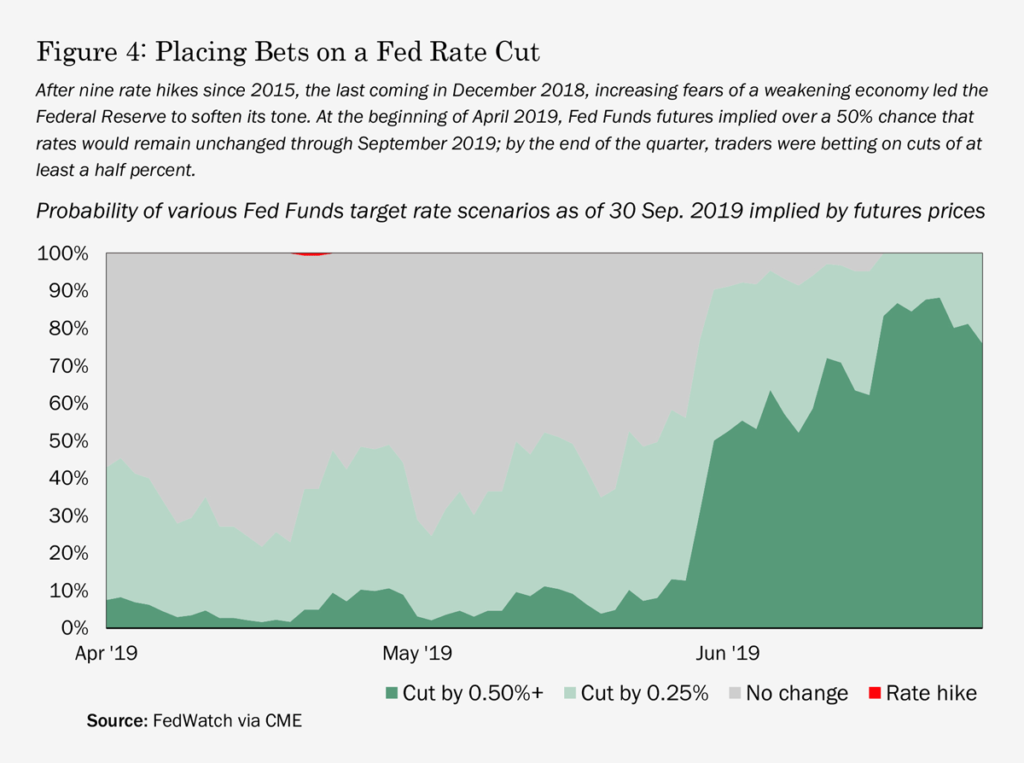

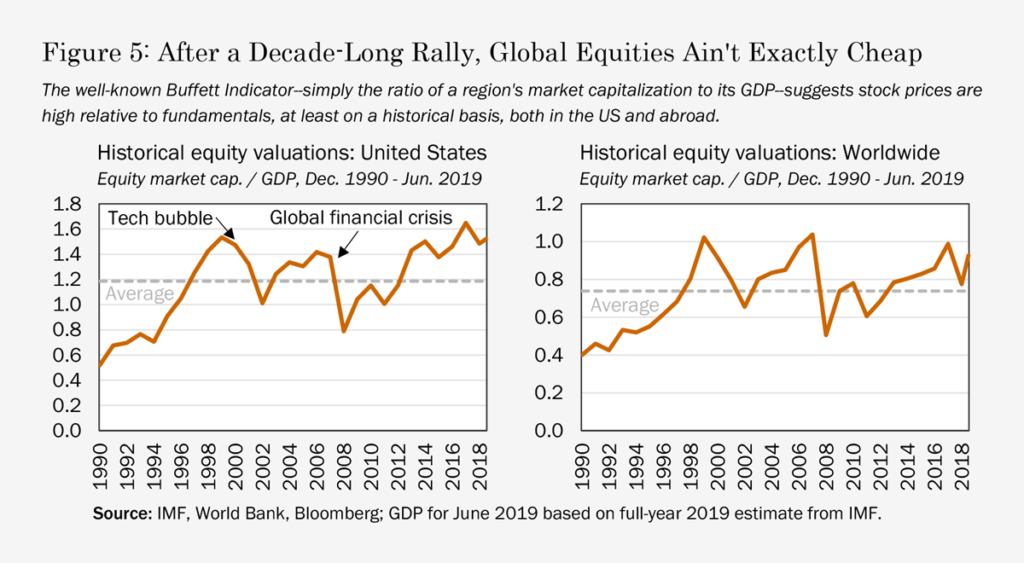

Meanwhile, US unemployment is as low as in the late ‘60s, productivity is rising and unit labour costs are still falling. What more could you ask of ‘sound money’? The trouble is that this kind of soundness has the stability of a spinning top and is based on unprecedented central bank intervention. Investors are haunted by two questions as equity markets soar. The first is ‘When will it end?’, and the second is ‘Given exceedingly low bond yields, where else but equities do you go?’ There is some near-term comfort because the US is in a mini cycle upswing, even if there really is a long-term interest rate trend change coming down the tracks. In any case, the December sell-off made the Fed lose its nerve and it is now in ease mode.