- The UK is reaping the rewards of a series of poor, long-term, social-economic decisions made over the last generation. We are sceptical either of the candidates can deal with these immense issues.

- Of the two, we would prefer Truss due to promises of targeted tax cuts, reduction in regulation and as a possible “agent of change.” By contrast, Sunak’s track record is one of slick personal promotion but economic and political incompetence.

- Regardless of who wins, we cannot see it ushering in a new golden age for the UK economy, but we support any incremental steps in the right direction.

- Ultimately, your portfolio remains diversified by geography and industry. Also, the price you pay for your investments has a bigger longer-term impact than—most—short-term macro headwinds. As macro headwinds increase, we expect to take advantage of this.

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.” — G.Michael Hopf

We have been asked by clients if we have any opinion as to who would make the better UK Prime Minister in terms of the UK economy.

In our recent note, ‘Don’t think in seas, think in oceans’ we highlighted we are not sure it matters that much, in the grand scheme of things. Our longer term – ‘oceans’ – view is that, along with much of the Western world, we have reached the end of a long economic cycle and have started to enter a probably volatile period of regime shift. We expect this regime shift to manifest itself economically and politically. In essence, the problems associated with a series of badly thought-out economic concepts and regimes from the 1990s have finally come home to roost.

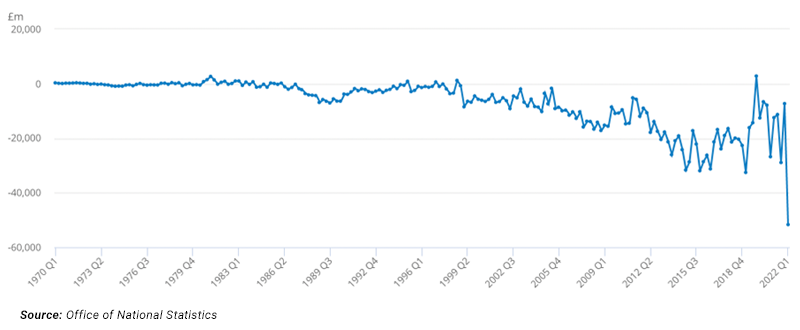

Chief amongst these are the long-term consequences of inappropriate economic policy (particularly in an increasingly globalized world), but also the inherent fragility of vast extended supply lines and promotion of rampant consumerism over long-term investment. As in the US, this has led to an ever-widening current account deficit in the UK as we live beyond our means.

Chart: UK Current Account Balance

As can be seen above, and for a variety of reasons, ‘free trade’ does not appear to have been a success for the UK. Some of this is due to domestic reasons, such as a lack of investment and weak productivity growth. Some of this is due to external factors, such as mercantilist and non-profit-maximizing policies of China, Japan and especially the Eurozone in exporting their surpluses.1

It is very hard for free trade to work when countries have very different economic systems and policy objectives. Large deficits like this fall very unevenly on society, with some benefiting greatly but others struggling as jobs and capital are exported.2 Politics often follows economics and we are beginning to see that on both sides of the Atlantic.

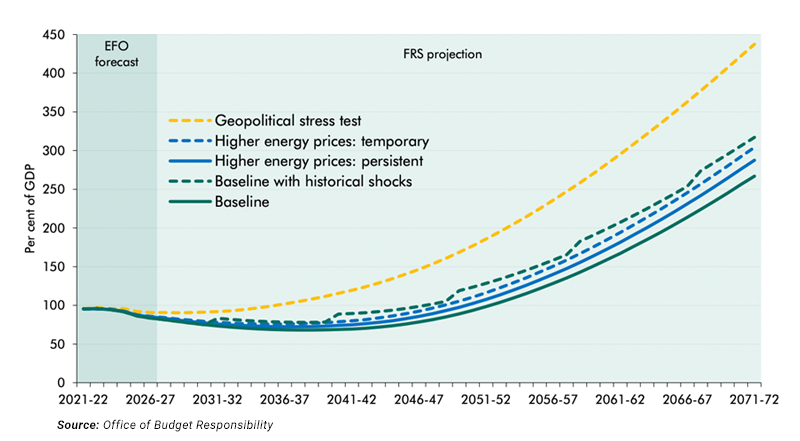

Chart: UK Long Term Government Debt Projections

The UK’s long-term debt trajectory also looks unsustainable. This is due to several factors: such as weak demographics, the health needs of an aging population and changes in energy use & costs.3

Though for all the talk of the UK running up debts, it is important to remember that a sovereign balance sheet is different from a private sector one. Sunak has been talking about a 90% debt/GDP level being a limit – but this is based on very flawed research and ignores the notable exceptions.4 In reality, nobody knows what the true debt loading a country can bear but in cases like the UK it does mean a higher debt load can be run and may even be desirable if the money is put to long term productive purposes such as building new infrastructure.

Key amongst these would be the need for energy which is greatly underestimated.5 Regardless of your view of climate change, the problems with the Ukraine have highlighted the need for cheap and reliable domestic energy sources independent of authoritarian, unstable and unreliable regimes. In small steps we have started to make moves towards this, but a lot more needs to be done.

And now the good…

For all the doom and gloom the UK has many things going for it. It has a flexible and educated workforce, fantastic research universities, fast-growing technology clusters and deep liquid capital markets. Importantly, venture capital and a culture of entrepreneurism are on the rise both financially but also culturally. Nurturing and growing this area of the economy is crucial for future success.

Whilst it lacks the resources of the United States it also has the benefits of being smaller and nimbler – an important feature in a fast-changing world.

The UK also needs to viewed relative to its close peers. It has better demographics than Germany, Japan, China or Italy. The UK avoided joining the Euro – possibly one of the best financial decisions made in recent years, as current events are once again demonstrating.

The UK has also started to extract itself from the financial morass that is fast enveloping the Eurozone. Outside of banking circles it is not commonly understood just how vast the debts of the EU itself are.6 Even more incredible, these are in addition to the high debt burdens of many of the countries themselves.

Given the limitations of a shared currency this either means very high and sustained inflation for years, with all the political instability that brings. Or the short but painful option of a major financial disaster and possible sovereign default. How the EU resolves this mess remains a cause for concern.7

And in the blue corner…

If I explain why I don’t think Sunak is the right choice, then it makes clearer why Truss might be a better one by default, though I make this suggestion without much enthusiasm.

Sunak – form over substance?

Much is made of Sunak’s business ‘experience’ but like his track record in office it doesn’t hold up to close examination.

Sunak never advanced beyond a very junior grade at Goldman Sachs, before then spending another two years back in university doing his MBA. He then moved onto a hedge fund where allegedly he advanced to the nebulous title of partner. Despite this alleged success, he briefly moved onto another fund which didn’t appear to work out before then managing investments for his father-in-law and finally then into politics.

In City terms, this really doesn’t amount to much. More importantly, his inability to stay anywhere for any real period and progress internally is a classic red flag for hiring.

As a politician it is tempting to write Sunak off as a well packaged version of the same brand of ideology ‘lite’ managerialism that started to emerge under Major, accelerated under New Labour and reached its peak under Cameron. In common with these two he may present well but his record suggests he is both politically and economically incompetent.

As I explained in my last note, I thought the budget was one of the most incoherent I have ever seen. This is due to the logic of tightening of fiscal policy just as the economy was recovering from the biggest shock in 300 years, and at the same time the Bank of England was finally starting the tighten monetary policy. This was all in the face of a cost-of-living shock caused by external factors.

Then there was the thoughtlessness of the tax rises, in particular the rise in corporation tax, key to economic growth of new businesses, and rise in National Insurance which also broke a manifesto promise.

Combined with the freezing of personal allowances for 5 years, in a world of 11% inflation, it remains extremely unclear what he was trying to achieve other than making people poorer and damaging a recovering economy. As I have already pointed out the UK’s national balance sheet operates differently to a private sector one and the current debt load is lower than levels seen in the past.

As Churchill long ago commented you cannot tax yourself into prosperity, the economy needs to grow.

Politically, he also appears inept. The prime example of this is how he thought it was remotely appropriate for the wife of the Chancellor of the Exchequer to be using a non-domicile tax status to avoid tax. His reaction was all wrong as he appeared more concerned that it had been leaked rather than the ethics of the act itself. He should have left office.

Rather than any clear strategic vision for the UK, Sunak appears obsessed with power for power’s sake. His leadership campaign seems to have started the day he became Chancellor, with a personal media team and the crass PR campaign, such as applying his signature applied to government policy.

Actually, Rishi it’s our money you are giving out, not yours.

Finally, there is the crude betrayal of his political sponsor only to immediately launch a leadership campaign himself with a pledge for ‘unity’ and the claim only he could undo the mess…that he had helped make.

And also in the blue corner…

Unfortunately, I don’t have much enthusiasm for Truss.

Truss is an uninspiring public speaker (and possibly leader too) and—outside of education—appears largely devoid of any guiding strategic vision like Sunak. Despite the media labelling of her as ‘thick’ her academics are almost identical to Sunak’s, a PPE from Oxford. Instead of an MBA, she qualified as a management accountant.

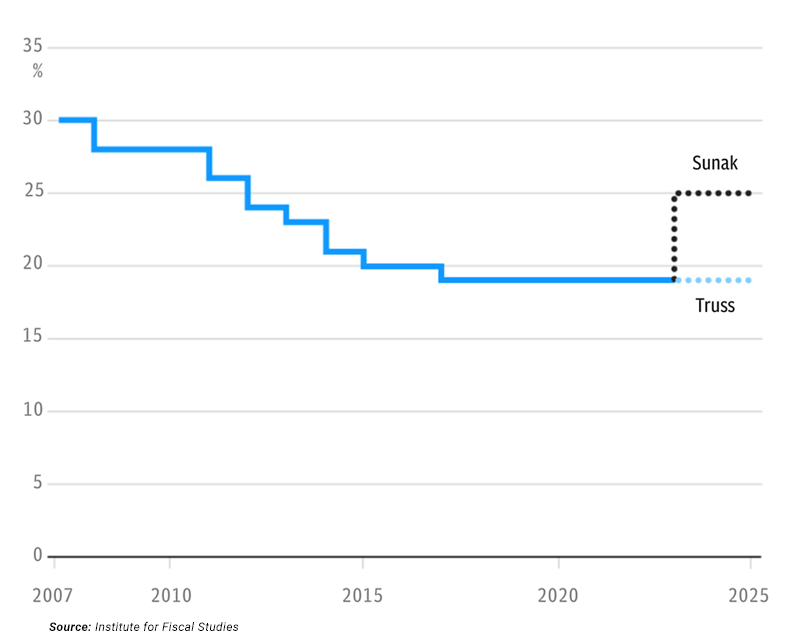

But she is proposing two key things that I think are important. Rather than another re-run of Cameron’s austerity, Truss is proposing to alleviate some of the effect of Sunak’s tax raises which I believe will be beneficial for the UK economy. If targeted correctly, I do not believe they will contribute to inflation if monetary policy continues to tighten.8

Chart: Proposed changes in UK corporation tax

Secondly, for the UK to utilise key benefits from leaving the EU more radical changes will have to happen. Almost none of this has so far happened. For Brexit to achieve superior economic outcomes then just avoiding the EU’s debt problems is unlikely to be enough. The UK is going to have to take more dynamic action.

Given a successful UK effectively represents an existential threat to the bloc this will require a more robust line with the EU. I believe Truss is more likely to do that and may therefore offer some benefit as an ‘agent of change’ that was part of both Johnson’s and Corbyn’s appeal. By contrast, Sunak appears too cautious to trade off short term friction for longer term gains.

So, in conclusion

Our preference would be, with a low degree of enthusiasm, Truss.

That said the UK has a series of long-term issues that will take years, if not decades to rectify. We cannot see either of the two Conservative candidates being realistically able to fix this. Indeed, both major parties have been actively complicit in the country getting into this position over the last generation. Regardless of who wins Harold Macmillan was once asked what the most difficult thing about being Prime Minister was, he replied, “Events dear boy, events” and we may find we are all soon overtaken by them.

Whoever wins, we are sceptical they will even manage to maintain internal party discipline going into the next election, let alone win it. But with the Labour party mired in its own myriad of issues, we are sceptical they could achieve an outright victory at the next election. Hence, we think – like the 1970s – we are likely to have a series of weak, ineffective, governments. But there might be a silver lining to this too, as the opening quote states perhaps this will lead to ultimately better leadership.

Endnotes

1D. Blake. ‘The UK is the Eurozone’s dumping ground’. City, University of London.

2There is a lot of academic literature on this on this, for a shorter watch Sir James Goldsmith also predicted much of this in the early 1990s.

3https://obr.uk/overview-of-the-july-2022-fiscal-risks-and-sustainability/

4The research comes from ‘This time it’s different’ by C. Reinhart & K. Rogoff. Famously, the research it was based on had a flaw in the spreadsheet. I think this is relatively minor. The bigger problem I had with it was that it tries to extract a general principle from about 140 very different incidents – over 200 years. It ignores monetary regimes, historical events (wars and revolutions) and extreme outliers such as the UK’s 248% debt to GDP in late 1940s or Japan.

5For those interested in the role of energy in shaping the global economy, I recommend ‘Disorder’ by Helen Thompson or ‘Life after growth’ by Tim Morgan

6In addition to the high debt loading of most of the major European economies the EU has managed to rack up its own enormous debts including a EUR 122billion unfunded pension deficit for itself. Added together this leaves an 82billion negative equity position!

Finally, there are the massive debts of a web of related supranational entities, such as the European Investment Bank with its EUR 565 billion of debts resting on just EUR 22 billion of capital—a leverage ratio of 25 times compared to commercial banks which tend towards 8x or less.

7I will cover the EU’s challenges in more detail in a later note. I appreciate, in our post-referendum world, highlighting the EU’s problems means you get labelled as a Brexiteer. The reality is I get paid to manage your wealth and it is a key risk for any UK based investor.

8At time of writing, Sunak has also started to promise tax cuts. This highlights to me, just how much is show over genuine substance.

IMPORTANT INFORMATION

Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809.

The information contained in this article is the opinion of Henderson Rowe and does not represent investment advice. The value of investment may go up and down and investors may not get back what they invested. Past performance is not an indicator of future performance.