“Now is not the time for fear… that comes later.”

—The Dark Knight Rises

Talking Points

- The performance of our funds recently confirmed our low beta approach

- We have used the recent market volatility to buy some very attractive investments

- We will continue to watch the situation, but our current expectation is that we will continue with our cautious stance; there appears to be no grand master plan behind Trump’s actions

I apologise for this note being slightly delayed. We have been very busy over the last few weeks. Most of this has been in a good way, you’ll be pleased to hear.

I have also managed to fracture my wrist and damage my rotator cuff. As many know, I am an active mountain biker, skier and rugby referee. Naturally, none of these were involved. I slipped over at Bank tube station.

In addition to market volatility, my typing is very slow, so please excuse me. This note will be in an abridged format.

A Quick Note

Before I start, I regularly get asked my opinion on politics and what it means for the economy. I want to remind readers that, in my experience, strong ideological views about how the world ‘should be run’ usually get in the way of objective investing. Hence, my views try to be observational and objective.

There are policies that I think will favour the economy and assets, and those that don’t. But the allocation of these is a matter for democracy to decide. Usually, this seems to be a pendulum where we go too far to one side and start to revert.

Currently, I think we are moving to more of a populist right and away from the left.

“And the public gets what the public wants. But I want nothing this society’s got.”

—Going Underground, The Jam

Big Picture

Just a quick reminder of our ‘big picture’ view

- We are going through the most significant social-economic change since at least the 1970s

- Hence, there is a risk that we see 1970s levels of disruption in markets

- We are also seeing a breakdown of the post-Cold War economic system

- Most major parties in the UK and Europe are ill-prepared for this. Many will not survive this transition. The political centre in Europe is likely to move ‘to the right’, and Reform is a good example of this in the UK.

- There is likely to be persistent inflation and a shift to favour labour over capital.

Recession Delayed, Not Avoided

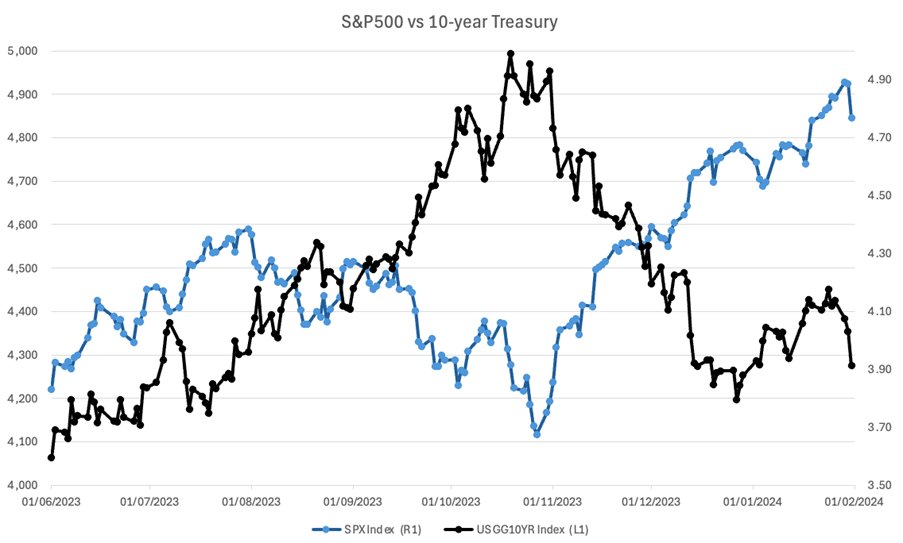

Regular readers will know we thought we were heading for a bigger market correction in 2023. Everything was proceeding in line with our expectations until October 2023, when the yield on the US 10-year bond hit 5%, and both the US Treasury and the Federal Reserve appeared to panic. This caused a sharp reduction in yields and propelled another leg upwards to risk markets.

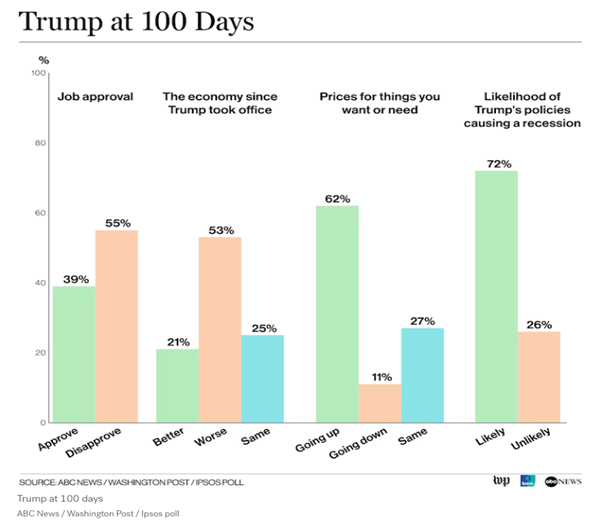

We admit that we were a bit surprised at the size of the response and thought it would likely cost Biden the election, as it would continue to fuel inflation, a key issue for voters. And lo, it came to pass. Despite allegedly full employment, US voters were very unhappy with falling living standards.

More importantly, it was delaying the inevitable in that the US couldn’t continue on the path it was on.

It’s All Fun & Games Until Your Funding Costs Go Sharply Up

Source: Bloomberg.

“Thought you were clever when you lit the fuse.”

—Eton Rifles, The Jam

Trump’s Trade War

Into this volatile mix, we have a Trump acting like a bull in a China Shop. Regular readers will recall that we thought Trump would likely be more dynamic than he was in his first term. In that we were correct. However, we also thought he might prove to be more competent. In that we were mistaken.

Putting aside the Trump noise around Canada or Greenland, a problem with the US economy was inevitable at some point. Whilst Trump is the catalyst, he isn’t the cause.

The fundamental issue is that free trade doesn’t work as it’s ‘meant to’ in the textbooks. Keynes pointed this out in 1933, and others have since – including Sir James Goldsmith in the 1990s.

Massive, persistent trade imbalances can only occur through deliberate policy. As Keynes observed, financing these leads to financial instability, usually social and political instability.

Simply put, the US (and the UK) cannot afford its current lifestyle. Too much capital is leaving the country, and too many people are reliant on state handouts or support in one form or another.

Yet instead of a well-considered multi-year plan about rebalancing the economy, we have a high-stakes game of brinkmanship where companies were given weeks to change supply chains that had taken years to construct.

Needless to say, this is likely to cause a negative shock to the economy later this year. Also, the root problem of rebalancing the US economy and fixing its finances has still not been addressed. We are going to get pain, but no noticeable gain. Hence, we remain cautious.

Voters Are Noticing the Real-World Effects of Trump’s ‘Plans’

“I’m quite happy with what I got.”

—Going Underground, The Jam

What Does This Mean For Your Portfolio?

Hopefully, you will have noticed that our portfolios held up well despite all the recent chaos. Given the uncertainty, we have been asked why we don’t hold more in cash. This is a good question. There are a couple of reasons for this. First, we haven’t reached the point where we think it is necessary. We are still finding good ideas.

Whilst we sympathise with Warren Buffett’s selling large amounts of equity, we are not under the same constraints. Berkshire Hathaway is a super tanker valued over $1 trillion USD, and selling $300bn of equities cannot be done in an afternoon. When operating on such a massive scale, you must ‘leave the party early’ when liquidity is still available. Berkshire also retains some very large equity holdings.

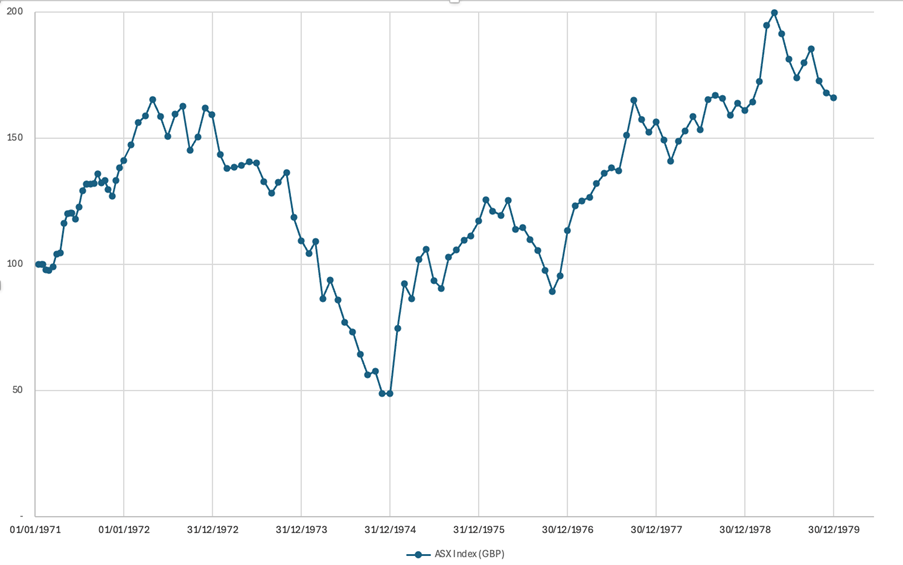

Secondly, being in cash is not always an optimum strategy in an inflationary bear market. Below, I give the example of the UK stock market in the 1970s.

Despite All the Inflation and Turmoil of the 1970s, the Stock Market Finished The Decade ‘Up’

Source: Bloomberg.

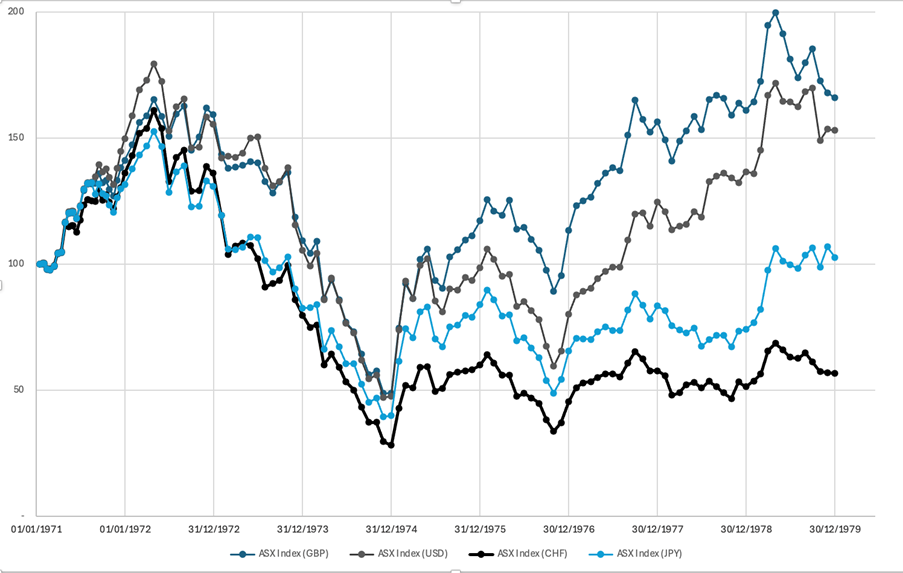

However, this was a nominal gain. If you had been a Swiss investor, you would have seen the real value of these investments drop by nearly 50% in CHF terms. This is what Irving Fisher called ‘the Money illusion’.

‘A Great Many Things Depend On Your Point Of View’; Currency Effects Impacted Returns In Real Terms

Source: Bloomberg.

This is one reason our portfolios have considerable geographical and currency diversification. It’s also why we have moved the bond allocation to an income-based approach. This was one of the things that worked in the 1970s rather than traditional government bonds.

The Knebworth Fund – Your ‘Income’ Sleeve

This currency diversification is one reason the Knebworth fund’s Net Asset Value (NAV) is slightly down. GBP has rallied, as it often does in H1, but it usually weakens in H2. Also, both the bond and equity markets have been volatile. While the fund is mainly a bond fund, it also includes some high-yielding equity-like instruments that offer inflation protection.

We are pleased to report that we deliberately slowed the investment rate of your income/bond sleeve. Hence, we have benefited from the recent market disruption by making what we believe will be really attractive investments at what we think will prove to be great prices.

The recent volatile market conditions allowed us to become largely invested at superior yields, credit quality, and interest rate risk than we originally expected.

Going forward, we expect the fund’s high yield to soon outweigh short-term currency fluctuations. We also suspect the market’s current obsession with the US dollar will reverse and soon shift back to the far greater problems in Europe.

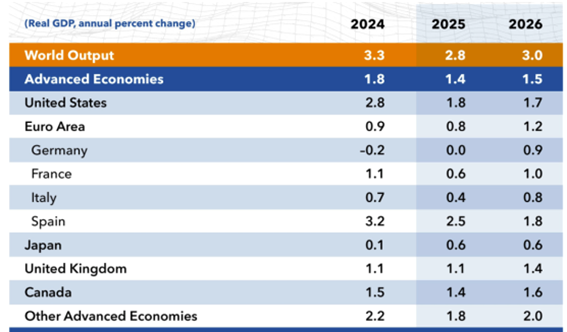

Despite Trump, the IMF Still Has the US Growing Quicker Than Europe

Source: IMF.

“You choose your leaders and place your trust

As their lies wash you down and their promises rust

You’ll see kidney machines replaced by rockets and guns.”

—Going Underground, The Jam

UK Politics

Readers may differ, but Starmer seems to have marginally improved since Christmas. His resolve around Ukraine and rearmament has generally been well received by the public.

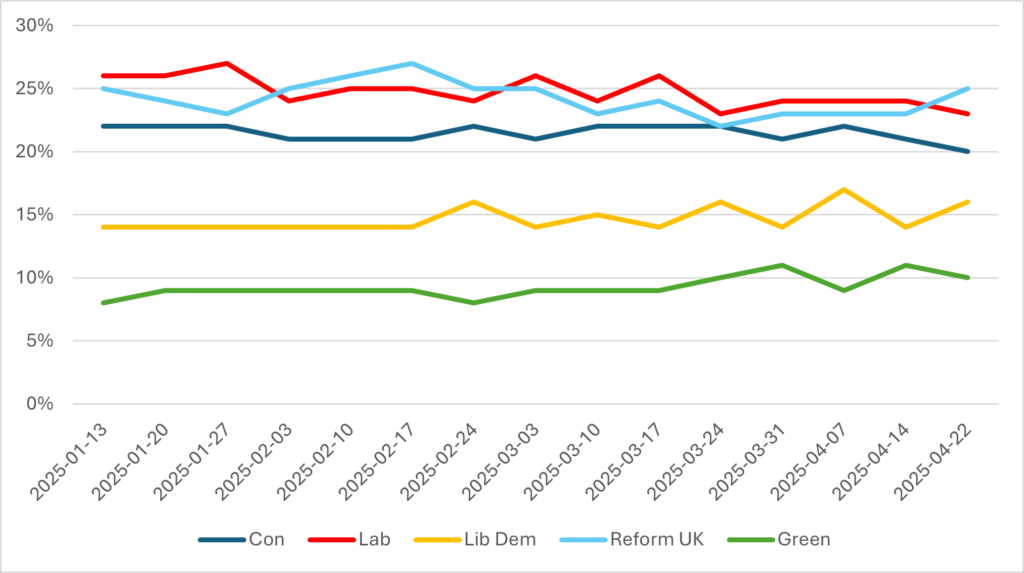

Despite this, Reform continues to move higher in the polls, and we expect this trend to continue. The Labour Party does appear to have finally woken up to the issue, and the nationalisation of Scunthorpe steel works was a good example of that.

That said, Reform’s Nigel Farage raised the plight of the steel workers, demonstrating that Reform is pivoting to attracting the ‘blue Labour’ voters rather than being a Thatcherite Right tribute act.

Also, despite the nationalisation, British Steel will remain structurally unprofitable with Labour’s energy policies. So, it rather looks like Farage has goaded Labour into a political trap. The taxpayer now owns a massive money-losing steel plant that is only viable if Net Zero is scrapped—something Reform strongly advocates, but Labour does not.

Reform Continues to Rise at Labour’s Expense

Source: Ipsos.

The other problem was the sudden damascene conversion of the Labour Party to behaving like err……the traditional Labour party and protecting heavy industry and working-class jobs. This is likely to cost them votes to Liberal Democrats and Greens, who themselves are rapidly pivoting into something more left-wing, if not sectarian.

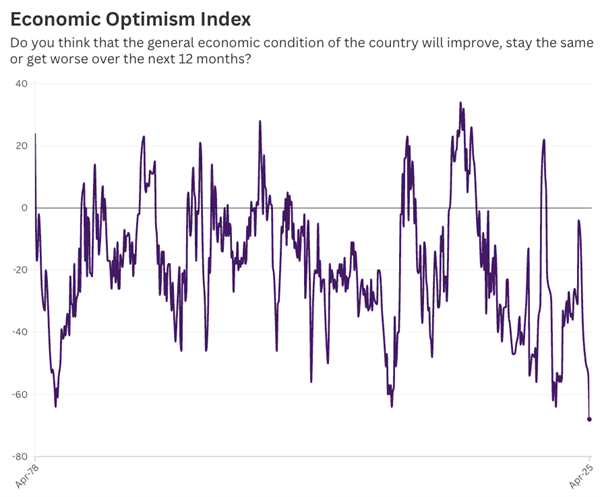

The other issue the Labour Party is facing is an immense collapse in economic confidence. It is now the lowest level recorded by Ipsos since they started the measure in the late 1970s.

Source: Ipsos.

We wonder how much longer party discipline can hold up. As we have repeatedly pointed out, to survive, Labour will have to pursue more and more right-wing policies. Like the 1970s, we suspect a break will start to appear with Labour’s pragmatists and idealists, making effective administration more difficult.

Finally…

The past few weeks’ events confirm our view that we are heading into our expected 1970s redux. We expect further economic and political dysfunction and headlines to match. But forewarned is forearmed. Volatile times can often make for some of the best bargains. Whatever happens, we remain vigilant and will continue to prioritise capital preservation.

Important Information – Henderson Rowe

The Knebworth Active Income Fund is the sub-fund of Henderson Rowe SICAV (“the Umbrella Fund”), which is an UCITS fund authorised and regulated by the Financial Market Authority (“FMA”) in Liechtenstein.

The Umbrella Fund is an investment company that has been established as Specific Undertakings for Collective Investment in Transferable Securities in the legal form of an investment company with variable capital under Liechtenstein law in accordance with the Act of 28 June 2011 concerning Specific Undertakings for Collective Investment in Transferable Securities, as amended (the “UCITS Act”) and the Ordinance of 5 July 2011 concerning Specific Undertakings for Collective Investment in Transferable Securities, as amended (the “UCITS Ordinance”). LGT Fund Management Company Ltd acts as the management company of the Umbrella Fund; whereas Henderson Rowe Limited has been appointed the investment manager by LGT.

This article is issued by Henderson Rowe Limited, authorised and regulated by the Financial Conduct Authority (“FCA”) under Firm Reference Number 401809. It constitutes a financial promotion under Section 21 of The Financial Services and Markets Act 2000 (“FSMA”).

This article is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution would be unlawful and participation in the Knebworth Active Income Fund referred to herein shall not be offered or sold to any person where such sale would be inappropriate. Any onward distribution of this article is strictly prohibited.

The information contained in this article has been taken from sources where stated and it is believed to be reliable and accurate. Whilst every effort has been made to ensure the accuracy, we are not responsible for any error, omission or accuracy. Nothing in this article constitutes investment, tax, legal or other advice by Henderson Rowe Limited.

Investors should be aware of the risks associated with data sources and models used in the portfolio construction and asset allocation processes. Information contained in this article is based on analysis of data and information obtained from third-parties. Errors may exist in data acquired from these vendors. Henderson Rowe Limited has not independently verified the third-party information. Henderson Rowe Limited, its directors, employees, or any of its associates, may either have, or have had, a position, holding or material interest in the investments concerned or a related investment.

Before investing in the Knebworth Active Income Fund, investors should carefully read and understand the Prospectus and the Key Investor Information Document (“KIID”) and seek independent financial advice.

Legal Information – LGT

This publication is a marketing advertisement. It is intended only for your information purposes and does not constitute an offer, solicitation of an offer, or public advertisement or recommendation to buy or sell the above-mentioned fund. Investment decisions should always be made on the basis of the current articles of association including annexes relating to sub-funds and prospectus, hereinafter the “constituent documents” (KoDo), the key information document and following consultation with an expert. The current constituent documents, the key information document as well as the respective annual and semi-annual reports can be obtained free of charge from LGT Fund Management Company Ltd., Herrengasse 12, FL-9490 Vaduz, Liechtenstein as well as electronically from the website of the Liechtenstein Investment Fund Association (Liechtensteinischer Anlagefondsverband,”LAFV”) at www.lafv.li. This publication addresses solely the recipient and may only be forwarded, multiplied or published to third parties by authorized persons. The content of this publication has been developed by Henderson Rowe Ltd. and is based on sources of information that is considered to be reliable. However, no confirmation or guarantee can be made as to its correctness, completeness and up-to-date nature, as the circumstances and principles to which the information contained in this publication relates may change at any time. Once published information is therefore not to be interpreted in a manner implying that since its publication no changes have taken place. The information in this publication does not constitute an aid for decision-making in relation to financial, legal, tax or other matters of consultation. Advice from a qualified expert is recommended.

This product does not use a sustainability label because the fund is a non-UK fund and the management company is not undertaking sustainability in-scope business in relation to the sustainability product as defined in the UK Financial Conduct Authority Environmental, Social and Governance Sourcebook.

Distribution countries

The fund may only be marketed in the Principality of Liechtenstein and the United Kingdom. Where units are distributed outside Liechtenstein, the pertinent provisions in the respective country shall apply. The units have not been registered under the United States Securities Act 1933. With regard to distribution in the United States or to US citizens or persons resident in the United States, the restrictions detailed in the constituent documents shall apply.

Facilities for UK investors

Zeidler Legal Services (UK) Ltd.

E1 Studios, 3-15 Whitechapel Road, London

E1 1DU, United Kingdom

E-Mail: facilities_agent@zeidlerlegalservices.com

Further Information

Investors should be aware of the fact that the value of investments can decrease as well as increase. Therefore, a positive performance in the past – even if it relates to longer periods – is no reliable indicator of a positive performance in the future. The risk of price and foreign currency losses and of fluctuations in return as a result of unfavorable exchange rate movements cannot be ruled out. There is a risk that investors will not receive back the full amount they originally invested. Forecasts are not a reliable indicator of future performance.

The commissions and costs charged on the issue and redemption of units are charged individually to the investor and are therefore not reflected in the performance shown. We disclaim, without limitation, all liability for any losses or damages of any kind, whether direct, indirect or consequential nature that may be incurred through the use of this publication. This publication is not intended for persons subject to a legislation that prohibits its distribution or makes its distribution contingent upon an approval. Persons in whose possession this publication comes, as well as potential investors, must inform themselves in their home country, country of residence or country of domicile about the legal requirements and any tax consequences, foreign currency restrictions or controls and other aspects relevant to the decision to tender, acquire, hold, exchange, redeem or otherwise act in respect of such investments, obtain appropriate advice and comply with any restrictions.