“The Supreme Court has ruled that they cannot have a nativity scene in Washington D.C. This wasn’t for any religious reasons. They couldn’t find three wise men.”

—Jay Leno

Talking Points

-

- Trump doesn’t have 4 years to push through policy, so he is going to have to be very dynamic over his first 2 years to achieve anything.

- Combined with financing the gigantic US deficit this could make 2025 a pivotal year.

- Europe is a morass of dysfunctional politics and economic mismanagement. This includes the UK.

- Putting it together, we still think financial conditions will benefit riskier assets into 2025 but navigating the year will be tough.

As usual we have compiled a list of typical Q&A we have been asked over the year. But first we will start with a brief market overview.

Investment Outlook – Threading the Eye of a Needle

Probably the most important thing is the incoming US administration. Unlike the other major developed parts of the world, the US economy continues to grow strongly but it remains very reliant on government borrowing to achieve this. Hence, government policy – and therefore Donald Trump – is key to this.

The market seems to have binary opinions on Trump with either boundless optimism that he is going to cut taxes and renew the US economy, or that he is about to wreck the world trade system and the US economy into the bargain too.

Our opinion is: wait and see. For reasons we will explain later we believe Trump 2.0 may be ‘better’ this time round, not least because he has spent significant time preparing for power unlike 2016.

That said, we think he has a very difficult job to do. The US public finances are a mess, and he probably has less than 2 years to enact anything. Also, changing the US’s trade agreements whether by tariff or renegotiation will be hard. So, in effect Trump is attempting to thread the eye of the needle.

Positioning

As regular readers know, we were concerned about asset prices in 2022 going into 2023 due to elevated valuations and the Fed’s sudden rate rises to deal with inflation. However, it became increasingly clear to us that after the initial activity the outgoing Biden administration was not serious about either fixing the US public finances or inflation.

Whilst this might have helped engineer a soft landing it has cost them the election. Most Americans don’t benefit from asset price rises but have been badly affected by inflation.

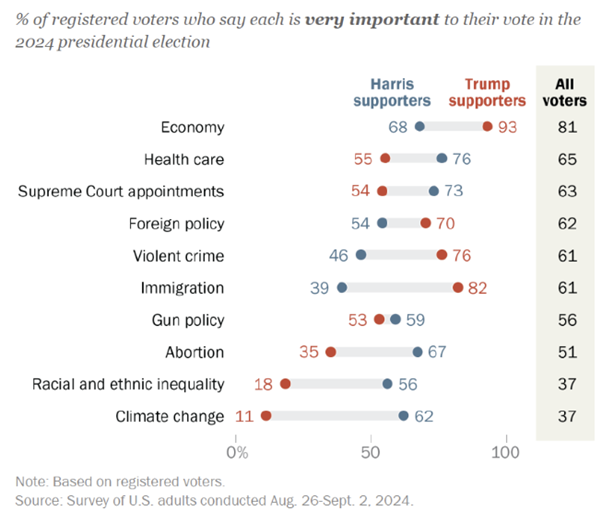

One Man, One Vote — Most Americans Have Been Very Unhappy with Inflation

Note: Based on registered voters.

Source: Pew Research, Survey of US adults conducted August 26-September 2, 2024.

We continue to have a bias to growth assets and that means a strong bias to the US by extension. Tariffs may well benefit the US dollar in the short term as it reduces the outflow of the currency into the global economy. On the bond side, we continue to be underweighted both duration and government debt in general. Finally, we suspect returns to be strongly biased to the first half of the year. We are far more cautious on H2’25.

Typical Q&A

What’s your view on the UK economy?

Negative.

As we expected, the current UK government is rubbish as far as economics and commerce is concerned. As we stated previously, we expect the Labour government to comprehensively fail. They are the wrong people, in the wrong place, at the wrong time with the wrong policies.

But don’t just take out word for it: Greencore, Curry’s, Marston’s, Pets At Home, Kingfisher, JD Sports, Royal Mail owner IDS, Genuit, Young & Co’s, Whitbread, Fuller, Smith & Turner, M&S, Wetherspoon, Vistry, Sainsbury’s and Tesco have also highlighted how bad the recent budget was for business.

We would also note that since the election, UK GDP has quickly turned negative. Without a major reboot in policy, which will probably need a crisis to facilitate it, we see no reason to change our view.

Have tax rises ended?

We suspect that they haven’t.

Reeves has very little financial headroom and she has decided to drain resources from the productive part of the economy and dump it into the least productive part (the state sector). This might produce a short-term sugar rush in official statistics in much the same way that Soviet potato production numbers would but it’s unlikely to translate into a feel-good effect in the real economy.

In fact, it’s likely to be worse than that. A stagnant – possibly even recessionary economy – combined with breathtakingly high levels of low value immigration is lowering GDP per capita. Combined with persistent inflation and high taxation this is almost a perfect mix for social unrest and increasing right-wing populism.

Ironically, the Labour Party’s current policy mix is exactly what Nigel Farage needs to boost his party’s support base.

After their disastrous start might Labour improve?

This is a relative opinion. Some readers might think that Labour is doing the right things on a social basis. We are focused on economic matters, and we think they have been exceptionally poor.

Our working assumption is 2025 is the make-or-break year and we suspect reality is likely to come crashing in around the time of the Spring spending review. This might be the crisis that triggers the changes in cabinet.

Other potential issues could be the pending report into the Unite the Union’s finances or the growing amount of money being spent on housing illegal immigrants especially whilst cutting winter fuel payments to pensioners. At the very least, this is an odd and likely very unpopular message to send to voters. Similar issues have become deeply unpopular in both Europe and the US and even former Labour Prime Minister, Tony Blair, is warning the current government about this.

One large variable is the problems in Europe, and France in particular, might mean the ECB is forced to return to QE. This might give the economy some extra time as the money printing spills over to reduce UK borrowing rates.

But barring that, we expect the government to deteriorate further.

Is Keir Starmer likely to remain Labour leader?

Despite being one the least popular Prime Minister since Ipsos started collecting data in the 1970s we suspect he will remain leader for the foreseeable future. First, there is no obvious alternative. Second, the process of changing Leader in the Labour Party is more convoluted than in the Conservatives so changing leaders is hard.

It is likely that Reeves and Miliband will have to go if Starmer is to try and save his premiership. However, discontent is rapidly growing. As we pointed out previously, many of the things the Labour needs to do to facilitate growth is very much against the leadership and Parliamentary party’s DNA.

Next election?

Our working view is the UK is heading for more political fragmentation, and a hung Parliament is a highly probable outcome for the next election. This is because we believe the Conservative Party leadership still hasn’t grasped they are in mortal peril, even though the lower levels of the party can see the danger.

We believe the country is drifting ‘right’ and most of the social changes in voting will ultimately benefit Reform. At the end of the day, ‘it’s the economy stupid’ as the US Democrats recently discovered.

What about Europe and the EU?

The EU is what our US colleagues would call a ‘slow motion train crash’. It is inflexible and over regulated and – crucially – has no feedback mechanism to change this. Additionally, as was always inevitable with mercantilist powers it has run into problems with its trade partners; largely the US and UK.

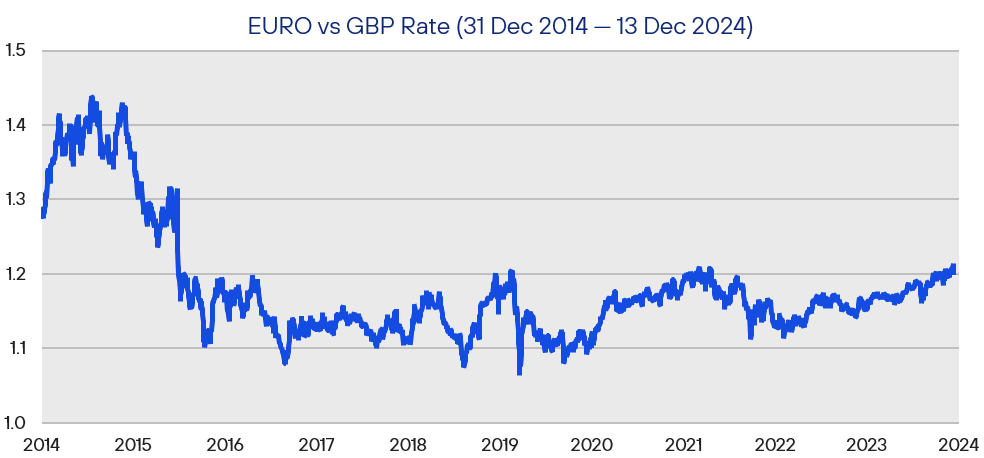

Whatever You Can Do I Can Do Better! The EUR Falls to Its Lowest Level Since Brexit as the EU Slumps

Source: FactSet, Henderson Rowe Research.

As regular readers know, we have long held negative opinions about the WTO, NAFTA and the Single Market (and the European Union to a lesser extent). They are all good concepts that were badly executed and had very poor outcomes for some of the countries involved. This is something that the EU itself has finally acknowledged with the Draghi report.

In short, the EU is a political project that didn’t bother focusing on the economic underpinnings. Since the economics are not working, it is coming apart politically too. The UK rejoining would just import more problems.

How about the US economy?

The US economy is growing above trend, but it is requiring considerable stimulus to do this. One of our biggest concerns for 2025 is the US government ability to keep financing this. A lot of this depends on the new administration.

What do you think about Donald Trump?

We think Trump 2.0 is going to be an improvement from Trump 1.0; admittedly a low bar. For starters he does not need to be re-elected so he can just concentrate on the here and now. Secondly, he may only have 2 years to enact policy, not 4 and in contrast to last time he appears to have actually prepared for government so we could see a very dynamic administration.

Additionally, some of his staff picks are very capable individuals with a lot of finance and commerce experience. That said, US public finances are a mess, and Trump’s policies may well add to the problem.

However, Rome wasn’t burnt in a day and we believe there is still sufficient momentum and liquidity to propel US assets for a bit longer. But we remain vigilant.

What about some of the people he wants that have zero experience in executing policy?

They have one thing in common, they are good pushing their views on TV. I do not believe many of these people will have much actual say in policy: that’s going to be decided by Trump and his inner circle. So, I do wonder if it’s more about controlling the message.

Will he fire the Federal Reserve Chairman Powell?

He doesn’t have to. Powell’s term is up in early 2026. Until then he has a perfect punchbag to blame for any problems until then.

How will Tariffs impact the market?

The key thing for Q1’25 is what Trump’s tariffs look like. If they are implemented quickly and at the scale suggested they will be extremely disruptive and probably inflationary. They would also be negative for the UK and even more so the EU.

If they are implemented more gradually or used as bargaining chips for bigger deals, then we might have a more moderate outcome. We suspect we are likely to find out quite quickly in 2025. But in general, high tariffs will be a significant issue for the global economy.

Is US Inflation under control?

As we discussed earlier, inflation was a huge issue for US voters. Trump’s picks for Treasury Secretary (Scott Bessent) and Commerce Secretary (Howard Lutnick) are both very experienced in the bond market and no doubt understand the risks, especially given the inflationary risks around tariffs and unbalanced government spending.

That said, the US has a large fiscal deficit and huge amount of debt to issue, so the risk of inflation is to the downside. Ultimately, we suspect the US is going to settle at a higher level of inflation and interest rates will have to adjust upwards accordingly.

As an aside, we wouldn’t be surprised if Trump does some sort of tax deal around Commercial Real Estate, it continues to be a huge problem in the US and whilst he no longer runs the Trump Corporation it is a real estate company.

Will there be a US/UK Trade deal?

Unlike Biden, Trump did do some trade deals in his first term. Whilst Trump has indicated he would like to do a UK trade deal, and many are keen in the Republican party to ‘extract the UK from the EU’s regulatory orbit’ we are sceptical it will happen.

Firstly, as one of their biggest markets the EU is likely to make it difficult for the UK to agree terms with a major international competitor. A less Europhile and robust UK administration would take advantage to the EU’s economic weakness and the huge trade surplus with the UK to extract better terms, but we don’t see that happening.

Secondly, we suspect the Labour administration is ideologically opposed to a US deal due the party’s obvious dislike of Trump.

Finally, there are some key issues such as agricultural product standards though we think it could be solved with labelling. Though the US, like the UK, has also become a net food importer.

How about other geopolitical issues?

We suspect that Trump will support Israel in pursuing regime change in Iran. Israel has a brief window to do this before Iran develops atomic weapons and a new regime in Tehran would be widely supported by most Middle Eastern states. This could be very disruptive for energy prices.

We suspect Putin is going to be negatively surprised by Trump’s demands over Ukraine. The Russian economy is beginning to seriously struggle as the war effort dominates the rest of the economy.

We have no opinion on China and Taiwan.

In summary

We are acutely aware that – unlike last year – our views are relatively consensus.

The US equity market has priced a continuation of the good times despite the extreme valuations. We are much more cautious around a lot of the large US tech names.

We are probably more nervous around the bond market than most, something that has served us well as longer dated gilts posted yet another negative year for most investors. Our performance has benefited from being relatively short term. But we suspect rising longer-term interest rates will ultimately end this long bull market.

For the Average Investor UK Government Debt Lost Money Again, Apparently, They Are ‘Risk Free’ According to the Government

Source: FactSet, Henderson Rowe Research.

It is important to remember that financial markets have seasons too and at some point, there will be winter; which is just part of the process.

Rest assured, whatever happens we will continue to remain vigilant and react to events.

Charity appeal

Some of you have asked if we are supporting a charity this Christmas and we are!

It is James Place https://www.jamesplace.org.uk/ which supports young men with mental health issues. Something that seems to be tragically on the rise.

Finally – Merry Christmas!

And with that, we thank you for placing your trust this year and wish you a Merry Christmas and a Happy New Year!

Important Information

The information contained in this article is the opinion of Henderson Rowe and does not represent investment advice. The value of investment may go up and down and investors may not get back what they invested. Past performance is not an indicator of future performance.

This document is intended for the use and distribution to all client types. It is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution would be unlawful and participation in the portfolio referred to herein shall not be offered or sold to any person where such sale would be unlawful. Any onward distribution of this factsheet is strictly prohibited.

The value of investments and the income from them can go up as well as down and you may realise less than the sum invested. Some investments may be subject to sudden and large falls in value and you may realise a large loss equal to the amount invested. Past performance is not an indicator of future performance. If you invest in currencies other than Sterling, the exchange rates may also have an adverse effect on the value of your investment independent of the performance of the company. International businesses can have complex currency exposure.

Nothing in this document constitutes investment, tax, legal or other advice by Henderson Rowe Limited. You should understand the risks associated with the investment strategy before making an investment decision to invest.

Investors should be aware of the risks associated with data sources and quantitative processes used in our investment management process. Errors may exist in data acquired from third-party vendors, the construction of model portfolios, and in coding related to the index and portfolio construction process. Information contained in this fact sheet is based on analysis of data and information obtained from third parties. Henderson Rowe Limited has not independently verified the third-party information. The firm, its directors, employees, or any of its associates, may either have, or have had, a position, holding or material interest in the investments concerned or a related investment.

Henderson Rowe is a registered trading name of Henderson Rowe Limited, which is authorised and regulated by the Financial Conduct Authority under Firm Reference Number 401809. It is a company registered in England and Wales under company number 04379340.