Market Overview

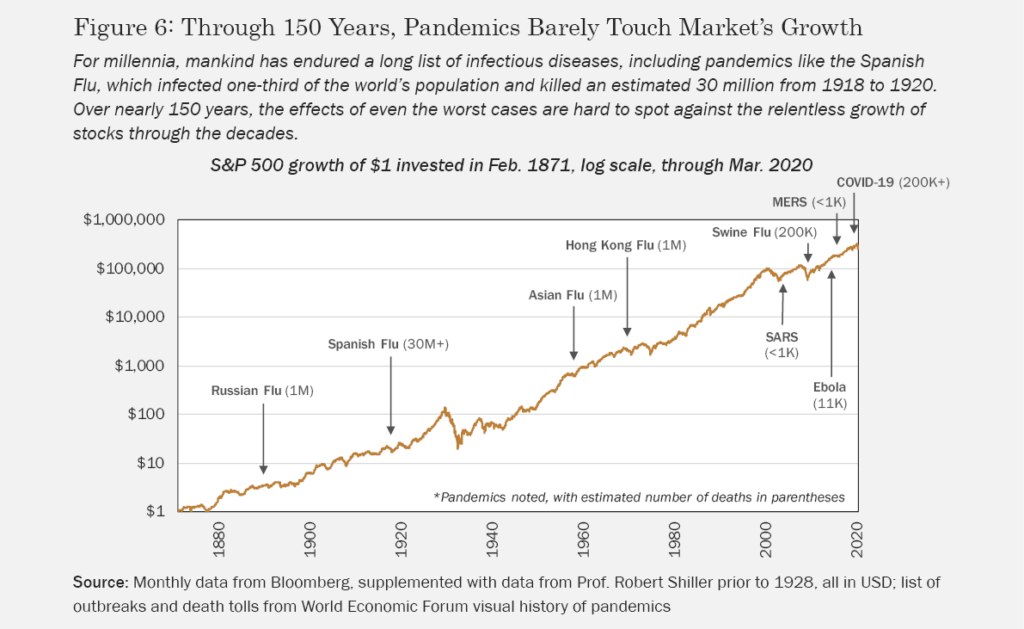

Past pandemics—such as the Spanish Flu which infected 500 million people from 1918 to 1920—were followed by a strong economic recovery, rallying stock markets and a significant improvement in living standards. Of course, the world was different then and we shouldn’t necessarily expect such dramatic leaps to materialise this time around. The fact is, we still don’t know exactly how long the current lockdown will last and we can’t be sure of the ultimate economic and social cost this pandemic will have. It does seem likely that this crisis will have a profound impact on how we do business, invest, travel and go about our lives for some time to come. So, what will the post COVID-19 world look like?

Many of the trends we write about below were already well underway before COVID-19, and we believe this pandemic has the potential to significantly accelerate some, if not all of them. As is the case with any disruptive change, this will create much pain, along with many opportunities for old and emerging industries. The noted economic philosopher, Rudiger Dornbusch, once said: “It takes a lot longer for things to happen than you think that it can, but then they happen much faster than you thought they would.” This is how we should approach the crisis.

For example, the rise of populist politics, embodied by the election of Donald Trump in 2016, might have been the fuel for deglobalization and COVID-19 might provide the spark. Likewise, large fiscal stimuli announced around Europe and the US might be a catalyst for a wider discussion about the modern monetary theory (MMT), wealth redistribution and addressing the balance of trade issues for surplus economies like Germany. Many politicians elected on the populist platform now have very little choice but to deliver what they promised, which means an increase in government’s share of GDP, the potential for higher taxes on businesses and tougher immigration controls.

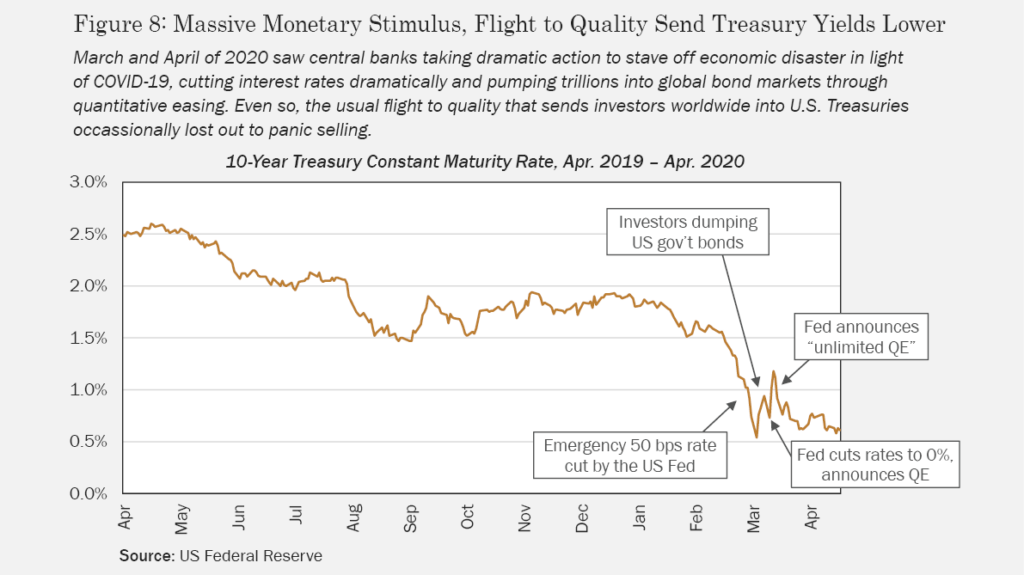

In the wake of the Global Financial Crisis, the Fed and many other central banks faced a wave of criticism for embarking on Quantitative Easing (QE). The main argument was that expanding central banks’ balance sheets will inevitably lead to runaway inflation. Twelve years on and most economies who engaged in QE programs are struggling to get inflation above 2%. So why should we be worried now? Relative to QE, fiscal stimulus is a very different animal. While the former is simply a balance sheet operation or buying assets from the banking system, the latter, especially in the form of MMT, has a real potential to be inflationary and, in some extreme cases, hyperinflationary. Add immigration control driving labour shortages and a recovering global demand to the mix and you may end up with more than you bargained for.

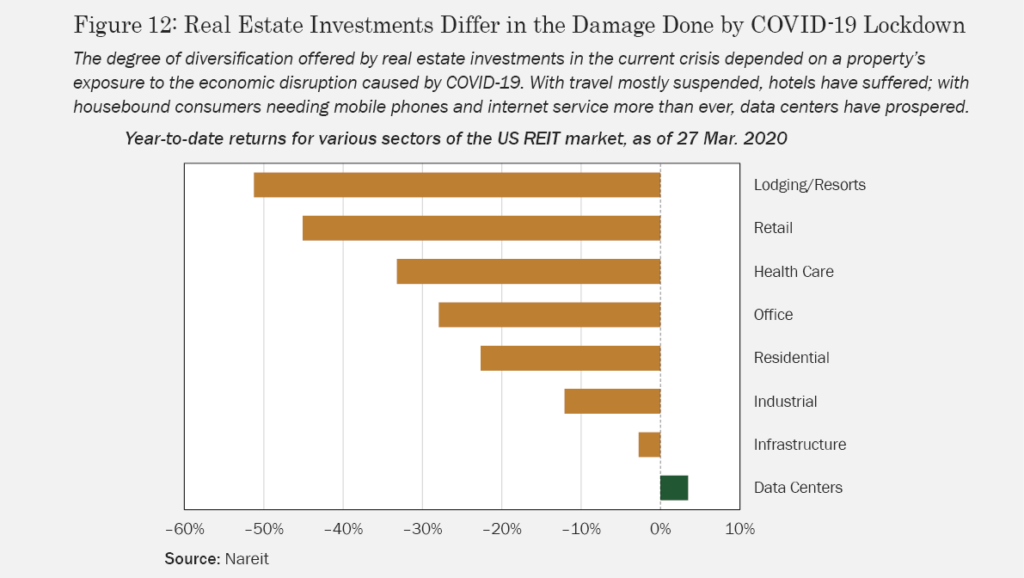

Another big shift in businesses’ behavior we might expect from the post-COVID-19 world is somewhat subdued demand for commercial real estate as firms realise staff can be as efficient working from home as from an expensive prime-location office. This should also drive demand for remote access solutions and cybersecurity software. Most businesses which couldn’t be bothered or never had a real need to use tools such as video conferencing, electronic signatures and remote desktop access will have to adapt or die.

And what will happen if China recovers ahead of the West? It will likely find itself heavy on supply and light on demand for its exports, which could easily accelerate its transition to a consumer economy. That in turn might well lead to a significant change in the architecture of global supply chains, which have been set up to support the Chinese export machine for over two decades. A powerful, Asia-focused supply cluster might emerge to support local and domestic economies. The region could become more self-sufficient which could promote the de-dollarization of certain Asian economies: a big geopolitical win for China, which has been trying for decades to expand its sphere of influence.

Of course, the lockdown gives us plenty of time to muse about what macro changes might lie ahead, but as this pandemic has illustrated so clearly, that exercise is full of uncertainty. While it’s important to consider what accelerating trends might mean for economies, industries, and individual companies, nobody knows exactly what the future holds. We don’t claim to have a crystal ball—we won’t predict when the lockdown will end or the recovery will begin—but we will commit to building diversified, defensive portfolios, positioned to benefit wherever the trends take us post-pandemic.